Thames Water boss defends exec bonuses as sewage spills soar

Getty Images

Getty ImagesThe boss of Thames Water has defended executive bonuses as the firm calls for a hike in customer bills to ensure its survival.

Chris Weston said the supplier needed to offer "competitive packages" to attract talent, but the water regulator has previously said that customers must not foot the bill for "undeserved bonuses".

It comes as the embattled company saw a 40% increase in pollution incidents in the six months to 30 September, as its debts continued to swell, according to its latest set of results.

Thames approaches a critical moment next week, with Ofwat set to decide whether to allow a proposed 59% increase in consumer bills over the next five years.

The ailing business is saddled with debts which stood at just under £16bn at the end of September.

The firm has said customer bills need to rise or else it will not be able to recover from its financial crisis. However, if the company does collapse, water supplies will not be affected.

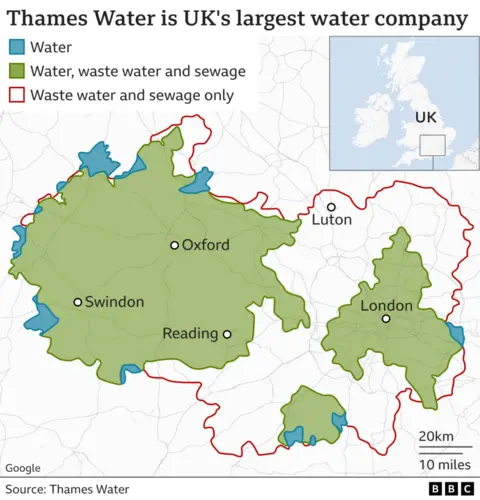

Water firms across the UK have faced a fierce backlash over sewage discharges and pipe leaks in recent years, but Thames has been in the spotlight given its debt pile, and the fact one in four people in the UK rely on it.

Critics have argued the water industry has historically neglected investment in favour of paying executive bonuses and shareholder dividends.

But on Tuesday, Mr Weston defended bosses getting £770,000 in bonuses.

"I completely understand that there are customers out there who struggle with their bills," he added, pointing to bill support offered to about 377,000 customers in the last year.

Mr Weston, who was hired in January, was also awarded a bonus of £195,000 for his first three months at the company.

The regulator Ofwat recently blocked three companies, including Thames, from using customer money to pay executive bonuses as bills have steadily increased.

A final decision on whether Thames can increase its bills by 59% is due on 19 December.

Mr Weston described the upcoming decision as a "critical" step which would be "fundamental" to the company's future.

Bosses have argued they need extra cash to make Thames "investible" enough to attract fresh funding, and to pay for improvements to its network of pipes and sewers.

Thames reported a 40% rise in sewage pollution with 359 incidents in the six months to September.

Mr Weston blamed a particularly wet spring and summer period, and said that problems with its infrastructure were "decades in the making".

Ofwat has also appointed an independent monitor to supervise Thames as it attempts its turnaround.

Pivotal moment

The company could run out of money within the first three months of 2025, which is why its creditors have offered it a further £3bn cash loan to be released in two tranches, the first £1.5bn of which could be released in February.

It is waiting for a court date next week to approve the cash injection which could prove pivotal as it would mean it had enough money to last until October next year.

An insider told the BBC that if it was not for the firm's huge debt pile, Thames would be in reasonable shape financially.

In its latest results, it reported a profit before tax of £249.6m for the six months to September, up 20% on the year before.

When Thames Water was privatised in 1989 it had no debt. However, over the years it borrowed heavily.

Thames needs to raise about £4bn in new equity too, which would not need to be paid back.

While there are several interested parties that could put that money in, the investment would depend on how much pain lenders are willing to take and whether or not Ofwat will allow the company to push through steep bill increases.

Mr Weston said on Tuesday there was "considerable interest" from potential equity investors in the company.

But the process for an equity injection cannot be finalised until Ofwat makes a decision on bill increases.

Unions argued on Tuesday that a recovery for the company was now "virtually impossible".

Gary Carter, the national officer of the GMB union, called for government to step in.

"Right now the company is being squashed by an ever-increasing debt mountain, on increasingly arduous terms," he added.

Unite general secretary Sharon Graham also called for officials to stand up for the "public interest" and consider bringing Thames back into public ownership.

Speaking on Tuesday, Mr Weston said that the firm had not asked the government or regulators to step in and implement a form of publicly funded administration, called a special administration regime.