Mortgage rates set to drop after tariff turmoil

Getty Images

Getty ImagesSome lenders are set to cut rates on mortgages after turmoil from US President Donald Trump's tariff policy raised expectations that UK interest rates could be cut further this year.

TSB Bank said it will reduce some two-year fixed rate mortgages by up to 0.25 percentage points on Tuesday, following MPowered Mortgages which trimmed rates across a number of its deals.

Financial markets and economists are predicting that the Bank of England will cut interest rates by more than expected this year to avoid an economic downturn.

The Bank's main rate stands at 4.5%. It was forecast to reduce it twice this year but the uncertainty created by US tariffs has changed the expectation to three cuts.

Sarah Coles, head of personal finance at Hargreaves Lansdown, said the Bank of England, and other countries' central banks, "will be really looking to cut interest rates as much as possible in order to support growth".

"And of course mortgage companies start to price that in right away and we've already seen mortgage rates start to fall and we should see plenty of that in the coming days," she added.

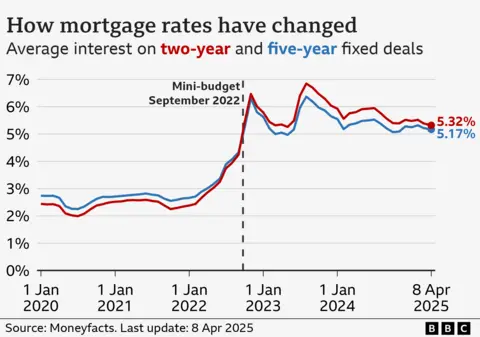

The average mortgage rates on two-year and five-year fixed deals were unchanged on Tuesday, at 5.32% and 5.17% respectively, according to financial information company Moneyfacts, although it said rates were expected to come down in the coming weeks.

Mortgage brokers told the BBC that if so-called swap rates, which lenders use to price loans, stay as they are then some mortgage rates may fall to as low as 3.79% in the coming weeks.

Laith Khalaf, head of investment analysis for AJ Bell, said: "Trump's tariff announcement might have created havoc in the stock market, but there could be a silver lining for UK mortgage borrowers."

However, the lowest rate deals will not be available to all borrowers, particularly first-time buyers and they may come with a hefty fee.

Many homeowners coming off fixed deals signed before interest rates started rising in mid-2021 will still find themselves in a higher mortgage rate environment.

According to figures from the Financial Conduct Authority, 1.3m homeowners' existing fixed-rate deals are due to end between April and December.

Rachel Springall from Moneyfacts predicted that as soon as a big lender trims rates, others will follow.

"Usually once a notable brand moves to cut mortgage rates, others follow suit," she said.