Bank lowers interest rates and hints at more cuts to come

Getty Images

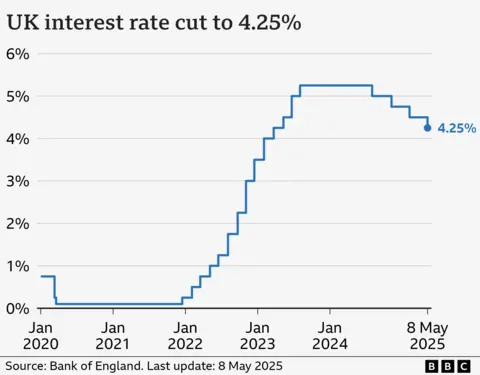

Getty ImagesUK interest rates have been cut to 4.25% from 4.5% and the governor of the Bank England has hinted more could follow in the coming months.

Andrew Bailey said he would not "give predictions as to when and how much", but said he was "still of the view that the path, gradually and carefully, is downwards".

The reduction in rates on Thursday marks the fourth cut within the past year and the Bank considered an even bigger cut to 4% due to concerns the global trade war could hit UK economic growth.

Mr Bailey welcomed a UK-US deal on tariffs and said it was "important as a signal, I hope, of many more to come", adding a UK trade deal with the European Union would be "beneficial".

"Maybe we need a bit of a jolt to the system to remind us that trade is important," Mr Bailey said, adding he hoped the likes of deals between the UK and US, and the UK and India, would help to "rebuild the world trading system".

On Thursday, the UK and US announced a deal to avoid tariffs on certain goods in order to boost trade.

As it announced the latest cut in interest rates, the Bank said that while a trade war could hit economic growth, it could lead to lower inflation in the UK over time as countries such as China look to divert cheap goods originally bound for America.

Mr Bailey said the path for rates was "downwards", but said future rate cuts were likely to be "gradual and careful".

The minutes of the Bank's meeting showed the rate-setting committee was divided. Of the nine members, five voted to cut rates to 4.25%, two voted in favour of a larger reduction to 4% and two voted for no change.

The Bank's base interest rate dictates the rates set by High Street banks and lenders. The higher level in recent years has meant people are paying more to borrow money for things like mortgages and credit cards, but savers have also received better returns.

More than eight in 10 customers have fixed-rate deals, but could continue to face higher repayment costs when renewing.

However, mortgage rates have been edging down recently, primarily because the markets and lenders expect further rate cuts this year. On Thursday, the average two-year fixed mortgage rate was 5.14%, while a five-year deal was 5.08%, according to financial information service Moneyfacts.

About 600,000 homeowners have a mortgage that tracks the Bank's rate, so rates being cut will have an impact on monthly repayments.

A typical tracker mortgage-holder is likely to see about £29 knocked off their monthly repayments following the latest cut, said the banking trade body UK Finance.

Homeowner Vanda, who has a tracker, told the BBC she had a "really good rate", but then got "caught out" when rates were previously increased.

"A drop would help because I've just been made redundant, so that would help a wee bit. I don't think it will ever go back to the way it was, though," she said.

Interest rates are the Bank's main tool in try to maintain the annual rate of inflation at, or close to, its target of 2%.

The most recent UK inflation figures show prices rose 2.6% in the year to March. However, the rate is expected to jump following a series of household bill increases at the start of April – including energy and water prices.

The Bank said it expected inflation to rise "temporarily" to 3.5% this year due to the bill increases before falling back due lower oil and gas prices set to feed through in the coming months.

The theory behind increasing interest rates to tackle inflation is that by making borrowing more expensive, more people will cut back on spending and that leads to demand for goods falling and price rises easing.

But it is a balancing act as high interest rates can harm the economy as businesses hold off on investing in production and jobs.

The Bank expects UK growth for the first three months of this year to be stronger than it originally forecast at 0.6%, boosted by US firms stockpiling goods ahead of Trump's tariffs coming into effect. The official figures are set to be released next week.

A boost in growth would be welcome news to the government, which has made growing the economy its main priority in order to boost living standards.

The government's Budget decision to increase National Insurance last month for employers kicked in last month, but the Bank said the effect of the tax increase "appears to have been fairly small to date", though it added business confidence had taken a hit in recent months.

A lot of firms are taking a "wait and see" approach to whether the UK economy picks up before hiring and investing, it said.

Chancellor Rachel Reeves said the latest rate cut was "welcome news", but added: "There is more to do, and I know families are still facing cost of living pressures.

Mr Bailey said the UK had "still a lot to do" on growth: "We have seen over the last, really since the financial crisis, 15 years or so now, the rates of growth be consistently lower than they were before that."

Sign up for our Politics Essential newsletter to keep up with the inner workings of Westminster and beyond.