What could the Budget mean for Leicestershire?

BBC

BBCIt's not just employers and employees waiting to see what the Budget holds for them this time round.

Local councils are looking for more than crumbs of comfort too after a decade struggling with shrinking funding from Whitehall.

Politicians in Leicester, Leicestershire and Rutland will be listening carefully as the chancellor sets out her economic plan on Wednesday.

A year ago, Leicester's elected mayor Sir Peter Soulsby warned the then Secretary of State for Local Government Michael Gove, that effective bankruptcy was "becoming almost inevitable before we set the 2025-26 budget".

Now his team is starting to put that budget together.

For this financial year, the council plugged a £61m gap between spending and income from reserves. That left about £7m in the emergency pot for the years ahead. And demand for services it has to provide keeps rising.

So cuts to non-statutory services will continue and scary-sounding numbers form an equally scary financial reality at places like Leicester's nine children's adventure playgrounds - run for years with council funds - now looking for different ways of keeping going.

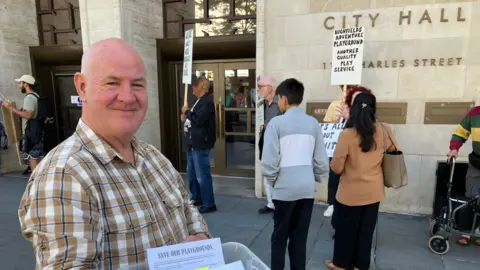

Kevin Sherriff has kept campaigning to protect Highfields Adventure Playground, whenever its funding has come under threat.

He's worked there for years and helps keep between 140 and 170 kids a day off the streets and safely occupied during the summer holidays.

He's co-ordinated several protests outside the city council's offices, as councillors have discussed the cuts.

The authority says it wants the playgrounds to continue and is providing five-year leases to help them secure funding from other sources.

But legal complexities at various sites have made this a difficult process.

"It's been traumatic having to face up to the idea of losing staff but people are more worried about losing the projects than their own jobs," said Mr Sherriff.

He's worried that years of skill, experience and most importantly, trust - built up between staff and children - will be lost with any redundancies.

Tough decisions

The city mayor has watched two nearby authorities issue section 114 notices in recent years - in Northamptonshire and Nottingham - but that doesn't make it an easier decision to take, financially or politically.

Right now, the council is looking at how it can do everything possible to avoid issuing a section 114, rather than setting a date for issuing one.

But without a massive bit of good news in the upcoming Budget, it seems unlikely they can hold off on it for long.

So funding for all the council's non-statutory services could be at risk including:

- Public events like Diwali celebrations

- Council tax support for people on low income

- Children's centres (11 were closed in 2017, 12 remain open)

- Support for transport to school for over-16 special educational needs and disabilities (SEND) children

At Leicestershire County Council, the politicians' talk was more confident earlier this year.

"We are not in crisis territory. But we do have a significant budget gap and need to deliver services differently," the authority said.

It maps out a four-year budget, with a £6m budget shortfall next year – rising to £83m in 2028. More scary figures.

And again in the face of rising demand for its statutory services, adult and children's social care.

Leicestershire also publishes a list of savings under development, where departments look at services where they might be able to make future savings. This year's list included:

- Child to adult social care transition

- The council's mobile phone usage

- Country park cafes

Last month, the council called on the new Labour government to "level with us" on plans for funding as it planned its latest budget.

Conservative-controlled Leicestershire has been one of the lowest funded county authorities in the country throughout the last government.

It will want to know how the new government can - or will - help it balance the books.

While business rates are set nationally, it is local councils that send out the bills to businesses and collect payments. Across Leicestershire, it’s districts and boroughs and they have their own financial constraints too.

These councils also make decisions on whether businesses are eligible for business rate relief.

Local councils retain half of the money collected and will no doubt want to see that income maintained.

But for business owners like Nicki Worthington, who runs the Coal Bunker Cafe in Coalville, it's time to cut this tax.

"Business rates can be very detrimental. There's a lot going out that people don't see," she said.

"People always assume that if you've got your own business, you've got a load of money... and that isn't the case."

Her business also helps out smaller independent traders with unit space and display cabinets within her cafe building, to keep costs to a minimum.

She says VAT and energy prices are other things the government needs to consider in helping small businesses, particularly in the hospitality sector.

"It needs looking at across the board," she says.

Tax burden

Rutland - the country's smallest county - has a tiny budget compared to its neighbours but it makes the numbers a little easier to take in. The council's net budget for 2024-25 was £49.1m and featured about £1.8m of savings.

Rutland says it now relies on council tax contributions for 77% of its core funding, compared to 56% at other councils.

And that might go somewhere to explaining its council tax bill for residents: £2,113.49 for its charges in 2024-25 on a Band D property, compared to £1,924.63 in Leicester and £1,601.58 in Leicestershire (none of which include any district/borough, parish council, fire and police charges).

Rutland also faces a financial gap, caused by £5.2m of new budget pressures this year.

So, no matter where you live in Leicester, Leicestershire and Rutland, your local councils are hoping for some relief from further tough financial times - to help you and themselves.

Follow BBC Leicester on Facebook, on X, or on Instagram. Send your story ideas to [email protected] or via WhatsApp on 0808 100 2210.