Gen Alpha are ready to spend – and they want to be treated like adults

Getty Images

Getty ImagesThe youngest consumers can't yet drive themselves to the shops. It won't stop them from buying like their millennial parents.

When I was 13 in the late 2000s, finally old enough to be dropped off at our local mall in Delaware, US, there was only one place I wanted to shop: Limited Too. The store, founded in 1987, was a younger offshoot of adult clothing brand The Limited, and was a tween fashion destination filled with logo tees, floral sundresses, plaid skirts, denim vests and plenty of sparking accessories.

Limited Too was among many stores of the time that catered to the in-between age – Wet Seal, Delia's, The Body Shop, Lush, Charlotte Russe – where young people were playing with ideas of who they could become. But by 2008, Limited Too's retail locations had vanished, many having merged with the tween store Justice, which, as of 2020, also shuttered all physical locations.

Today's tweens have few retail spaces to frequent, not because their generation isn't interested in shopping – quite the opposite. Gen Alpha, born between 2010 and 2024, is more brand-aware than ever, but they have few dedicated spaces or brands targeting their specific needs. Instead, Gen Alpha want to enter directly into the brands of adulthood, preferring to shop where their millennial parents shop: Lululemon, Sephora, Walmart, Target.

Mature brands are ready to welcome these young shoppers – and for good reason. As an estimated 2.5m Gen Alphas are born weekly, the demographic's economic footprint is expected to reach $5.46tn (£4.32tn) by 2029 – almost as much as the spending power of millennials and Gen Z combined. By setting their sights on the youngest consumers, adult brands can secure the loyalty of the next generation by simply expanding the offerings they already have.

Getty Images

Getty ImagesThe end of the tween branding space

The concept of a "tween" is largely a North American term, and wouldn't exist were it not for advertising. Short for "tweenager", one of the word's first appearances was in 1964 as a size designation in a New York Times article about shopping. By the late 1980s, the term had taken firm hold, with tween shopping habits for things like Polaroid cameras and video games making frequent headlines.

"No, not teen-ager. Tween-ager," a 1988 USA Weekend article reads, per the Oxford English Dictionary. "She's that nine-year-old suddenly dressing to the nines. He's that 10-year-old buying Benetton instead of baseball cards. They hang out at the local tween mecca – the shopping mall."

Other languages have their own designations, such as "teini" in Finland; and the Arabic "sin el morahqa", which translates to "age of getting closer". Tween shopping has similarly gained an international foothold. There was Tammy Girl, a haven for UK tweens in the '90s that shut its doors in 2005, and Pull&Bear, a streetwear-casual store for young people founded in Spain in 1991. It's still going strong. American tween brands like Abercrombie & Fitch and Hollister have also found success abroad, with stores in Asia, Europe and South America.

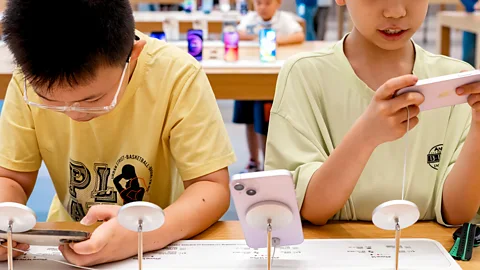

But recent attempts by adult brands to target the tween demographic – like Franki, the younger version of the women's mall-brand Francesca's, and Project Gap, a category within the larger Gap brand – come nowhere near the top of Gen Alpha's favourite stores. According to US advertising and media company Razorfish, that honour goes to Amazon, Apple, Nintendo, Target and other places on a typical adult's gift list. The same goes for the UK: Smyth's Toys, Sports Direct and Tesco top Performance Marketing World's list of "coolest" brands for kids.

"Because this cohort is so brand mature, you have to be very aware of the authenticity of your brand," says Josh Campo, New York-based CEO of Razorfish. "I do think that that's part of the reason that you see their affinities not towards the typical kid brands. It probably doesn't have the same authentic feel because it's almost like you're patronising them."

Getty Images

Getty ImagesBrand audiences are also no longer defined by narrow demographics: everything is for everyone. Razorfish reports Gen Alpha and Gen Z share all but two of the same top 10 favourite brands. And millennials are likely to share the same Stanley tumbler as their kids.

"Trends these days are not age specific," says Casey Lewis, who writes the youth consumer analysis newsletter After School. For example, instead of creating a new line of clothes specifically for tweens, brands have simply expanded the size range of their current lines. "Women's clothing comes in smaller sizes," explains Lewis, so it's easier to start wearing at a young age. "Young girls are wearing baggy jeans and flared leggings, and so are millennials, so there's really less of a distinction."

But while Gen Alpha may have strong preferences in their shopping choices, they don't yet have independent spending power. The reality of what kids wear, buy, and apply to their faces is still, for the most part, down to their parents' purses. As of now, Gen Alpha has an additional $300bn (£237.3bn) in spending power through parental influence, which is why brands continue to market to adults, even if their consumers are getting younger. If you're wondering why $45 (£35.50) products with retinol and exfoliating acids are appearing in 10-year-olds' shopping carts, look at who's paying for it. "Millennial habits are trickling down to their own kids," says Lewis.

Online habits and offline experiences

These habits were built online throughout the past decade, first on Instagram, where millennials learned to lead photogenic lifestyles; and then on TikTok, where Gen Z and Gen Alpha have learned to "get ready with me" by listing off the brands they consume in a morning.

Getty Images

Getty ImagesBy associating with these brands, tweens can participate in online culture. Trends popular with multiple generations, such as "face-baking" and "pimple-patching", are based entirely on trying and reviewing different products.

The relentless appearances of certain products across Instagram Stories, YouTube haul videos and TikTok For You Pages has elevated them to cult status. They do more than serve their functional purpose. The possession of certain brands also grants the tween immediate acceptance into an elite community of multigenerational tastemakers. Purchasing a certain brand has become the new entry into adulthood.

Perhaps this is just what happens when three generations that span nearly 40 years share the same digital space: 43% of Gen Alphas in the US had tablets before the age of six, and 58% received their first iPhone by age 10.

"What we see is not so much as the targeting of Gen Alpha, it's the overlap of where content gets consumed between Gen Alpha and Gen Z and older generations more generally," says Razorfish's Campo. "It is leading them to have a far more sophisticated brand maturity than we would've expected."

"The rise of the 'shelfie', a photo of what's in your bathroom shelf, has been a game changer for our brand," Marc Elrick, who launched the global skincare brand Byoma in 2020, told Business Of Fashion. "This demographic is collecting skincare and it helps if your brand is aesthetically pleasing and fun."

There are brands creating and marketing with Gen Alpha in mind, mainly focused on price point and visual appeal. While trending skincare brand Drunk Elephant's best-selling products land somewhere between $30 to $80 (£23.70 to £63.75), the UK skincare brand Bubble – which markets itself towards Gen Z and Gen Alpha – keeps its individual products under $20 (£15.80), while also remaining age-appropriate for their skin.

Other brands hope to target the younger generation by emphasising their values. Sustainability is already a value important to Gen Alpha, reports Razorfish, and Australian clothing store Ziggy Zaza secures the loyalty of environmentally-minded kids and their parents by manufacturing using sustainable and renewable materials. London-based What Mother Made has a similar ethos, but hopes to attract children and their parents by offering handmade, zero-waste clothing products for both.

But more often, the "tween" designation works the other way around – that items from brands designed for all ages end up getting an unintended "tween" designation, thanks the demographic's enthusiasm. At the end of 2023, Lewis rounded up the most popular Christmas presents for teens, based on TikTok haul videos. The gifts included Stanley tumblers, mini-platform Uggs, Dyson hair gadgets and Birkenstock clogs – all items adults can buy for themselves, but also purchase for their kids.

Courtesy of Kate Lindsay

Courtesy of Kate Lindsay"If you, 10 years old, saw that Drunk Elephant serum on TikTok and then you talk to your mum about it and your mum does a little research, she's like, 'Huh, this is actually well reviewed on Sephora'," says Lewis. "So, then you end up buying that Drunk Elephant. Kids have always had tons of purchasing power even before having the money, but I do think… because Gen Alpha and Gen Z are so digitally native, this group of young consumers will have even more purchasing sway over their parents' decisions."

A tween playground

While Gen Alpha might lean into adult tastes, they still want a place to play. "The thing with tweens is there are fewer spaces specifically for them now," says Lewis. Physical retail has seen a decline in recent years, with US malls closing at a rate of 15 to 20 per year, according to real-estate advisory firm Green Street Advisors. Overall, the US saw the closure of at least 2,800 retail stores in 2023.

Yet Gen Z increasingly prefer to shop in person. Malls that remain, like New Jersey's Garden State Plaza, have seen their occupancy rate rebound to pre-pandemic levels, and sales at malls increased more than 11% between 2021 and 2022. And the places that are the most popular are those that feel like a place to play. "You go into a Sephora and it's like an amusement park for make-up," says Lewis. "It really is sort of a free-for-all for adults and kids alike."

Big-box stores such as Walmart and Target, two of Gen Alpha's favourite brands, also offer a similar kind of retail playground. But this is not without growing pains: malls like Garden State Plaza have been so overrun with young shoppers that they've begun instituting curfews for minors due to a rise in unruliness. Unaccompanied minors must be picked up outside by 17:00, or in the case of a Los Angeles mall, be required to wear lanyards with their names and parents' phone numbers.

There is also the potential that adult brands granting Gen Alpha early access may run the risk of alienating their adult consumer base – think the ongoing Sephora teen panic, in which older customers have complained about a surge of misbehaved young shoppers. "I don't really want to have to elbow my way through a gaggle of 10-year-olds to get some blush," says Lewis. But with $5.46bn and an even longer lifetime of brand loyalty on the table, it's a risk brands are willing to take.