Hunter Biden: Who are the IRS tax whistleblowers?

Getty Images

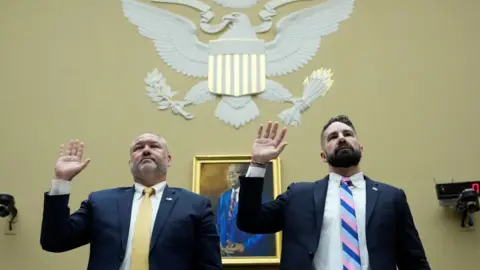

Getty ImagesTwo Internal Revenue Service (IRS) investigators have testified to Congress that the investigation into Hunter Biden's tax returns were hampered by justice department officials for political reasons.

They allege that Mr Biden, who agreed on 20 June to plead guilty to two misdemeanour tax offences and a felony firearm violation, should have been charged with more serious crimes.

Instead, they claim, he received more lenient treatment because he is the son of US President Joe Biden.

Here are the basics of the story.

Who are the whistleblowers?

The two IRS employees who testified about the Hunter Biden investigation are Gary Shapley, a supervisory special agent, and Joseph Zielger, a criminal investigator.

Mr Shapley has worked for the IRS for 14 years and serves as a team leader in the agency's International Tax and Financial Crimes group, which oversaw the IRS investigation into Hunter Biden.

Mr Ziegler, whose identity was concealed until he publicly testified to the House Oversight Committee on 19 July, has worked in the IRS Criminal Investigations Division for 13 years. In November 2018, he initiated an inquiry into Hunter Biden's tax filings.

That investigation would subsequently be merged with a Delaware-based federal investigation of Mr Biden's finances that began in January 2019 and is headed by US Attorney for Delaware David Weiss.

During his testimony, Mr Ziegler told the committee he is a "gay Democrat married to a man" - although he said this was no reason to give his testimony extra credibility.

Getty Images

Getty ImagesWhat are they alleging?

During their public testimony, the two men said that throughout the Hunter Biden investigation, decisions were made that benefited the president's son.

The two whistleblowers accuse Delaware Assistant US Attorney Lesley Wolf, an assistant to Mr Weiss, of repeatedly blocking further investigation into Hunter Biden. They say she denied a request for a search warrant of Joe Biden's Wilmington home, where Hunter Biden kept some of his financial records, citing "optics".

They say she also prevented investigators from asking about Joe Biden's connection to his son's finances and denied a request to interview Mr Biden's adult grandchildren about their connections to deductions claimed on Hunter Biden's tax returns.

She informed Mr Biden's lawyers that investigators were interested in documents contained in a rented northern Virginia storage unit, allowing Mr Biden the opportunity to access the unit before investigators could take action, they say.

"I have reason to believe that there was gross mismanagement present throughout the investigation, that there was a gross waste of funds relating to the tax dollars spent on investigation this case and that there was an abuse of authority," said Mr Zielger during his testimony.

Mr Shapley said that the IRS had largely concluded its investigation by the end of 2021 and recommended that Hunter Biden be charged with multiple tax fraud felonies. The agency officially referred those conclusions to US government attorneys in Washington DC, in February 2022, and in California in September 2022. Neither took action.

Ultimately, Mr Weiss brought charges against Mr Biden as part of a plea deal - but for misdemeanours that carry no prison time, not the felonies the IRS investigators recommended.

In a 7 October 2022 meeting, Mr Shapley described how Mr Weiss told a group of senior IRS and FBI officials that he "was not the deciding person on whether charges are filed". Mr Shapley documented the meeting, which he attended, in an email later that day to an IRS colleague.

"That was my red line," Mr Shapley said during his Oversight Committee testimony. "The justice department allowed the president's political appointees to weigh in on whether to charge the president's son."

He said the following month, the statute of limitations was allowed to lapse on Hunter Biden's 2014 and 2015 tax returns, even though prosecutors could have sought an extension.

Getty Images

Getty ImagesHow has US Attorney Weiss responded?

When Mr Biden took office in January 2021, he announced that he would keep Mr Weiss, a Donald Trump appointee, in his job as US attorney in Delaware to continue the Hunter Biden investigation. Typically, all US attorneys appointed by a previous administration tender resignations so they can be replaced by the new president.

That has not insulated Mr Weiss from accusations by Republicans that he has succumbed to political pressure when he offered Hunter Biden the plea deal on reduced tax charges.

Mr Weiss has repeatedly been asked by Republican members of Congress about the extent of his power to investigate Mr Biden.

In a 6 June 2023 letter to House Judiciary Chair Jim Jordan, he wrote: "I have been granted ultimate authority over this matter, including responsibility for deciding where, when and whether to file charges and for making decisions necessary to preserve the integrity of the prosecution, consistent with federal law, the principles of federal prosecution and department regulation."

In a follow-up letter, Mr Weiss said he stood by what he wrote, adding that he had been assured by justice department officials that he would be granted authority to bring charges outside of Delaware if he deemed it necessary.

Getty Images

Getty ImagesWhat are Democrats saying?

During the 19 July whistleblower hearing, Democratic Congressman Jamie Raskin characterised the objections the two men had with Mr Weiss and the justice department as typical disagreements between investigators who gather evidence of crimes and prosecutors who have to exercise discretion over whether that evidence is sufficient to bring charges and obtain convictions.

Mr Raskin said that Hunter Biden, suffering from grief over the death of his elder brother and while addicted to drugs, "made foolish and criminal choices, including failing to pay his taxes". But he said he is being held criminally responsible.

Democrats also pointed out that much of the justice department conduct to which the whistleblowers object, including investigative delays and procedural blocks, took place in 2020, during the Trump administration, when Joe Biden was a private citizen.

The justice department and the White House have denied any interference in Mr Weiss' investigation and have said that the president has never been involved in his son's business dealings.

What happens next?

Hunter Biden will be arraigned on his plea deal charges on 26 July.

House Republicans pledge to continue their investigations into the younger Biden's finances and any connections they may have to the president.

The whistleblower testimony has renewed calls by some conservatives to bring impeachment proceedings against US Attorney General Merrick Garland, who they say lied to Congress when he testified that Mr Weiss's investigation was free from influence by justice department political employees.

Republicans will also continue to press for Mr Weiss to personally testify before Congress - something that the justice department has said will happen "at an appropriate time", after the Hunter Biden investigation has concluded.

That investigation is ongoing the justice department said in June, after Hunter Biden's plea agreement was announced.