Debt ceiling deal: US House overwhelmingly passes bill

Getty Images

Getty ImagesA deal allowing the US to borrow more money has moved closer to becoming law, days before the world's biggest economy is due to start defaulting on its debt.

The measure easily passed the House of Representatives by a vote of 314-117, despite defections on both sides.

The Senate is now meeting ahead of a vote, which the bill needs to pass before it can be signed into law by President Joe Biden.

The government is forecast to hit its borrowing limit on Monday 5 June.

That has left little margin for error as lawmakers race to avoid the US defaulting on its $31.4tn (£25tn) debt, which underpins the global financial system.

A default would mean the government could not borrow any more money or pay all of its bills. It would also threaten to wreak havoc on the global economy, affecting prices and mortgage rates in other countries.

On Wednesday evening, 165 Democrats joined 149 Republicans in approving the 99-page bill to raise the debt ceiling, allowing it to pass the House by the required simple majority.

With Republicans in control of the lower chamber of Congress and Democrats holding sway in the upper chamber and White House, a deal had proven elusive for weeks until Mr Biden and House Speaker Kevin McCarthy inked a bipartisan compromise over the weekend.

In a statement, Mr Biden thanked the speaker, saying he had negotiated in good faith.

"Neither side got everything it wanted," said the president. "That's the responsibility of governing."

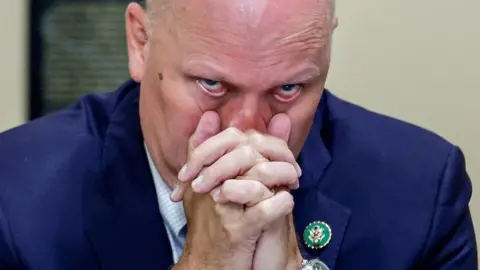

A triumph for Speaker McCarthy

Kevin McCarthy was able to push Joe Biden and reluctant Democrats to the negotiating table by passing a bill that raised the debt limit but included a laundry list of conservative priorities.

Then he was able to hold his party together as he struck a less ambitious deal with the president that modestly trimmed the growth in federal spending and added some new conditions on aid for low-income Americans.

That was not enough for a group of hard-line conservatives, some of whom hinted they would unseat Mr McCarthy and force a new election for Speaker.

But by Wednesday, even the hottest of firebrands were backing away from their rhetoric. And when it came time to vote, a majority of Republicans approved Mr McCarthy's deal.

While the hard-liners may grumble, it is clear they do not have anywhere near the level of support they would need to replace Mr McCarthy - or even any idea who to replace him with.

The agreement suspends the debt ceiling, the spending limit set by Congress which determines how much money the government can borrow, until 1 January 2025.

The legislation would result in $1.5tn in savings over a decade, the non-partisan Congressional Budget Office said on Tuesday.

But the bill's passage had been in jeopardy after lawmakers from both parties voiced opposition.

Ultra-conservative Republicans complained they had secured too few concessions in exchange for raising the debt limit.

Democrats objected to provisions raising work requirements for Americans on federal food aid, and restarting student loan repayments.

Emanuel Cleaver, a Missouri Democrat, said he would vote for the bill, even though he viewed it as the "second serving of Satan's sandwiches".

The leader of the House Democrats, Hakeem Jeffries, said his party had politically bailed out the Republican speaker.

"Once again, House Democrats to the rescue to avoid a dangerous default," said the New York congressman.

Eli Crane, an Arizona Republican who had vowed to stop the bill, tweeted: "More Democrats voted for this 'historic conservative victory' than Republicans.

"What a joke."

Getty Images

Getty ImagesRepublicans control the House by a narrow 222-213 majority, but Mr McCarthy was able to push the bill over the line with support from political centrists on both sides of the aisle.

He framed the package as "the biggest cut and savings this Congress has ever voted for".

The bill is not yet assured of passage. It now heads to the Senate, where some combination of Democratic and Republican votes may again be needed.

One conservative Republican, Mike Lee of Utah, has already threatened to use "every procedural tool" to stall consideration of the deal.

Left-wing Senator Bernie Sanders also came out against the bill on Wednesday, saying he cannot "in good conscience" support it - but he told CNN he would not delay its passage.

Both Democratic and Republican leaders in the Senate are working to ensure that a bill reaches Mr Biden's desk for his signature this weekend before a default can occur.

The last time the US came this close to overshooting its debt ceiling, in 2011, the credit agency Standard & Poor's downgraded the country's rating, a move that has yet to be reversed.

Before Wednesday's vote, US stock markets ended the day down a little, with the Dow closing 0.4% lower, while the S&P and Nasdaq both dipped by 0.6%.

With Nomia Iqbal and Jessica Parker reporting from Capitol Hill