What Americans can learn from Denmark on handling debt ceiling crisis

Getty Images

Getty ImagesThe high-wire drama of raising the US debt ceiling is making headlines again. Is there a better way? Perhaps Denmark has the answer.

The US Congress is once more arguing about the country's debt ceiling - the limit on how much the government can borrow.

If the two major parties don't agree on lifting the cap in the next few weeks, the US could for the first time in history default on its debt.

A default would send shockwaves through global financial markets and could be disastrous for the US economy, experts believe.

But Republicans, who control the lower chamber of Congress, want spending cuts before they will agree.

The ceiling was introduced more than a century ago and it makes the US something of an outlier in global terms.

Only one other industrialised nation - Denmark - has a formal debt ceiling, but it is handled without the drama and brinkmanship often seen in Washington.

In fact, the Danes' debt ceiling is rarely ever talked about, because it's never even come close to being broken.

Called "gældsloft" in Danish, it was introduced in 1993 as a constitutional requirement.

Obama White House Archives

Obama White House Archives"It's there so that the government cannot just write a blank cheque," said Las Olsen, chief economist at Danske Bank.

Though the American and Danish laws appear similar, they work rather differently.

"[Danish] politicians consider it to be more of a formality. It's not a political issue," Mr Olsen said.

"They [parliament] have already passed all the laws requiring spending and they have also passed the laws about how much tax to collect," he added.

"So it would be a little strange not to allow the government to borrow the difference."

The Danish threshold is set at DKK 2 trillion ($284bn, £237.7bn). For a small country that's relatively high, and means there's scope to take out state loans without repeatedly hitting it.

"The total level of state debt at this point is DKK 645 billion. So that's a long way off," said Mr Olsen.

The ceiling has only been lifted once, when it was doubled in 2010. This followed the 2008 financial crisis and the move was widely backed by Danish political parties.

"All of a sudden the government really did have to borrow a lot of money in a short period of time to support the economy," said Mr Olsen.

In comparison, the American ceiling has been raised on 78 separate occasions since 1960 - 49 times under a Republican president and 29 times under a Democrat.

Danish politics is less polarised than in the US and there are more than a dozen different parties with seats in parliament.

Mr Olsen said that, while Danish politicians often disagree about what the budget should be spent on, they're mostly aligned on how to manage it.

"They broadly agree on the framework, which is that finances should be sustainable and that expenses should be paid for," said Mr Olsen. "That brings a different kind of political discussion than maybe you see in the US."

One major way in which Denmark's scenario differs from the US, is that its debt has generally been shrinking. The government ended 2022 with a budget surplus, and used the money to pay down a large chunk of its borrowing.

"There is actually a lot of saving going on," Mr Olsen explained. "It's a policy aimed at making sure that the economic situation is sustainable in the long term, when we know there's a lot of pensioners and we'll be living a lot longer."

A simple guide to the debt ceiling

- If government spending exceeds revenue received from tax then government must borrow

- Since World War I the US has set a limit on that borrowing - a debt ceiling - which it raises when it needs to through a vote in Congress, which used to be routine

- Currently Democrats control Senate and Republicans run House so they need both parties' votes to raise the cap

- The US has never defaulted on its debts but experts say such a scenario would have devastating consequences for the global economy

THE POLITICS: A nightmare of its own making

THE ECONOMY: What happens when the US hits debt ceiling?

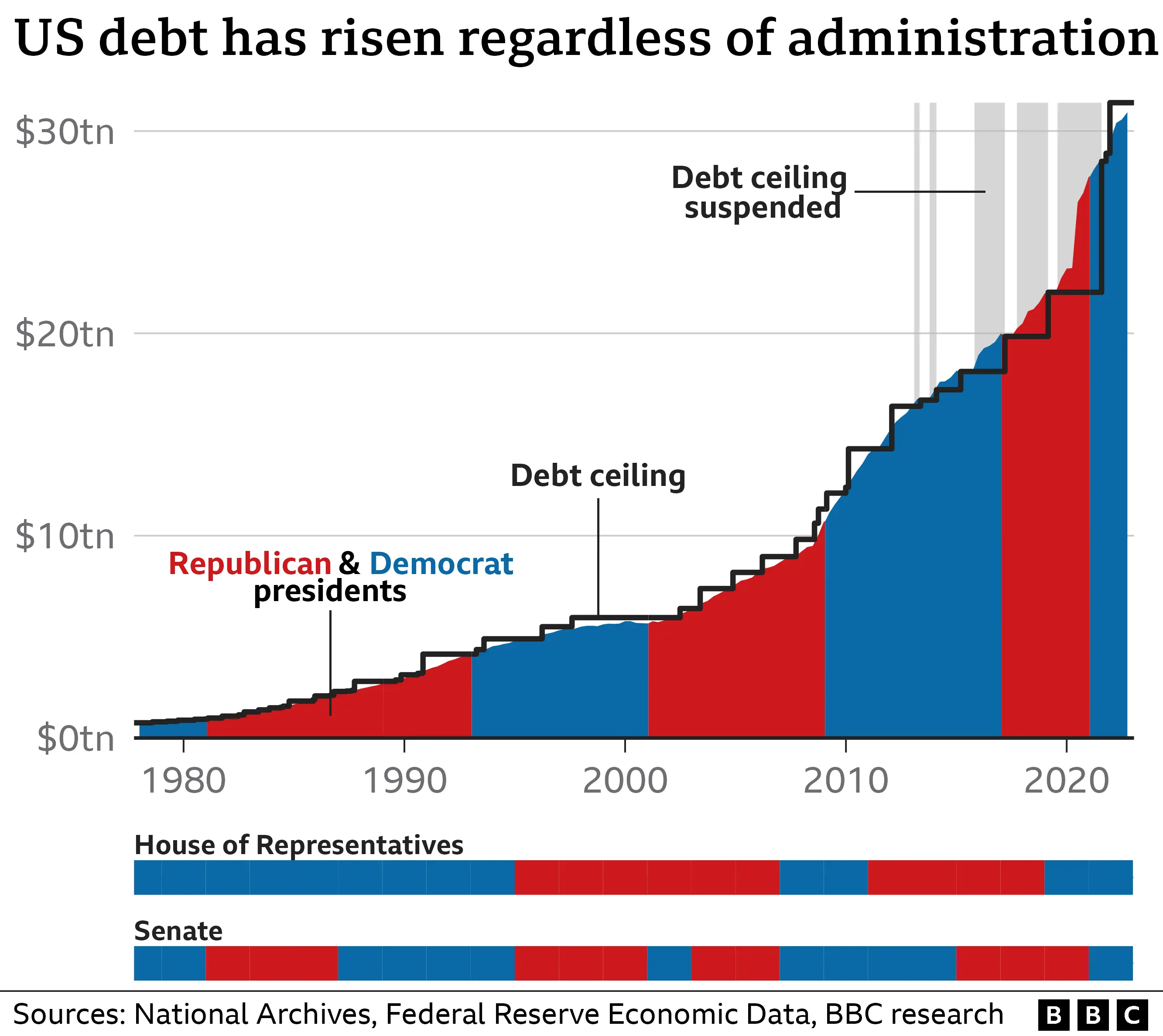

The US national debt has been growing since the early 1980s, with the government accumulating debts far bigger than the US earns in a given year. It surpassed the size of the country's GDP in 2013 and has now exceeded $31tn (£26tn).

Many other countries opt for a different method, and look at debt as a proportion of GDP instead. This shows how much a country owes relative to the size of its economy, and can give a better sense of a country's ability to repay its borrowing.

In fact, EU member states have agreed to keep debt to less than 60% of GDP - though not always in practice.

Denmark is unique because it has both a debt ceiling and has also committed to the EU cap. "It's a much more meaningful constraint on governments," said Mr Olsen.

So what would it take for the US to be more Danish in its approach?

Extracting the politics from the American debt limit fight won't happen any time soon because it's become a partisan ritual, says Jacob Kirkegaard, a non-resident senior fellow at the Peterson Institute for International Economics.

He supports getting rid of the US debt ceiling, which he argues is more of a "nuisance" than a sensible tool that constrains government spending.

But he thinks neither party would risk doing it because they risk being vulnerable to the charge that they don't care about balancing the nation's books.