Warren Buffett's company Berkshire Hathaway sells US airline shares

Reuters

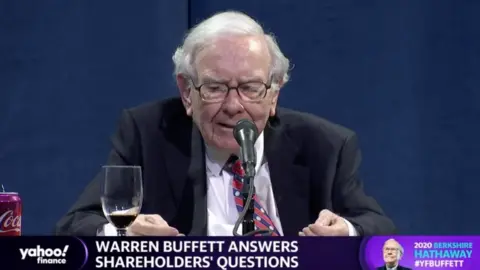

ReutersBillionaire investor Warren Buffett says his company Berkshire Hathaway has sold all of its shares in the four largest US airlines.

Speaking at the annual shareholders' meeting, Mr Buffett said "the world has changed" because of the coronavirus.

He then said he had been wrong to invest in the airline industry.

Mr Buffett's comments came just hours after Berkshire Hathaway announced a record $50bn (£40bn) net first quarter loss, Reuters news agency reports.

The conglomerate had an 11% stake in Delta Air Lines, 10% of American Airlines, 10% of Southwest Airlines, and 9% of United Airlines, according to its annual report and company filings.

The firm began investing in the four airlines in 2016, after avoiding the aviation industry for years.

What did Warren Buffett say?

Mr Buffett told the meeting, which was held virtually: "We made that decision in terms of the airline business. We took money out of the business basically even at a substantial loss.

"We will not fund a company that... where we think that it is going to chew up money in the future."

Getty Images

Getty ImagesThe US travel industry has almost collapsed as a result of the coronavirus pandemic, with airlines cutting hundreds of thousands of flights and taking thousands of planes out of service.

Mr Buffett said he had been considering investing in additional airlines before the pandemic hit.

"It is a blow to have, essentially, your demand dry up," he said. "It is basically that we shut off air travel in this country."

In a statement, Delta said it was aware of the sale and has "tremendous respect for Mr Buffett and the Berkshire team".

The airline added that it remains "confident" in its strengths.