Paid Off: TV show offers to pay off student debt

In the world of TV game shows, people have had their lives changed by winning expensive cars or houses. In 2018 America, a new programme is offering a slightly different - but perhaps as coveted - prize.

Your student debt paid off.

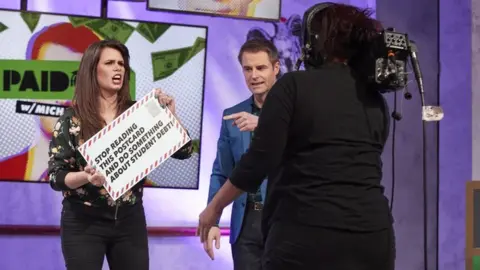

"It's a comedic trivia show that's an absurd answer to an absurd problem," said actor Michael Torpey, presenter of Paid Off, which premiered this week on the entertainment channel TruTV.

The programme sees three contestants, usually in their late 20s and early 30s, answering basic general knowledge questions. As they advance, they get closer to having their loans - some above $40,000 (£30,000) - fully covered.

The idea for the project, Torpey said, came when he met his wife. She had some $40,000 in loans for degrees and was doing "all sorts of odd jobs" to earn money. At the same time, she was also working towards getting her licence as a mental health counsellor.

"I didn't appreciate what it was to have this burden impact you all day, every day, keeping you from picturing your life moving forward - the ability to have kids, a home, go on vacations, down to the small stuff of having a second cup of coffee."

So when debt-free Torpey - known for his role in the Netflix drama Orange Is The New Black - booked his first commercial campaign, he knew exactly where the money would go.

"We wrote the cheque, put it in the envelope, and my wife just started crying."

HANDOUT/TRUTV

HANDOUT/TRUTVThe programme, which will air 15 other pre-recorded episodes, says nearly $500,000 in student debt has been wiped out.

The producers tried to pay it directly to the debt-holders, the Washington Post reports, but because of logistics and tax implications, the winners are getting a cheque instead.

For now, it is broadcast only in the US.

How does it affect you?

The competition may be funny but the issue is anything but:

- Some 45 million Americans have student loans, according to Student Debt Crisis, a non-profit group that offers help to those in debt

- This amounts to $1.5tn, which is reportedly $620bn more than the total credit card debt in the US

- The average debt is $37,000, higher than in the UK ($30,000), Australia ($22,000), Canada ($20,000) or Germany ($2,400), the Student Loan Report says

As part of the BBC's Ask America series, we have asked our readers if President Donald Trump was right to say "there's never been a better time to be young and American."

Many have responded negatively, citing student debt as one of the main obstacles (some of the answers have been edited for clarity).

- Claire Gear, 21, Milwaukee, Wisconsin: "The cost of a college education is overbearing; I'll be graduating next year with my undergrad degree and will be over $50,000 in debt, despite making monthly payments. In order to get two-thirds of jobs in the economy, however, this is necessary. Yes, the loans will be paid off eventually but this is a crippling investment; we can't invest in our retirement funds, buy a house, start a family, buy a car, or further our education"

- Courtney Kayser, 27, Madison, Wisconsin: "I'm currently over $50,000 in debt from both my bachelor's and master's degrees, which makes it extremely difficult, if not impossible, to save up to buy a car or a house. I struggle with rent every month and live paycheck to paycheck. I work every single day and can barely keep myself afloat with rent and loan payments. Most of the time I'm wondering how I'm going to manage and still eat or have a roof over my head"

Some, however, were not so pessimistic.

- William Larkin, 27, Washington DC: "Some people have chosen to take on crippling debt to get degrees that are worthless in addition to going to schools that are overpriced. I feel that these people made poor decisions. There are many ways that that could have been avoided. Either by military service or working for companies that will help fund your degree. I paid my loans as I worked. I left college with about $20,000 in debt, most of which I've since already paid off over the past five years since I left it"

Join the conversation

Has student debt affected your life? What are the other issues that matter to you and your community?

Send us your comments or questions to [email protected] and we will respond to what you tell us, as part of our Ask America series.

Previous stories