Donald Trump: Has US debt fallen since the president took office?

BBC

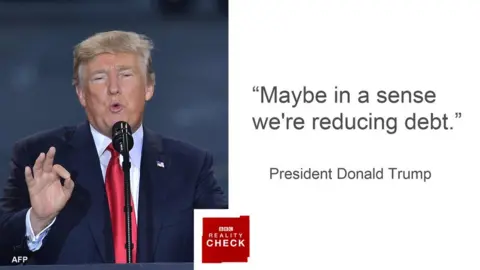

BBCPresident Trump made a number of claims about the economy in his first answer on Sean Hannity's programme on Fox News on Wednesday.

This is what he said:

"The country - we took it over, it owed $20 trillion. As you know, the last eight years they borrowed more than it did in the whole history of our country. So they borrowed more than $10tn, right? And yet, we picked up $5.2tn just in the stock market. Possibly picked up the whole thing in terms of the first nine months, in terms of value. So you could say in one sense, we're really increasing values. And maybe in a sense we're reducing debt."

Let's go through that one claim at a time.

The Treasury handily gives daily updates on the level of debt, which is the total amount owed by the US government.

On 20 January 2017, the date of the president's inauguration, the total outstanding public debt was $19.95tn (£15.2tn).

So he's right on that one.

Nearly right.

On 20 January 2009, when President Obama was sworn in, the debt was $10.63tn. The difference is $9.32tn, which is not more than $10tn, but is still a lot of borrowing.

Comparing figures with the amount of debt borrowed in the whole history of the country is a bit tricky.

We have to assume he means since 1789, because that's when the US Treasury's records go back to.

Clearly there are problems with this comparison, because the economy in the late 18th Century is in no sense comparable with the one today.

If we take the outstanding debt on inauguration day in 2009 as the total amount borrowed since 1789, then President Obama did not borrow more than that, he borrowed $1.31tn less than that.

Of course, that net debt figure is not the total amount borrowed. The total amount borrowed will be considerably more than that because some debt will have been repaid over the last few hundred years.

And if it's not quite true in cash terms over that period then it will certainly not be true using any measure that takes into account the growth of the economy.

Bloomberg's US exchange market capitalisation (measuring the value of all listed companies) puts the current value at $28.39tn, while the value the day after the inauguration was $25.55tn, so that's an increase of $2.84tn.

But we know from President Trump's Twitter account that he was actually comparing with the level on election day.

Allow X content?

On 8 November, the market capitalisation was $23.89tn, so it has grown by $4.5tn.

That's not quite $5.2tn but it's still growth of about 19%, which is pretty hefty.

This bit is harder to interpret, but it sounds like he is comparing the US debt with the value of the shares on the US stock exchange.

Market capitalisation is not the government's money - it is shareholders' money.

It might lead to more taxes being paid eventually, but the two figures do not belong in the same category.

Remember, on inauguration day, the debt was $19.95tn.

Well, the Treasury's latest figure for 10 October was $20.38tn, so that's gone up by $430bn.

Debt did actually fall in the early months of the presidency, but it jumped on 8 September when the president signed a bill raising the debt ceiling.