How did Lebanon become the third most indebted nation?

Getty Images

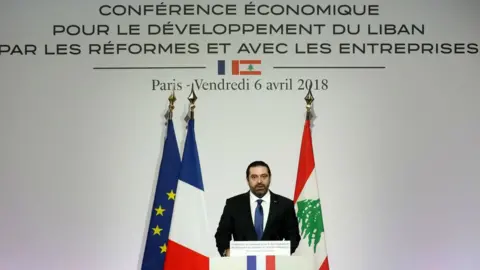

Getty ImagesFrom Mount Lebanon to mountains of debt, the government of Prime Minister Saad Hariri has been mobilising to reduce the country's huge deficit and level of borrowing over the past year.

A flurry of cabinet meetings, consultations and developments since the formation of Lebanon's latest government has highlighted key weaknesses in the country's economy.

With a 152% debt to GDP ratio, Lebanon is the third most indebted country in the world after Japan and Greece. Interest payments consume almost half of government revenues, crippling public finances. A public sector wage increase in 2017 and higher interest rates have added to the budget deficit.

Huge costs in Lebanon's post-war reconstruction were a leading precursor to today's financial problems. Achievements evidently favoured the country's rich and mostly focused on gleaming property developments in the capital, Beirut.

Sectors such as transport and energy need urgent overhauling - especially Lebanon's infamous electricity infrastructure. With the country unable to meet local demand for decades now and resorting to rationing electricity, most citizens use back-up generators for several hours during daily national blackouts.

At the beginning of February, Lebanese President Michel Aoun said he would make this a major priority. In fact, the grid is in such a desperate situation that it has been used as a bargaining chip by Hezbollah's regional allies, Syria and Iran.

Getty Images

Getty ImagesIran's ambassador to Lebanon, Mohammad Jalal Firouznia, said in February that "Iran was prepared to provide all the help that Lebanon needs, whether in terms of electricity, medication, or protecting Lebanon from the aggressor [Israel]".

After eight years of civil war and massive destruction of its own infrastructure, Syria sold electricity intermittently to Lebanon in 2017 and 2018, while at the same time blocking efforts by Jordan, a country which enjoys a surplus in electricity production, from selling power to Lebanon.

On 8 April, after a round of highly publicised meetings, the Lebanese government unanimously approved an electricity reform plan. Prime Minister Hariri told reporters: "This plan satisfies the Lebanese people because it will guarantee electricity 24 hours a day, which will reduce the budget deficit."

Steps towards fixing the power sector are viewed as a critical test of the government's will to forge ahead with long-delayed reforms that would help Lebanon unlock $11bn (£8.5bn) in funding pledged by donors last year at a key investment conference in Paris.

Unexploited energy reserves

The Lebanese government is relying on oil and gas reserves in the Mediterranean to fuel a bright future, opening up tenders to companies such as France's Total and Russia's Novatek for offshore drilling.

A deep mistrust of politicians, an absence of a functioning government for long periods of time and ongoing geopolitical disputes have hampered these efforts. While Lebanon's hydrocarbon wealth is promising, it is still far behind the progress of its neighbours.

Getty Images

Getty ImagesIn January, energy ministers from Cyprus, Egypt, Greece, Jordan and Israel, with representatives from Italy and the Palestinian Authority, met in Cairo to discuss regional co-operation in offshore gas. In addition, various export options and pipelines between some of those countries are already being advanced.

War in Syria has aggravated weaknesses in the Lebanese economy. Nearly 1.5 million Syrian refugees were displaced to Lebanon at the height of the war according to Lebanese government statistics - nearly one quarter of the population. The additional strain further compounded existing issues in public services such as education, healthcare and the national grid.

Financing Lebanon's deficit also depends heavily on critical transfers it receives from its large diaspora. In October 2018, the Carnegie Endowment for International Peace reported that the marked drop in remittances from Lebanese nationals in the Gulf had pushed the country further into debt.

Worsening prospects in the Gulf region and lower oil prices have affected significant numbers of Lebanese expatriates in oil-producing Gulf states. In 2018, the World Bank linked the issue to the November 2017 crisis between Lebanon and Saudi Arabia which involved claims that Prime Minister Hariri was being held captive and forced to resign.

The situation quickly escalated and Riyadh threatened to expel Lebanese nationals working in the kingdom. Tensions remained high even after Mr Hariri and his family were able to leave Saudi Arabia.

Lebanese workers in the Gulf contribute nearly one-fifth of Lebanon's GDP, making them a vital source of the deposits that banks use to finance more debt. About 400,000 Lebanese nationals - half of them in Saudi Arabia - contributed between 43% and 60% of total remittances in 2015.

However, total remittances dropped by 7% in 2017. The decline is further exacerbated by Saudi Arabia's Vision 2030 which undertakes unprecedented economic restructuring to create jobs for Saudis, including measures to encourage the replacement of foreign labour.

Military veterans protest

Cabinet efforts to pass an austerity budget to meet the criteria to unlock billions of dollars of pledges by overseas donors have alarmed some segments of society. Many are worried about potential cuts to pensions and state interference in the country's sophisticated banking system.

On 30 April, military veterans protested against anticipated reductions to their pensions. On the same day, the General Confederation of Lebanese Workers (CGTL) called for a three-day strike to protest against anticipated austerity measures in this year's budget, the state-run NNA news agency reported.

The union urged people to join protests against "infringements to public workers' salaries". The strikes affected several institutions including the Port of Beirut, the National Social Security Fund, Electricity of Lebanon (EDL) and Ogero Telecom.

On 8 May, the CGTL called the protests off after President Aoun informed the union that an article of the 2019 budget law relating to potential cuts to employees' salaries had been suspended "until the situation of each sector, one-by-one, is studied in co-ordination with relevant ministries", according to union leader Bechara Asmar.

The previous day, central bank employees announced a temporary halt to their strike.

As Mr Hariri tried to appease the various groups, he vowed to push through economic reforms. "Lebanon is far from bankruptcy," he said.

The latest wave of protests began on 17 October. Anger spilled over into the streets in major cities across the country over a government proposal to charge $6 for the use of WhatsApp and other VOIP apps. The government has since scrapped the plan but protesters have remained on the streets in large numbers.

BBC Monitoring reports and analyses news from TV, radio, web and print media around the world. You can follow BBC Monitoring on Twitter and Facebook.