Covid-19: 'Large scale redundancy' threat suspends support recovery effort

BBC

BBCPlans to recoup support from Guernsey businesses have been suspended to avoid "large scale redundancies", the Policy and Resources Committee (P&R) said.

Salary support given by the States of Guernsey in January or February will no longer have to be returned by profitable employers.

The decision was made to ensure businesses would not be prevented from reopening, Deputy Mark Helyar said.

An amended payroll co-funding scheme scheme was reintroduced on Monday.

It allows employers to claim 80% of Guernsey's minimum wage of £8.70 for workers, with businesses required to pay the remainder.

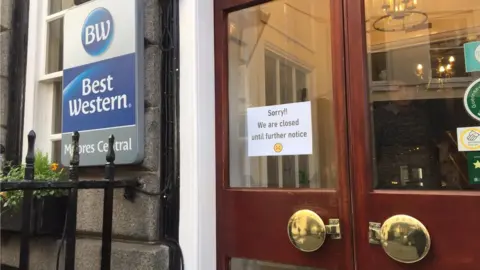

The scheme was reintroduced with a new repayment clause after the island locked down on 23 January.

The suspension will be reviewed at the end of February, the States said.

'Listening and communicating'

The clause inserted by P&R permitting them to reclaim financial support back was met with anger by businesses.

The committee amended the scheme to allow up to £50,000 profit from the self-employed and sole traders to be considered "personal expenses" last week.

This decision to suspend the scheme until March was made to avoid islanders losing their jobs and hampering businesses ability to reopen, Deputy Helyar explained.

The treasury lead for the senior Policy and Resources Committee said it reflected their hope this would be a "shorter lockdown" with businesses needing less assistance.

"The decision has been made urgently in order to avoid, in particular, large scale redundancies which could hamper the ability of some sectors to recommence trading quickly," Mr Helyar said.

"This demonstrates that we are listening and communicating actively with industry across a broad range of sectors and have taken on board the urgent need for more clarity.

"We must continue to ensure that we balance carefully the protection of public funds against the needs of industry to bounce back out of lockdown as in 2020."

Follow BBC Guernsey on Twitter and Facebook. Send your story ideas to [email protected].