Christmas: 'We'll only be buying for our kids, not each other'

BBC

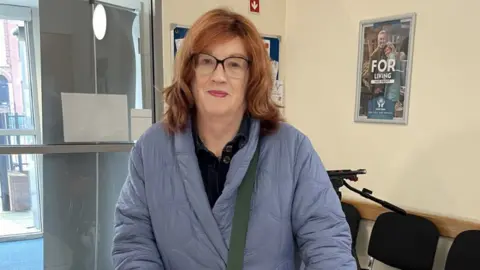

BBC"We've decided we'll just sort the kids out this year, we'll not buy for each other."

That is the approach to Christmas being taken by Coreinne Lewis, who works at the Newington Credit Union and is also a member.

Her view is reflected in a survey carried out by the Irish League of Credit Unions (ILCU).

It says about half of Northern Ireland consumers say they have less money to spend this Christmas than a year ago.

As a result they plan to cut back on presents and going out.

Only 5% of those surveyed said they had more money to spend this Christmas.

Ms Lewis said she definitely felt like she had less money this year and that despite her list for Christmas remaining the same, it cost more now.

She is cutting back on family gifts for her sisters and focusing on her children instead.

Getty/CatLane

Getty/CatLaneThe chief executive of Newington Credit Union in north Belfast - which has more than 25,000 members - said she had noticed a trend of parents not buying gifts for each other.

Julie-Ann McStravick said there has been a significant drop in the amount of money people planned to spend this Christmas.

"It is those families with children in the house, you know everybody wants to make Christmas special for kids and they're looking at that," she said.

"But we're also seeing households that wouldn't traditionally have suffered now are.

"Traditionally, it would have been single parent households that might have struggled at Christmas, whereas now we're seeing it across the households with small children."

Kevin Hart, a credit union member, said the last few years had been very difficult and that since the Covid pandemic he had been staying in more.

"Going out less, as has been the case all year," he added.

"Cut backs for everything really to make sure you have enough money to celebrate Christmas."

Patricia MacManus said there was a big difference between this Christmas and last Christmas.

"I wouldn't have pushed the boat out or anything like that, but you got by, you got enough," she said.

"This year, no, it's changed a lot.

"I'm lucky that it's only me, but at the same time I am feeling the pinch.

"You want to give yourself a wee treat to cheer yourself up but then you think no, I can't afford it, better wait and see."

The research suggested older consumers were least likely to plan to spend less and that families with children were the most likely to feel squeezed and have to cut back.

While inflation, the rate at which prices are rising, has fallen from its peak in 2022, food and energy prices remain elevated compared to two years ago.

Weaker consumer sentiment in November was driven by a drop in the number of those who believed the economy would improve in the next 12 months.

Getty/Maca and Naca

Getty/Maca and NacaSome 300 people took part in the survey, which was carried out earlier in November.

Martin Fisher, Northern Ireland manager at ILCU, said that "while some consumers may be starting to feel that the worst of the cost-of-living shock may be behind them, the economic and financial climate remains challenging for many households".

"We know in the credit union that many people have additional financial pressures which add to the stress of this time of year," he said.

Economist Austin Hughes, who prepared the report, said it showed a decrease in the number of consumers who expect things to get worse, but no major increase in the number who expect things to get better.

The survey suggests there was a drop in the number of consumers saying household finances had worsened in the past year, but shows no increase in the number of households reporting an improvement in their financial position.