Ukraine grain deal: Where are the ships going?

Getty Images

Getty ImagesThe UN secretary general called it "an agreement for the world".

Speaking in Istanbul on 22 July, Antonio Guterres said the Black Sea Grain Initiative would bring relief for "the most vulnerable people on the edge of famine".

The deal - agreed with Russia and Ukraine last month - allowed ships carrying much-needed Ukrainian food products to leave the country's Black Sea ports for the first time since the war began.

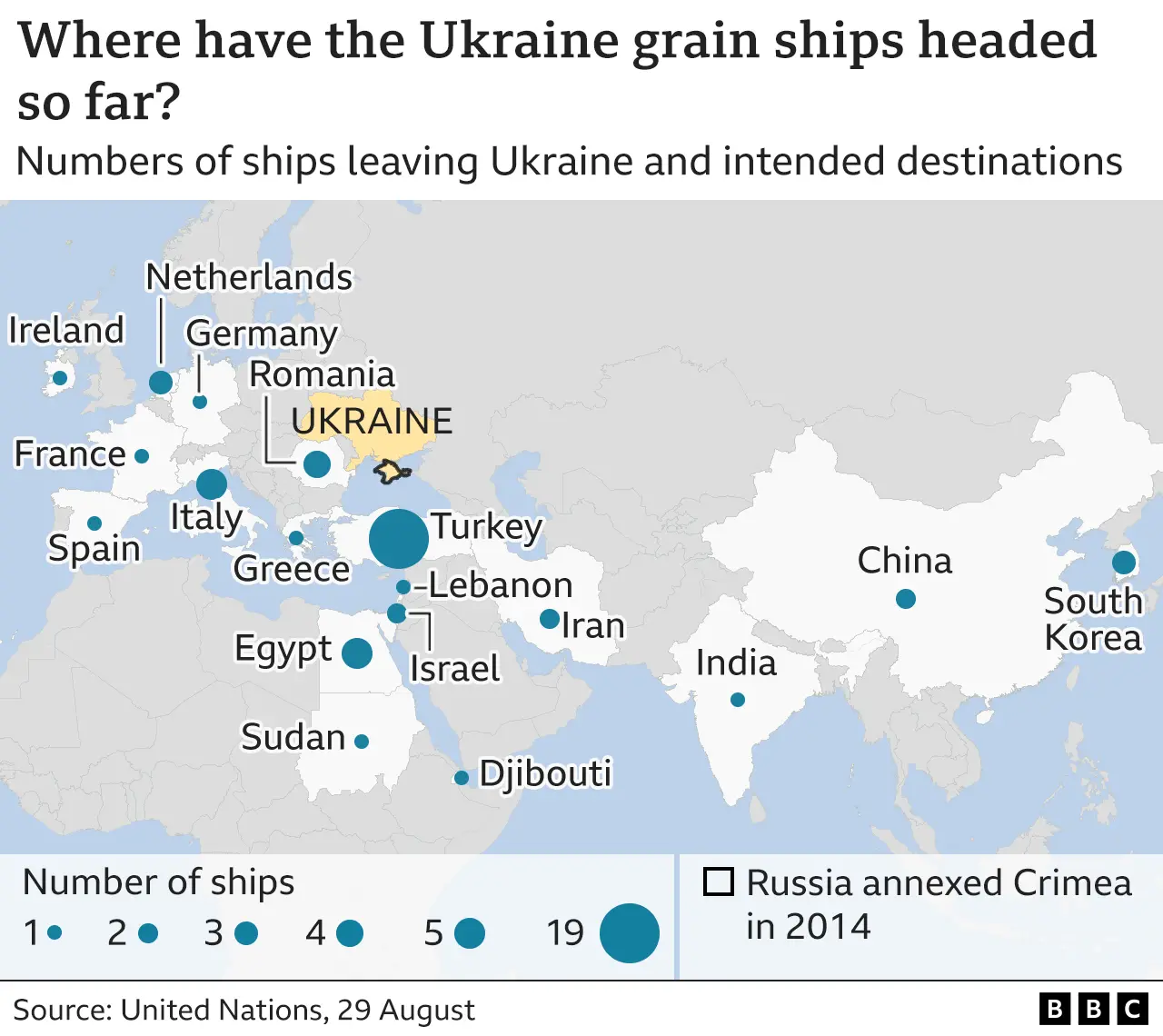

A month later, more than 50 ships have so far braved the risks and departed Ukraine - helping to export over 1.2 million tonnes of grain and other foodstuffs.

The war which rages close by has so far failed to intrude and more and more ships are joining in.

But where is all the food going?

A deal which the UN argued forcefully was needed to prevent millions of people from going hungry has so far seen only modest humanitarian benefits.

The first ship carrying food aid on behalf of the World Food Programme (WFP) has only just arrived at its destination.

The bulk carrier Brave Commander is carrying 23,000 tonnes of wheat intended for vulnerable communities in southern Ethiopia. It left the Ukrainian port of Pivdennyi on 16 August and has just berthed in Djibouti.

The WFP has a second ship, the MV Karteria, loaded and ready to carry 37,500 tonnes of wheat to Yemen, where it is badly needed.

Officials at the agency say they hope other shipments will follow.

But these are tiny quantities. In 2021, WFP distributed 4.4 million tonnes of food aid around the world. Two thirds of it came from Ukraine.

UN officials recognise that these are modest beginnings, but insist that the wider picture is important.

"You've got to separate what we're doing from the overall opening up of the ports and the flooding of the market with this extraordinary amount of grain," says Greg Barrow, senior spokesman for the UN's World Food Programme.

The reappearance of Ukrainian grain on the international market has certainly brought relief around the world.

"It's good news for Irish agriculture," says John Bergin, Commercial Director of R&H Hall, Ireland's leading importer of grain for animal feed.

The Navi Star, which recently arrived at Foynes on the west coast of Ireland laden with 33,000 tonnes of corn, was a welcome sight.

The ship was being loaded on 24 February, the day Russia's invasion began.

"There was 28,000 tonnes on that ship the morning the war started," Mr Bergin recalls. "Our supplier never got the ship out. Then the port became mined and the whole thing got stuck."

The war brought Ukraine's peak export period, which runs from December to April, grinding to a halt. Grain prices, already driven high by the coronavirus pandemic and droughts elsewhere, shot up, but have recently come down again.

"Average export prices were around 30-40% higher before the conflict began," says Alexander Karavaytsev, senior economist at the International Grain Council.

"Now they're 8% higher, so prices have declined markedly."

Some of the reduction in price is due to seasonal impacts, as harvests progress elsewhere in the northern hemisphere, but the psychological impact of unblocking one of the world's major grain producers is important. "It brings some solidity back into the market," Mr Bergin says.

As grain silos are emptied and previously trapped vessels are liberated, industry sources are daring to hope that better days are ahead.

"There is growing optimism that agriculture commodities will continue to flow," says a spokesman for Viterra, a grain and oilseed exporter with a significant presence in Ukraine.

"We are seeing an increased willingness from vessel owners to enter Ukrainian ports, which will also grow if passage remains safe."

But how big an "if" is that?

Despite the deal struck in Istanbul in July, freight costs are still almost double what they were before the war, reflecting a lingering nervousness about the potential dangers associated with sending vessels into a war zone.

That nervousness is likely to prevent Ukraine from hitting the targets it needs to generate badly-needed revenue for its battered economy.

"They want to hit 5 million tonnes a month," says Bridget Diakun, Lloyd's List data reporter. "It sounds ambitious."

For now, it's smaller shipping companies, many of them Turkish, which seem willing to take the risk, with many of the world's big players still holding back.

"They just want to keep the safety of the vessel and the safety of the crew as their top priority," says Nidaa Bakhsh, senior markets reporter at Lloyd's List. "And they can't guarantee that they will be safe."

The clock is ticking. The agreement brokered by the UN and Turkey only runs for 120 days. It can be extended in mid-November, but only if Russia and Ukraine agree.

For the UN, which has set so much store behind the success of the deal, to have it stop after just four months would be disastrous. "The world is going to struggle if that market is closed off again," says WFP's Greg Barrow.

Grain deals are normally struck 18 months to two years ahead. With no-one able to predict the state of Ukraine's economy in 2023-24, it's going to take time before that level of confidence returns.

Reuters

ReutersFinally, what ever happened to the Razoni, the first vessel to leave Ukraine, amid great fanfare, at the beginning of August?

The UN's checklist still has TBD ("to be determined") against the ship's destination, an awkward admission that the 26,000 tonnes of corn on board never reached its intended port, Tripoli in Lebanon.

When the original buyer rejected the shipment, apparently citing quality concerns, the Razoni embarked on a circuitous voyage around the eastern Mediterranean, much of it with its transponder switched off, indicating a reluctance to be tracked.

It finally unloaded most of its cargo at the Syrian port of Tartus.

There's nothing illegal about delivering food to Syria, or unusual about ships changing direction. But the Razoni's secretive journey shows that in the complex world of grain trading, you can't always be sure where individual cargoes eventually end up.