Iran nuclear deal: The EU's billion-dollar deals at risk

AFP

AFPThe EU is scrambling to find ways to safeguard huge business deals with Iran, amid the threat of US penalties.

Washington is re-imposing strict sanctions on Iran, which were lifted under the 2015 international deal to control the country's nuclear ambitions. On 8 May President Donald Trump denounced the deal, saying he would withdraw the US from it.

Since the deal took effect in 2016 major European firms have rushed to do billions of dollars' worth of business with Iran, and now thousands of jobs are at stake.

Many of those firms fear their business ties with the US could be at risk if they continue to do deals with Iran past a November deadline. Some firms say they are now preparing to wind down their business in Iran.

What can the EU do?

There is an existing EU "blocking statute", from 1996, aimed at countering US sanctions linked to communist Cuba. Now EU officials say they are revamping the statute to avoid the latest US restrictions on firms doing business with Iran.

But there are doubts about the statute's legal power. Reuters news agency says Shell and some other European firms with big operations in the US prefer to push for US waivers on a case-by-case basis.

US authorities have imposed hefty fines on banks for processing Iranian transactions, including UK-based Standard Chartered, HSBC and Lloyds.

France, Germany and the UK all say they remain committed to the nuclear deal with Iran and to expanding business ties, provided Iran sticks to its commitments.

AFP

AFPRead more on this topic:

How big is EU-Iran trade?

Before the imposition of punitive sanctions on Iran in 2012 the EU was its biggest trade partner. In 2011 Iran had a big trade surplus with the EU. Trade slumped in 2012, but has been climbing back up since the 2015 deal.

EU exports to Iran in 2017 (goods and services) totalled €10.8bn (£9.5bn; $12.9bn), and imports from Iran to the bloc were worth €10.1bn. The value of imports was nearly double the 2016 figure.

Most EU imports from Iran are energy-related - more than 75% is oil and other fuels.

EU exports to Iran are mainly machinery and transport equipment, followed by chemicals.

Italy's trade volume was highest, followed by France, then Germany and the Netherlands.

But trade with Iran makes up just 0.6% of the EU's total global trade.

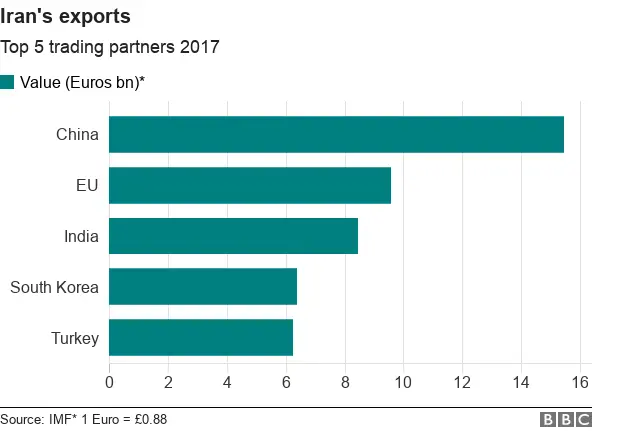

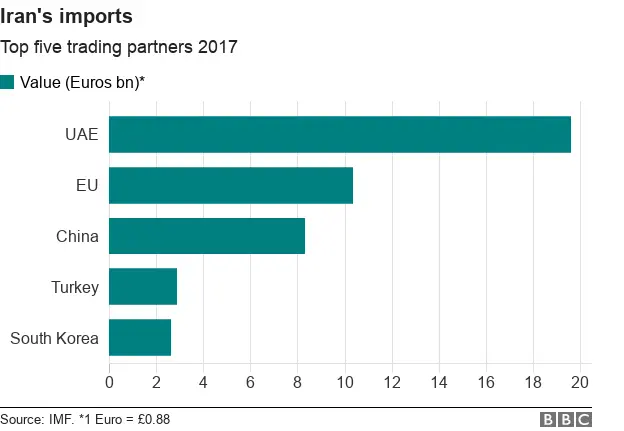

Iran's main trade partners are the United Arab Emirates and China, which account for 23.6% and 22.3% of the country's total trade, according to the European Commission.

EU trade, by contrast, makes up 6% of Iran's total.

What are the big deals at risk?

Since the lifting of sanctions there have been major EU-Iran business deals, among them:

- Total (French) signed a deal worth up to $5bn to help Iran develop the world's largest gas field, South Pars. Total now plans to unwind those operations by November unless the US grants it a waiver

- Norway's Saga Energy signed a $3bn deal to build solar power plants

- Airbus clinched a deal to sell 100 jets to IranAir

- European turboprop maker ATR (an Airbus-Leonardo partnership) agreed to sell 20 planes to Iran

- Danish oil tanker operators Maersk and Torm are now refusing any new contracts with Iran; Maersk is also the world's biggest operator of container ships

- Germany's Siemens signed contracts to upgrade Iran's railways and re-equip 50 locomotives

- Italy's state rail firm FS signed a $1.4bn deal to build a high-speed railway between Qom and Arak

- France's Renault signed a joint venture deal, including an engineering centre and a production plant, to boost Renault's production capacity in Iran to 350,000 vehicles a year