Reality Check: Why has Zimbabwe hiked petrol prices?

BBC

BBCClaim: Black market currency dealing and the illegal trade in fuel have contributed to Zimbabwe's severe fuel shortages.

Verdict: This is correct, but not the full story. The conditions which have led to this are rooted in the government's introduction of a controversial local currency pegged to the United States dollar.

There have been widespread protests in Zimbabwe's largest cities following an increase in the price of fuel.

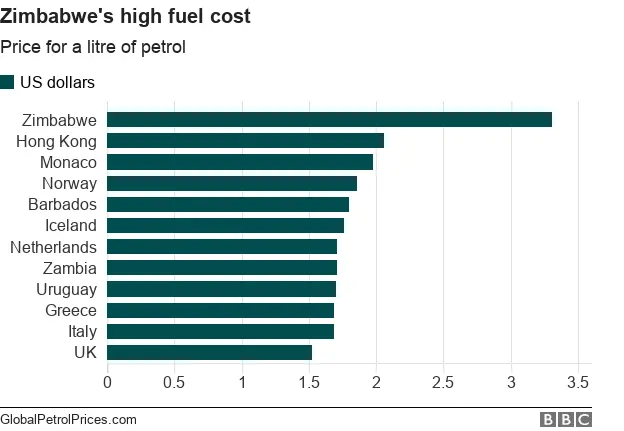

Prices have more than doubled, making petrol and diesel the most expensive in the world.

So why has the government done this?

Most expensive fuel in the world

The government says the price hikes were put in place to avert fuel shortages and to crack down on the illegal trading of fuel.

Petrol prices rose from $1.24 (£0.97) a litre to $3.31, with diesel up from $1.36 a litre to $3.11.

President Mnangagwa announced the increases and promptly left the country for a European tour, and to attend the World Economic Forum in Davos, Switzerland.

The price of fuel is set by the government and petrol stations are required to sell fuel at this price, pegged to the US dollar.

First, let's look at the shortages.

Zimbabwe has to import all its petroleum products. For this it needs hard currency, and with its current deep economic problems, this is in very short supply.

In November, Finance Minister Mthuli Ncube said scarce foreign exchange had been allocated to other more pressing sectors - and he mentioned the need to invest in the country's mining industries.

At the time, the minister acknowledged the shortages and promised to find ways to finance the import of more fuel.

A sharp rise in demand over the past year has also contributed to the shortages.

This rise is perhaps surprising given the sluggish state of the economy.

One explanation is that this is the harvesting season for tobacco, Zimbabwe's most important crop, which means there's a high demand for fuel to power tractors and machinery.

But this wouldn't explain the longer-term rise in demand for fuel.

Fuel hoarding and smuggling

The government has accused people of hoarding fuel and then selling it on the black market at inflated prices.

And because Zimbabwe's fuel has been cheaper than in neighbouring countries, smuggling has also been a big problem.

These activities have played a large part in increasing the demand for fuel in Zimbabwe and contributing to shortages.

Getty Images

Getty ImagesZimbabwe's controversial currency arrangements have also contributed to the problem.

The country has a local currency, officially pegged one-for-one to the US dollar. However, in reality it is being traded on the black market at far less than this value.

This means that if you have access to hard currency - US dollars for example - you can then buy the local currency on the black market and use it to buy fuel at the pegged 1:1 price.

The effect is that fuel has been much cheaper for those buying in this way.

It has also meant that there's been scope for widespread profiteering within the country or by smuggling the fuel into Zimbabwe's neighbours, such as South Africa.

Currency confusion

So if it's causing such a problem, why the pegged currency?

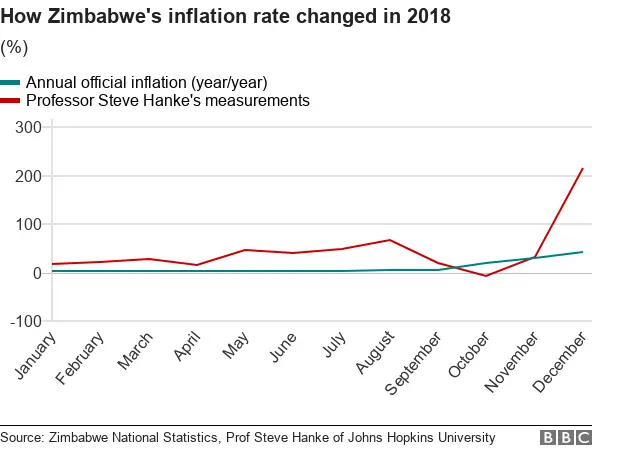

It has its roots back in 2008 when Zimbabwe's economy was in a tailspin and its currency was experiencing record-breaking hyperinflation.

The Zimbabwe dollar became virtually worthless and people were forced to trade in foreign currencies - the US dollar and the South African rand.

The following year, in an effort to stabilise the economy, the government declared US currency legal tender, officially abandoning the worthless Zimbabwe dollar.

When a government does this, it gives up its ability to set interest rates and print local money - important levers of economic control.

It therefore can't finance public spending by printing cash - which means the government has to cut spending or find other sources of revenue.

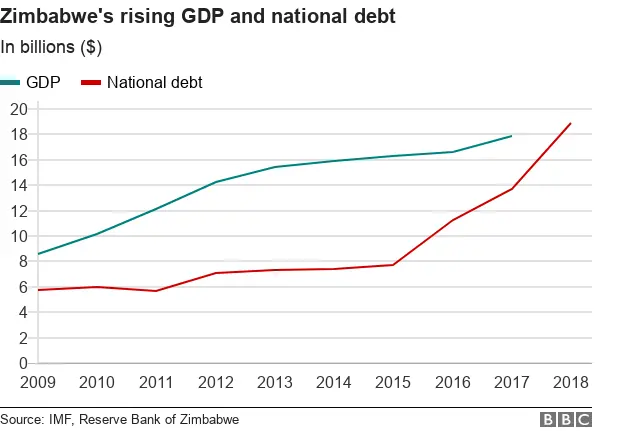

The introduction of this policy in 2009 largely stabilised the economy - and in 2016 the government introduced a new currency system.

It consisted of two parts: a bond note which could be traded as cash, and another which could be traded electronically.

Getty Images

Getty ImagesThe benefit of this arrangement was that it enabled the government to print and spend money again to support much-needed development and infrastructure.

This was also the problem. Successive governments have spent beyond their means, printing money to do so, leading to inflation and a falling currency value.

Dumisani Sibanda, an independent Zimbabwean economist, says this particularly increased after the military takeover in November 2017.

Local currency, which is officially pegged to the same rate as the US dollar, in practical terms is worth far less and its value is falling.

So hard currency becomes increasingly attractive, and those who have it will tend to hold onto it because it maintains its value, while the local currency depreciates.

"Bad money drives out good. If you have a fixed exchange rate for one-to-one, if one of the monies is bad, it drives up the good," says Steve Hanke, Professor of Applied Economics at the Johns Hopkins University in Baltimore, who specialises in hyperinflation.

How does this all affect the price of fuel?

The government's attempt to maintain the value of the local currency in parity with the US dollar has led to widespread incentives to buy and trade in fuel on the black market.

Severe fuel shortages have been the result. And the lack of hard currency, due in part to hoarding, has constrained the government's ability to import enough fuel to meet demand.

The decision to dramatically increase the price of fuel is designed to choke off demand and curtail black market dealings.

But the result has been widespread protest and demands for the decision to be reversed.

And across the country, businesses - already struggling to survive in desperate economic times - are facing a huge increase in their operating costs.