Cost of living: Energy debt worse in Wales than rest of UK

Christians Against Poverty

Christians Against PovertyPeople's mounting energy debts due to the cost of living crisis are the tip of the iceberg, a charity has warned.

Christians Against Poverty (CAP) has released figures suggesting that the proportion of people in arrears with their energy bills in Wales is worse than any other part of the UK.

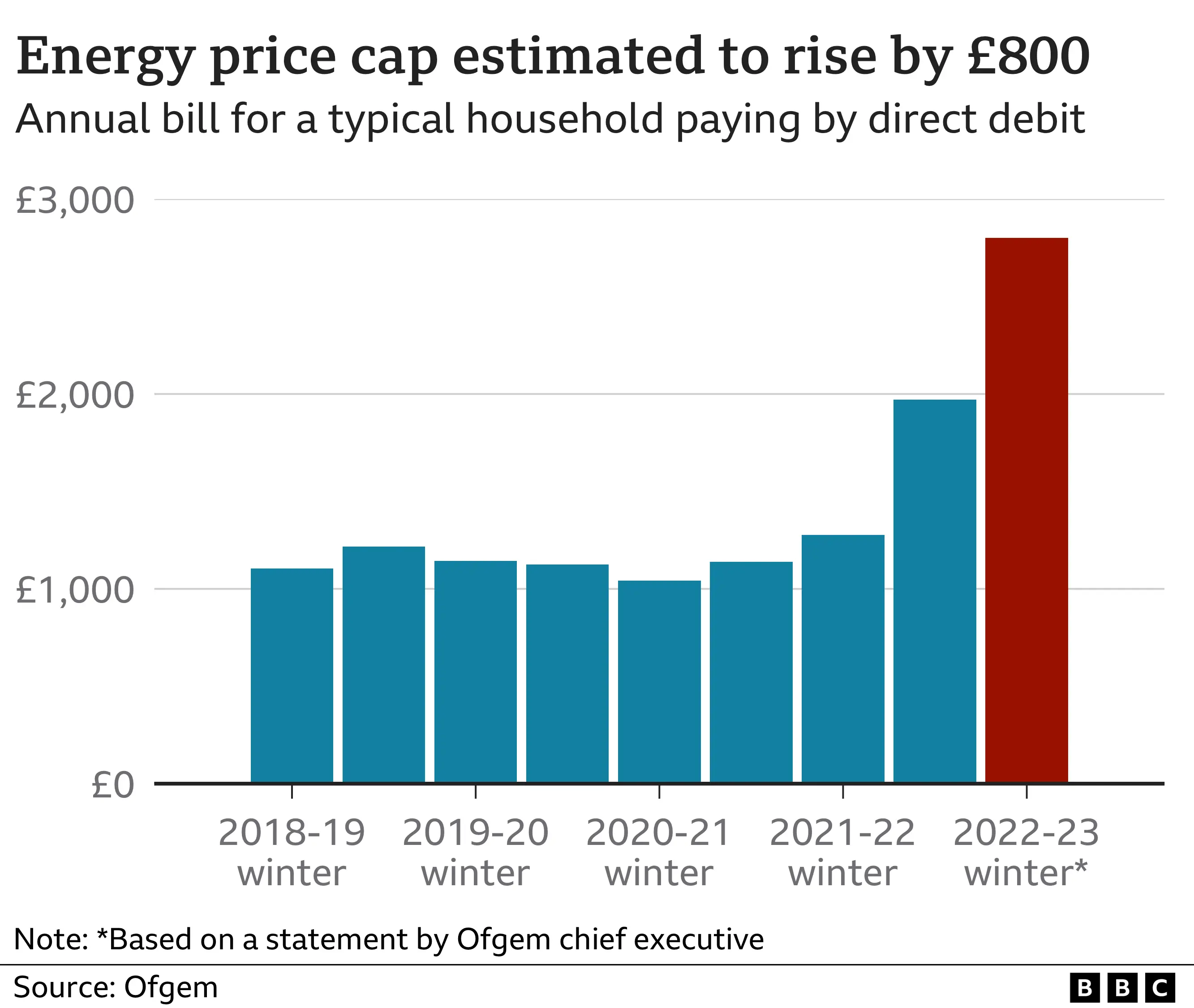

Energy regulator Ofgem has predicted the average bill will go up again by £800 in October.

CAP wants UK ministers to do more to support those struggling financially.

But there are fears that some people are "burying their head in the sand".

Julie, a single mum from Port Talbot, approached the charity for help in 2019 after getting into debt trying to provide for her children. It was decided that her best route out of debt was to be declared bankrupt.

"Being in debt was horrendous, a downward spiral, no light at the end of the tunnel, like walking round with a rucksack full of bricks," she said.

"I was worried about every knock on the door in case it was the bailiffs. I would wait until the kids had gone to bed and then I would break down.

"I did not think I would get out of it. I felt I was a lost cause."

Tony Quinn, CAP's debt manager for Swansea West, said he expected "a big jump" in people needing help after Covid, but that did not happen.

"There are two reasons for that - the first is embarrassment and the second is that people just do not know where to go to get help, and that's the big concern."

Tony's colleague Hannah Tallamy, who runs the debt counselling charity's Port Talbot operation agrees.

"My numbers have gone down: pre-Covid I always had a waiting list," she told BBC Politics Wales.

"But I think clients will bury their head in the sand, they think that this will just go away and that they are OK," she added.

Both Tony and Hannah think the furlough scheme and the £20 uplift to universal credit helped people avoid going into debt during the worst days of the pandemic, but the decision to discontinue them, and the rising cost of living mean, more people will need help the autumn.

CAP's figures, from a new report, also suggested people were struggling with the basics rather than luxuries, with 40% of new clients in Wales having difficulty paying council tax, rent, energy and water bills.

"Mortgages, gas, electricity, council tax, and for people on really low incomes that is starting to have an impact on their physical and mental health," said Tony.

"10 years ago it was a lot different - debt was mobile phones and credit cards. But now it is all about the basics."

According to the report, the proportion of new people seeking help who were in energy arrears was 20% in Wales, compared to 8% in Scotland and 1% in Northern Ireland.

The figure across the UK was 15%.

Across the UK, the report suggested that a third of people had considered taking or attempted to take their own lives as a way out of debt.

Christians Against Poverty

Christians Against PovertyHannah said many of those in most urgent need of help have almost shut themselves away from the rest of the world and "live in fear".

"I would describe the homes I go into as very very dark with the curtains drawn, because they are frightened of people knocking on the door asking for money.

"One of the things they are allowed to do under budgeting is spend on leisure, but they do nothing - not a trip to the cinema with the kids, not a takeaway every now and again.

"They need to get out to help their mental health, but they don't because they don't have the money and they are scared to go out too."

CAP has welcomed the measures introduced so far by the UK government to help people with the cost of living crisis, but wants more to be done.

This includes a review of social security to address what it sees as the inadequacies of the benefits system, an unfreezing of the Local Housing Allowance and a rise in the total amount of benefits people can receive.

They also want a six month payment holiday on benefits reductions for repayment of debt owed to the UK government.

The UK government said: "During the pandemic we increased Local Housing Allowance significantly and beyond inflation, benefiting over one million households by an average of over £600 over the year.

"We have increased the National Living Wage to £9.50, the largest ever increase since its introduction in 2016.

"We have also reduced the cap on Universal Credit deductions and paused the Fuel Direct scheme, that allows energy bill payments to be taken directly from benefits."

As the charity braces itself for a very busy autumn, Julie believes her decision to get help was life-changing.

"It's amazing, unbelievable, somewhere I never thought I would be," she said.

"Life is so much better now. I have a purpose to live."