How loan shark Tabitha Richardson, 83, scared people into paying up

Cardiff council

Cardiff councilIt may be hard to imagine how an 83-year-old woman could instil such fear into victims of her money lending scheme that they paid her tens of thousand of pounds of interest on top of illegal loans.

But loan sharks like Tabitha Richardson - who was told to repay more than £173,000 to six victims this week - are on the rise due to financial pressure being felt by people across the UK.

There are more loan sharks than ever under investigation, according to the agency Stop Loan Sharks Wales which brought Richardson's actions to light.

Methods of intimidation include threats of violence, stealing goods in lieu of payment and even kidnapping.

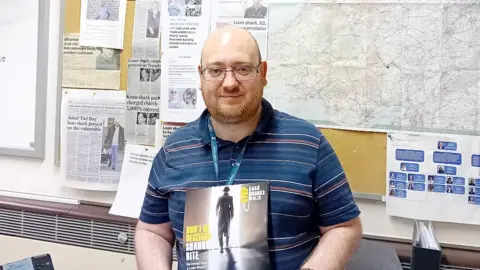

Ryan Evans, a client liaison officer with Stop Loan Sharks Wales, said he was seeing more active cases now than in the whole of his 11-year stint with the agency.

Perpetrators and their victims often belong to the same communities, he said, and recent cases have come from within church groups and the care industry.

It was his job, as someone who deals with victim support and safety, to speak to a couple of Richardson's victims after a concerned relative made contact with his team, which is run by the Wales Illegal Money Lending Unit.

Ryan Evans

Ryan EvansRichardson, from Newport, was a businesswoman who had previously run pubs and had at one time worked for a legitimate lending firm, at which time she would have had a licence.

"It seems over time that that firm ceased, but she carried on lending on an ad hoc basis to people who she claims requested it," Ryan said.

"She would not have been licensed at that point so the criminal offence was lending money without the required licence.

"She'd been lending money for a good number of years up until that point and that's how we stumbled upon it, through the investigation."

'You don't want me to come looking for you'

Ryan said the reasons why people were borrowing had changed in recent years.

"Prior to the pandemic it was something coming into the household, they didn't legislate for it - your washing machine, fridge-freezer.

"We're not seeing that now. [It's] because of everyday bills."

A total of 63% of victims report borrowing from a loan shark for this reason, he said.

Joe Giddens

Joe GiddensSeemingly respectable people like Richardson can create enough fear in people - particularly those who are already vulnerable - to keep them in financial thrall for years.

"So at the lower end of the spectrum, like you've got with Tabitha, there are nasty things like little menacing texts, harassment, that type of level.

"The text messages were, 'you don't want me to come looking for you'. 'Don't make me come and find you', things of that nature.

"But that can increase. In Richardson's case there were threats to talk to members of the victims' families, to tell them what's been happening."

The situation for the victim can then worsen. As more of their income goes just to pay even the interest on loans - which was 40% in Richardson's case sometimes but can run to thousands of percent in some cases - other bills such as gas and electric don't get paid either.

Threats of violence

More serious methods of intimidation can be employed. There have been threats of violence, taking goods in lieu of payment. There was even a kidnapping recorded in one of the cases Ryan said he dealt with.

For Richardson's victims, Ryan said they were not necessarily afraid of her directly but of people she knew, and this is a common theme.

"We come across that quite a lot with loan sharks. They are not necessarily the people who will be meting out the violence, or the threats of violence. It would be somebody they know, or somebody they are connected to.

"When we deal with cases in north Wales, it's normally 'people in Liverpool' - when we investigate, they're not [connected to them].

"In south Wales it's a bit more varied who they're 'connected' to. But it's normally somebody with a bit of a reputation. But when you look more into it from an investigative point of view, that's really not the case at all."

Getty Images

Getty ImagesRichardson was a good example, which he said was especially common in Wales, of being "the big fish in a small pond".

"On the face of it, Tabitha was a very successful businesswoman. She's got a bit of money behind her. People know that she's lent money before; people will go to her."

Ryan said that for Richardson, the sums involved might not have been a huge amount in the greater scheme of things, but it represented an enormous amount to those paying her.

"They were struggling to eat, struggling to heat their homes. One set of victims was trying to live off £100 a month and they were dropping money to her."

As in many similar cases, the amount of money people started off borrowing was low, but because they were repaying 40% interest on top of the capital, it snowballed from there.

"What happens then is if you're on a low income, you're already struggling. So to service that debt, you need to borrow some more," Ryan said.

'Vicious opportunists'

The amounts ranged from £80 to £20,000 over a period of time. One set of victims borrowed £31,000 and had paid back interest in the region of £12,400, while another borrowed £46,000 and paid £18,000 in interest.

Ryan said disabled and vulnerable people, such as those with mental health issues and learning difficulties, were also much more likely to be victims of loan sharks in Wales than in other parts of the UK.

"What we do tend to see in Wales is what I would call the vicious opportunists. They're actively going out and [using] grooming tactics to groom people into becoming victims."