Mortgage rates: 'I have £50,000 but can't buy a house'

Freya

Freya"I have £50,000 saved but I still can't buy a house."

Freya, 24, is just one young person trying to get on the property ladder with no end in sight.

With mortgage rates the highest they have been since the financial crash and rent costs soaring, she is not alone in worrying about her future.

And those who are renting say they feel they have no chance of saving enough money even to get a deposit together for a house.

Freya said some support from family meant she was able to get her own deposit, but high interest rates and a lack of affordable, "liveable" properties meant she was stuck paying almost half her salary on renting.

She has a well-paid job as a scientific content creator for an educational games company, but said she cannot see how single young professionals are expected to buy without further support.

Freya

Freya"My salary isn't enough to cover the threshold to get a mortgage of £200,000," she said.

"I was told by previous generations 'get a good degree and the rest will sort itself' but it hasn't.

"Although I work full time I can't earn enough. I don't drink, I don't go out to eat more than once a month, normally for a friend's birthday."

Freya, who pays £775 in rent a month, excluding bills, for her one bedroom flat in Cardiff, said: "I wouldn't mind renting if it wasn't so expensive for a property that often comes with a huge amount of issues."

She said she often found properties in the Welsh capital were low quality, and a previous property she was in had a collapsed ceiling which meant she was "so cold I couldn't sleep".

"I think young people are disheartened. How can we save for the future when we can't save enough to beat the price hump from renting to owning?"

Ben Birchall

Ben BirchallMortgage rates have risen to highest level for 15 years - a typical five-year fixed mortgage deal now has an interest rate of more than 6% - a level not seen since the financial crisis.

The Bank of England has said mortgage payments will rise by at least £500 a month for nearly one million households by the end of 2026.

The number of homes available is down by a third, adding even more pressure to buyers.

Wales' First Minister Mark Drakeford criticised the Bank of England's actions, saying it was in "real danger" of overcorrection in raising interest rates to control inflation, causing "avoidable" misery to thousands.

He accused the central bank of being "intent on inducing a recession".

"It's very clear from what they have said that they are going to rise interest rates to a point where unemployment is going to be rising across the whole of the United Kingdom, and Wales will not be exempt from that."

"It will not have seen the impact yet of all the interest rate rises its put into the system so far," Mr Drakeford told BBC Radio Wales Breakfast..

Citing Andy Haldane, the former chief economist of the Bank of England, he added: "The bank is in danger of trying to squeeze the very last drops out of inflation, at the expense of avoidable misery in thousands and thousands of lives."

The Bank of England has been asked for comment.

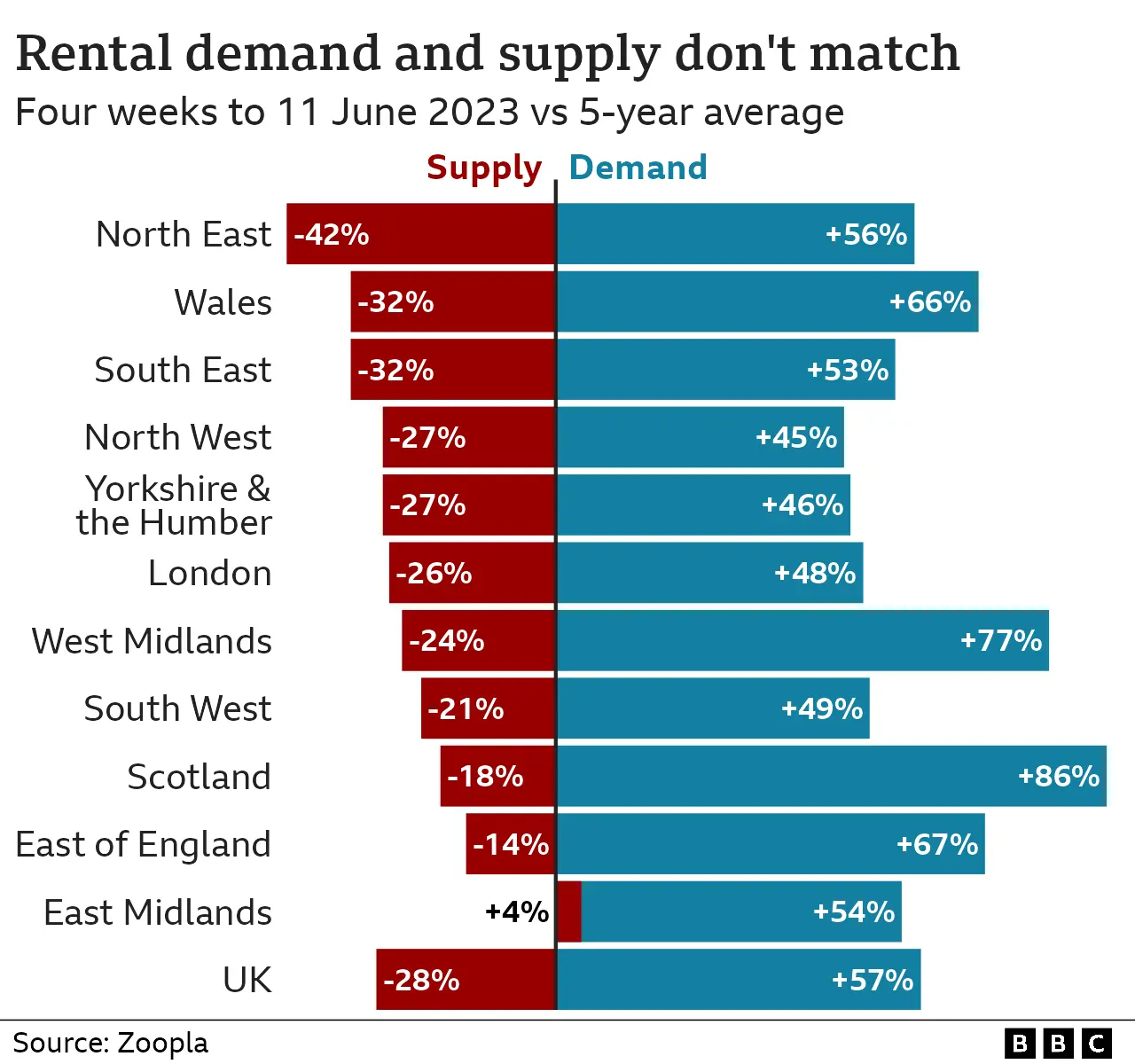

But it is not just mortgages hitting housing costs. Data from Zoopla shows in the UK the average rent increase in the year leading up to January 2023 was 11.1%, while the rate in Cardiff rose by 10.8%.

Rent levels in Neath Port Talbot went up the most in Wales at 16%.

Andrew Noel, 29, said people like him who rented were being discouraged from saving if they were not able to afford a mortgage anyway.

Andrew, who also lives in Cardiff with a housemate, has been told he must leave his property in February but is having difficulty finding a new one.

"We've been trying to look for somewhere that won't completely strip our wages every month," he said.

"Obviously, we want to have wages left for our energy bills, so we can't be spending £900 each as that is so much money to be able to afford when it really shouldn't be."

Andrew Noel

Andrew NoelHe said the only option for average earners his age to buy was to live at home long enough to brace for the high interest rates or buy as a couple.

"From my point of view, buying right now is not an option unless something magical happens," he said.

He said he believes rent controls may the only way to curb the problem.

Interest rates are set for the UK by the Bank of England, while housing is a devolved issue in Wales.

The Welsh government said: "We believe everyone has a right to an affordable and decent home.

"We're committed to publishing a White Paper on the potential to establish a system of fair rents, as well as new approaches to make homes affordable for those on local incomes."

Speaking on BBC Radio Wales Breakfast on Thursday, Mr Drakeford also said the Welsh government would build "20,000 affordable homes... for social rent during this Senedd term".

But Housing Minister Julie James said last year the target was "hanging by a thread" because of the state of the economy.

Have you been affected by the increase in mortgage rates? Get in touch by emailing [email protected].

Please include a contact number if you are willing to speak to a BBC journalist. You can also get in touch in the following ways:

- WhatsApp: +44 7756 165803

- Tweet: @BBC_HaveYourSay

- Upload pictures or video

- Please read our terms & conditions and privacy policy

If you are reading this page and can't see the form you will need to visit the mobile version of the BBC website to submit your question or comment or you can email us at [email protected]. Please include your name, age and location with any submission.