British Steel pensions: Failure to protect workers

Getty Images

Getty ImagesSome British Steel pension savers suffered losses of up to £490,000 because they were given unsuitable advice, a public watchdog found.

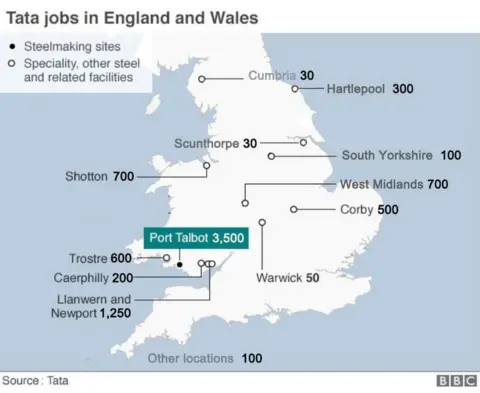

About 8,000 steelworkers, many from Wales, transferred £2.8bn from the scheme after restructuring in 2017.

A Commons select committee previously said they were prey to "vulture" financial advisors.

The National Audit Office (NAO) said the regulated financial advice market failed to protect them.

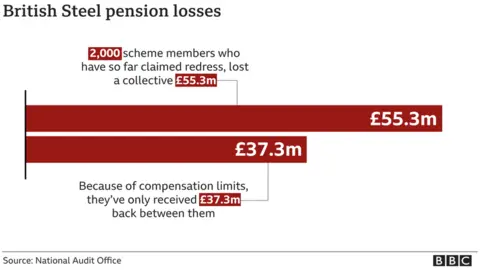

Its report found the 2,000 scheme members who have so far claimed redress, lost a collective £55.3m, but because of compensation limits, have received £37.3m back between them.

British Steel's scheme offered a large defined benefit pension, often described as "gold plated", as it guaranteed an income to members in retirement, based on how many years they have worked and the salary they earned.

It was sponsored by Tata Steel UK, but restructured in 2017 when the firm experienced financial difficulty.

Members were given options for what to do next.

But they had limited time to decide and advisers in steel-working areas saw a rapid growth in requests for transfer advice, the NAO said.

Scheme members blasted the process - with Port Talbot worker Richard Pugh losing more than £20,000.

He said workers "did not have a clue" what they were doing when they had to make decisions.

About 95% of those who chose to transfer out, received financial advice from a regulated firm, the NAO said in the report.

Of these, only about 25% have so far sought redress through complaining, it added.

It estimates that these pension scheme members have so far collectively lost £18m of redress because financial advisers have gone into liquidation and there are compensation limits.

The average loss for claims resolved by the Financial Services Compensation Scheme (FSCS) is £82,600, with individual losses as high as £489,000.

This is because the FSCS has compensation limits of £85,000 per person for advice firms that failed after April 2019 and £50,000 for those failing before then.

Getty Images

Getty Images"Although measures have been put in place aimed at improving how the pensions advice market is regulated and to attempt to remedy the financial losses suffered by British Steel Pension Scheme members, it is clear that many people have not been compensated fully under current arrangements," said NAO chief Gareth Davies.

The NAO said the Financial Conduct Authority (FCA), which was responsible for supervising financial advisers, told it many of the advice firms had limited experience of processing large numbers of transfers.

Most advisers were also financially incentivised at the time to recommend transferring out of the scheme, the NAO said.

'A failure from top to bottom'

It also found advice was unsuitable in 47% of cases and unclear in a further 32% of those who transferred.

The FCA has issued £1.3m of fines and has 30 more enforcement investigations ongoing.

Chairwoman of the Public Accounts Committee, MP Meg Hillier described the handling of the case as "a failure from top to bottom", saying many workers saw the rewards of their hard work "melt away".

She added: "Many of the pension advisory firms gave bad advice to customers and the FCA, whose job it is to regulate these firms, was asleep at the wheel."

An FCA spokesman said: "We recognise the harm these circumstances caused to steelworkers and communities, and that's why we continue to work to ensure that former British Steel Pension Scheme members who lost out financially due to poor advice receive compensation.