Pembrokeshire: Council tax to double for second home owners

BBC

BBCSecond home owners in Pembrokeshire will pay double the normal rate of council tax from next year.

The local authority area becomes the third in Wales after Gwynedd and Swansea to impose the maximum increase.

Last month, Pembrokeshire council's cabinet voted for the increase, saying it would help provide income to build more affordable homes.

Pembrokeshire council voted through the proposal after numbers of second homes increased by 1,200 in three years.

Hedd Harries, who lives in the village of Bwlchygroes, said his chances of buying a home in the area are slim after an influx of second home owners since the pandemic.

Although he "praises" the cabinet's support, he does not think raising council tax premiums is enough to tackle the problem.

"Pembrokeshire council need to push on the government to do more. I'm passionate about my community and I want to see change now before it's too late," he said.

"I know friends who've been gazumped as a result of people coming in with more money or other friends who can't get mortgages because they haven't got good enough jobs."

More than 1,200 properties in Pembrokeshire have become second homes in the past three years, an increase of 45%, according to latest Welsh government figures.

Except for properties registered as holiday homes, where owners pay business rates instead of council tax, these homes will now qualify for the 100% tax premium.

'Negative consequences for economy'

Chris Birch, director of letting company Holiday Homes Wales, said there could be negative consequences for the west Wales economy if local authorities charge higher council tax for second homes owners.

"It's further fuelling the argument that tourism and second home ownership is bad for the economy," he said. "I completely appreciate the argument that it might be a negative thing for some people who live in the area, but it also brings so many people from outside into west Wales."

Currently, Pembrokeshire council is collecting a 50% premium on 3,640 second homes in the county.

The new 100% premium would take a Band A property from £793.13 a year to about £1,500, with Band I homes increasing from £2,775 a year to £5,500.

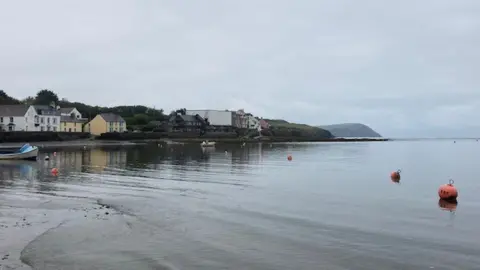

Leyton Jones, from Newport, who owns a second home in Tenby said he is "happy" paying the extra premium if it means second home owners' money is spent building more homes for people to remain in Pembrokeshire.

But others have said the situation is becoming worse, with every property coming onto the market being bought as a second home.

Resident Ros McGarry said people from Newport are being priced out of the market.

More than 70% of a local housing development built five years ago are now second homes, she said.

"People are really daunted by the changes - they're happening so fast.

"I've been helping the town council conduct a survey recently and the words on the lips of people who've lived here all their lives is 'no more second homes'."

The Welsh government said: "Wales is the only UK nation to give local authorities discretionary powers to charge a premium of up to 100% of council tax. We are also working at speed to implement sustainable solutions to what are complex issues."