British Steel Pension Scandal: Grant details to be released

Getty Images

Getty ImagesDetails of a £118,000 grant given to a firm later implicated in the British Steel pensions scandal must be released by the Welsh Government.

The Information Commissioner rejected claims this would damage the commercial interests of Celtic Wealth Management.

The decision followed a complaint by a BBC Wales journalist after the Welsh government refused to release the information requested.

The Commissioner called the Welsh government's arguments "contradictory".

In 2014, the Welsh Government gave £118,500 to the Pontarddulais-based Celtic Wealth Management.

The company was one of those accused of cold calling members of the British Steel Pension Scheme once they had to move to a new scheme, transfer to a private pension or enter the Pension Protection Fund from 2017.

It received money from financial advisors for referring those members to them.

Many steelworkers lost significant sums of money over the advice they were later given to transfer their pensions.

A Commons committee called such cold calling firms "vultures" and "parasites" in its report into the scandal.

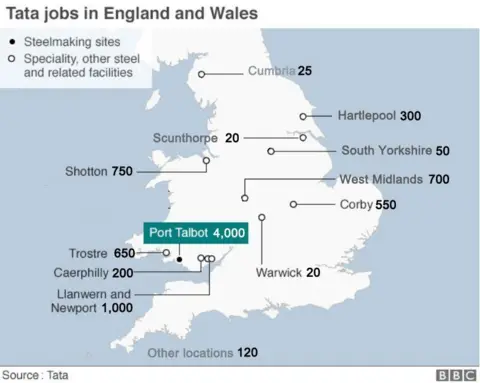

Indian-owned Tata now owns the former British Steel operations - employing more than 8,000 people across England and Wales, with 4,000 in Port Talbot.

But those numbers are dwarfed by the 100,000 retired workers who are enrolled on its pension scheme - with Tata saying it would become insolvent if it continued sponsoring it.

In 2017, a £14bn restructuring of the fund was announced to keep its UK loss-making operations afloat.

Under the Freedom of Information Act, BBC Wales asked the Welsh government for evidence of how Celtic Wealth Management had met the terms of the grant as well as an independent auditor's report and any other details of the grant agreement.

It refused to release those details and argued that it would breach the company's "commercial interests".

The Welsh Government's claim was supported by Celtic Wealth Management which said it would be "very unlikely" that it would "survive as a business" if those details were released.

Getty Images

Getty ImagesA BBC Wales journalist asked the Welsh Government for details of £118,500 given to the company in 2014 through an FoI request.

The request asked for evidence of how Celtic Wealth Management met the terms of the grant as well as an independent auditor's report and any other details of the grant agreement.

In refusing, the Welsh Government said releasing this information would put "commercially sensitive information" in the public domain, benefitting the firm's competitors.

This argument was supported by Celtic Wealth Management who said it would be "very unlikely" that it would "survive as a business" if those details were released.

When it refused, the journalist appealed to the Information Commissioner, who called the Welsh Government's arguments for refusing "contradictory".

The commissioner concluded the Welsh Government failed to show "a clear causal link" between releasing the details and potential damage to the company's commercial interests.

Getty Images

Getty ImagesThe ruling also said the Welsh Government had not shown why the withheld information was more use to the firm's competitors than what was publicly available through Companies House.

The Commissioner called a submission by Celtic Wealth Management "poor and unfocused".

The ruling also concluded that the Welsh Government had contradicted itself.

"It was arguing both that the withheld information contained nothing which would shed light on CWM's business methods and that disclosure would be so damaging to CWM's reputation that it would be likely to threaten the company's very survival," the decision states.

The ruling argued that there was nothing in the withheld information to suggest any of those involved had acted improperly.