Bank closures: More than 200 branches close in four years

National Assembly for Wales

National Assembly for WalesThe true scale at which banks are disappearing from Wales' high streets has been revealed as new figures show 216 were closed in the past four years.

Presenting the findings to AMs on Thursday, Thomas Docherty, of consumer group Which?, said the situation was of "deep concern" to "society as a whole".

He added many banking customers were faced with the "double whammy" of slow internet speeds and no branches.

The committee will make recommendations to the Welsh Government.

Mr Docherty was invited to give evidence to the assembly's Economy, Infrastructure and Skills Committee, which is conducting an inquiry into access to banking.

"The current situation on bank services is of deep concern, not just to our members and supporters but to society as a whole," he told AMs.

"Consumers in Wales spend approximately £4.5bn a month, and without that spending the Welsh economy would come to a halt."

While the number of branches which closed last year - 50 - was fewer than the 64 the previous year, Wales' high streets have still lost an average of 54 banks every year over the previous four years, according to Which?

'Nail in the coffin'

Abertillery saw its last permanent bank close after Barclays decided to close its branch in the Blaenau Gwent town in January.

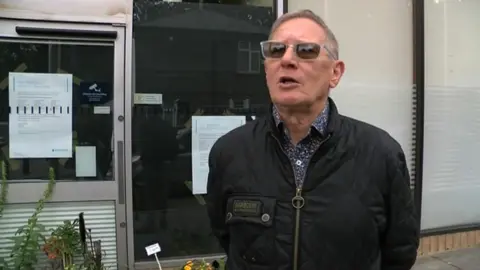

"It is devastating, especially for old people," said former businessman Stuart Gould, 72.

"I'm lucky - I can go online and all the things that go with it, but a lot of people, especially old people and the businesses, can't. Where are they going to bank?

"It's another nail in the coffin. It gets harder and harder for businesses to open, and without a bank where do they go?"

And businesses are finding it difficult to get change, which in turn can affect trade.

"Most people are finding it very frustrating because they can't get change anywhere," said Christine Coombes, owner of Scooby's Pet Supplies, which operates out of a former bank.

"They have to walk a long way out of the town to go and get money from a cash machine.

"And half the time they are not working, so what do you do? You just try your best and that's it."

Mr Docherty said he was also concerned about the loss of almost 200 free cash machines across Wales.

The biggest losers from bank and cash machine closures, he said, would be those living in rural areas.

Mr Docherty said Which? research found Brecon and Radnorshire has been the hardest hit constituency for bank branch closures, with 14 since 2015.

In this area of Powys, Mr Docherty said 40% of households could not access the minimum speed for broadband.

"So clearly there is a double whammy of less bank branches and not being able to use alternative forms of banking services," he added.

Its research showed NatWest has shut the most branches (70) in Wales between 2015 and 2018, followed by HSBC (46), Barclays (41) and Lloyds (27).