Scottish Budget: Higher earners to pay more income tax

Higher earners in Scotland are to pay more income tax, the Scottish government has announced.

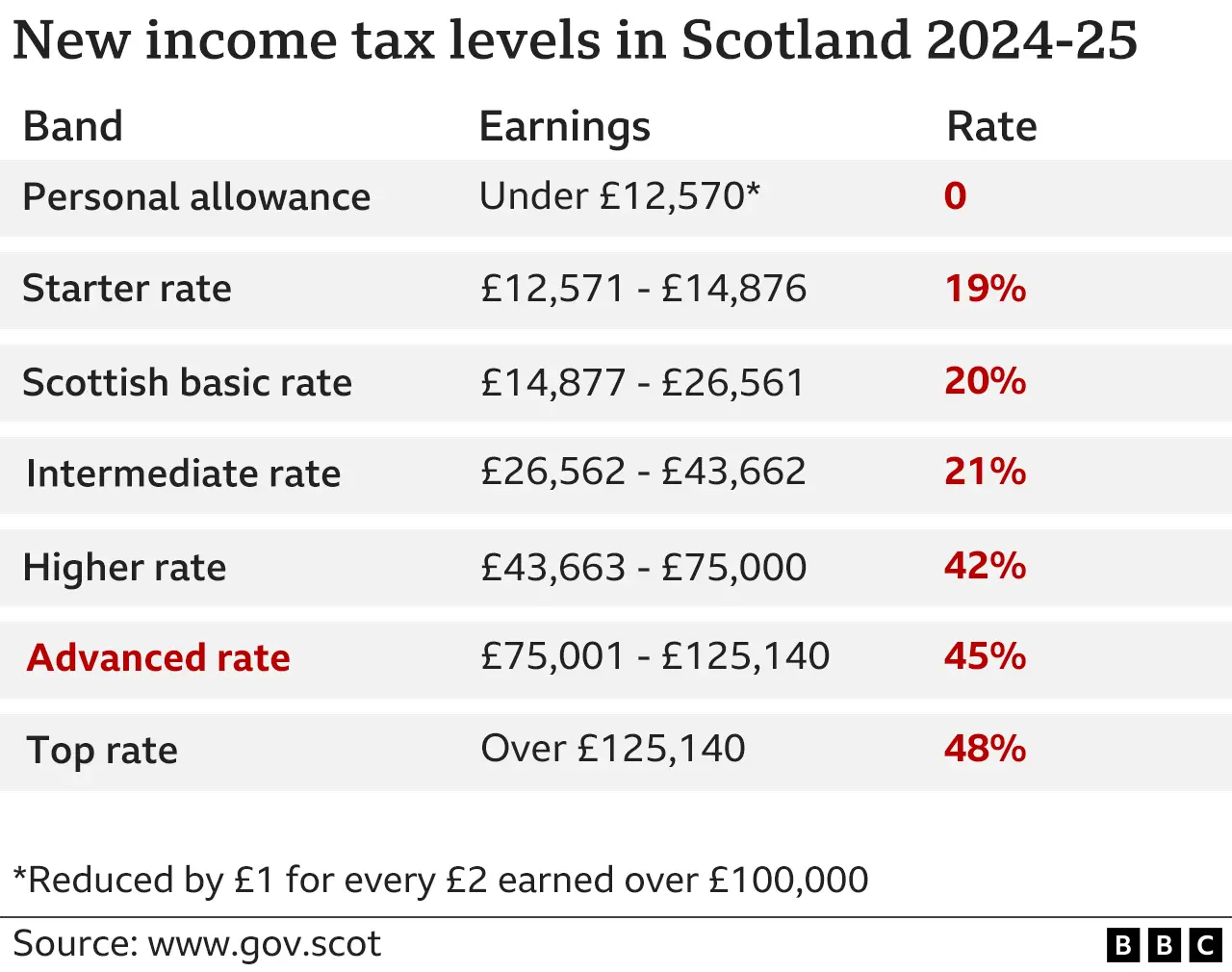

A new 45% band will be introduced for people earning between £75,000 and £125,140 - meaning they will pay more tax than they currently do.

The top rate of tax, paid by those earning more than £125,000, will also rise from 47% to 48%.

And the current threshold for paying the higher band - £43,663 - will be frozen instead of rising by inflation.

Finance Secretary Shona Robison confirmed the move as she unveiled the government's budget for next year, which included funding increases for the health service and councils - the latter to help offset a freeze in council tax - but cuts to enterprise funding, housing, higher education and rural affairs.

The tax changes mean Scotland will have six income tax bands while the rest of the UK has three, with middle and higher earners in Scotland paying more than other parts of the country.

The Scottish government estimates that 114,000 people will pay the new advanced tax rate for those earning between £75,000 and £125,000, with a further 40,000 people paying the top rate for those earning more than £125,000.

The announcement is designed to help plug a £1.5bn funding shortfall in the Scottish budget, with Ms Robison saying the tax rises for higher earners would raise an additional £80m.

The finance secretary also confirmed the current thresholds for the higher and top bands - £43,663 and £125,140 respectively - would be frozen, while the basic and intermediate bands will see the rates at which they kick in rise by the rate of inflation.

The freezing of the higher band threshold means a further 62,000 people will be pulled into paying the higher tax rate of 42% or more.

The Scottish Fiscal Commission (SFC) forecasts that the tax changes will help bring in a total of £1.5bn in revenue funding next year alone, although its chairperson said "tough decisions" were still likely to be necessary in individual government departments.

People who earn more than £28,850 in Scotland - slightly above median earnings - already pay more income tax than they would elsewhere in the UK, with those earning less than that amount paying slightly less.

The changes mean that anyone earning £50,000 in Scotland will pay £1,542 a year more than they would if they lived in another part of the UK, while people earning £150,000 will pay £6,000 more, according to the Scottish Fiscal Commission.

Ms Robison told MSPs the Scottish government would provide local authorities with £140m in additional funding to help finance a council tax freeze.

Council umbrella body Cosla had called for £300m to cover the freeze, which was announced by First Minister Humza Yousaf in October, with a report published last week warning that it was "only a matter of time" before a council effectively went bankrupt.

A Cosla spokesperson said a special meeting would be held on Thursday to discuss the budget.

Other major announcements included the government's intention to increase the Scottish Child Payment from £25 to £26.70 from April of next year.

Campaigners had called for an increase to £30 a week and Child Poverty Action Group director John Dickie called the budget announcement "bitterly disappointing".

Ms Robison also said the government would provide £1.5m to local authorities to cancel school meal debt.

According to research by the Aberlour children's charity published in October, more than 30,000 children had debts worth a total of £1.8m - up by 60% on the previous year.

Getty Images

Getty ImagesThe higher education sector faces cuts as the budget papers show a £107.4m reduction for the Scottish Funding Council, with funding for colleges down by £58.7m and universities by £48.5m.

Funding for NHS boards will rise "above real terms" by £550m (4.3%) MSPs were told.

The deputy first minister also announced business rates for premises valued at less than £51,000 will be frozen, while hospitality businesses in Scotland's islands will be given 100% relief, capped at £110,000 per firm.

The small business bonus scheme will also continue while the government will assess how valuations for business rates are carried out, Ms Robison said.

The finance secretary said Holyrood's block grant funding, derived from UK government spending decisions, had fallen by 1.2% in real terms since 2022-23.

"Devolution has brought many benefits, but it has also exposed quite how beholden we are to the decisions of Westminster," she told MSPs.

"We are fighting Westminster austerity with one hand tied behind our back."

Prime Minister Rishi Sunak said ahead of the budget announcement that the UK government was providing a record amount of funding via the Barnett formula to Scotland.

Speaking during a visit north of the border on Tuesday, he said Scotland was the highest taxed part of the UK and that it would be "very disappointing" to see tax rates rise further.

The Finance secretary says she's making very different choices to the UK government.

In broad terms by increasing the tax take and not replicating the business tax cuts introduced by the UK government, the Scottish government has created a pot of money to spend on public services.

There's extra cash for the health service and for social security benefits, and real terms increases in the education and justice budgets.

But the wellbeing economy, rural affairs and housing budgets have been cut.

Opposition politicians argue that had the SNP not wasted millions on failed projects it would have even more money to spend

Scottish Tory finance spokeswoman Liz Smith criticised the "extraordinary late delivery" of the budget to oppositions MSPs, who were given only a few minutes to examine the document before the announcement. She called it "discourtesy to parliament".

She accused the government of a "complete abrogation of responsibility for the running of the Scottish economy" since the SNP came to power in 2007.

Ms Smith questioned whether the government was sending out "the right message that Scotland is open for business".

She said: "For economic growth, for investment, innovation and job creation?" She asked. "Because it's abundantly clear that business and industry doesn't think so."

Ms Robison apologised to MSPs for the late deliver of the budget.

Scottish Labour finance spokesman Michael Marra claimed it was a "chaotic" budget from an "incompetent government that will leave ordinary Scots paying much more and getting much less in return".

Have you been affected by issues covered in this story? You can share your experiences by emailing [email protected].

Please include a contact number if you are willing to speak to a BBC journalist. You can also get in touch in the following ways:

- WhatsApp: +44 7756 165803

- Tweet: @BBC_HaveYourSay

- Upload pictures or video

- Please read our terms & conditions and privacy policy

If you are reading this page and can't see the form you will need to visit the mobile version of the BBC website to submit your question or comment or you can email us at [email protected]. Please include your name, age and location with any submission.