Scottish budget: Extra £100m for councils as tax-raising plans approved

PA Media

PA MediaMSPs have voted to approve the Scottish government's budget for the coming financial year.

The plans include an income tax rise for everyone in Scotland earning more than £43,662.

Deputy First Minister John Swinney said his 2023/24 proposals would help people who had been worst affected by the cost of living crisis.

The Scottish Conservatives said the SNP was widening the tax differentials with the rest of the UK.

MSPs voted by 68 to 57 to pass the budget bill.

During a debate in the Scottish Parliament, Mr Swinney - who is standing in for Finance Secretary Kate Forbes - also announced an extra £100m in funding for Scottish councils.

This came after extra funding was received from the UK government.

Mr Swinney said there would be a 3% real-terms increase in council funding.

The extra £100m for local authorities is in addition to last week's announcement of £123m to support a new pay offer for teachers, which has been rejected by the EIS union.

Mr Swinney said the new cash was to fund pay rises for non-teaching staff, and he hoped a "swift agreement" could be reached in those pay negotiations.

He also said there would be an extra £6.6m for Creative Scotland, which had faced using its reserves to maintain the current funding agreements for the arts in the coming year.

Creative Scotland said it welcomed the decision to reverse the proposed reduction in its funding.

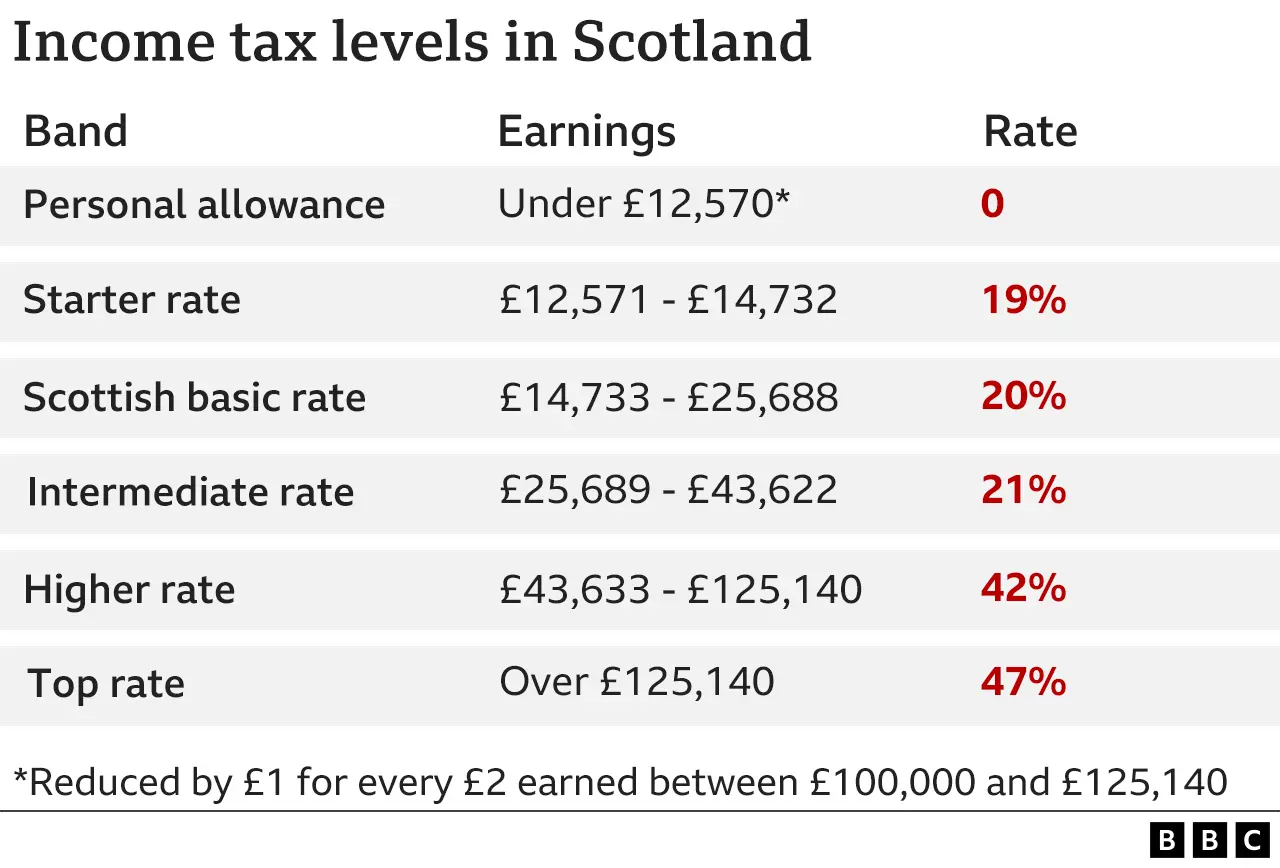

Under the budget, Scotland's income tax changes will see both the higher and top rates increased by 1p, rising to 42p and 47p in the pound respectively.

While the threshold for the 42p tax rate will be frozen, the Scottish government is proposing those earning £125,140 a year or more will pay the very top rate of income tax.

The lowering of the top rate tax threshold from £150,000 has already been announced for other parts of the UK by Chancellor Jeremy Hunt.

Income tax rates in Scotland, as well as several other taxes, are set by the Scottish government rather than at Westminster.

The increases are a significant departure from the SNP's manifesto aim not to alter income tax rates for the duration of this parliament.

Mr Swinney previously said that the changes will raise a total of £553m next year when taken alongside changes to other taxes including Land and Buildings Transaction Tax - the Scottish equivalent of stamp duty.

Ahead of the vote Mr Swinney highlighted an increase in the Scottish Child Payment and a £5.2bn investment in Social Security, with benefits due to rise by 10.1% from April.

The chancellor had already confirmed that benefits and pensions paid by the UK government would also rise by that figure.

The deputy first minister also said his income tax proposals would result in record funding of more than £19bn for health and social care.

Mr Swinney added: "The budget rejects austerity and provides relief for those in most need.

"It invests in transforming the economy and creating sustainable, high quality jobs which pay a fair wage, while confirming our commitment to future generations by continuing the drive towards net zero."

Getty Images

Getty ImagesThe Scottish Greens, who are in government with the SNP at Holyrood, said the budget "puts tackling child poverty and helping the most vulnerable at its heart".

The party's finance spokesman Ross Greer added that it was "the greenest budget in the history of the Scottish parliament".

But the Scottish Conservatives said the SNP was taxing middle and higher earners much more.

The party's finance spokeswoman Liz Smith said: "Scots are cumulatively paying more than £1bn extra a year in tax, yet because of slower growth this is raising just £325m extra for public services.

"John Swinney is in danger of creating substantial disincentives to living and working in Scotland.

"Instead of seeing any benefits for stumping up more cash to the taxman, all Scots see is public service cuts - in health, in education, in transport, housing, the creative arts and, of course, in local government."

Labour's Daniel Johnson said the SNP's new leader would inevitably make changes to the budget.

"This is not a budget that will last. I don't see any of the leadership candidates, once elected, leaving the budget well alone," he said.

Scottish Liberal Democrat leader Alex Cole-Hamilton said the budget was "just not good enough".

Creative Scotland said it welcomed the decision to reverse plans to cut its budget.

The Holyrood budget set out in draft on December 15 was a cold blast of bleak midwinter. At the same time, we were told that the economy was heading into an unusually long downturn.

The final stage of the legislative process in February comes with some hopes that the economic downturn will not be as harsh as previously forecast. And if you think next year's budget looks very difficult, they look a lot worse for the years that follow.

Health and social care get a lot more, rising to £19bn, though whether the proposed National Care Service will get all that it has been allocated may be down to the next first minister. The legislation for that is bringing political problems, to say the least.

To accommodate a sizeable boost to those priorities as well as a rise in spending on welfare benefits - notably taking the Scottish Child Payment to £25 per week - means a squeeze on other spending.

Local authorities tend to complain most loudly, and with quite good reason. They have started setting council tax, at 5% more from April, while making deep cuts to services and grants to local organisations.

Among the unknowns, though, is how much will have to be found in next year's budget to settle pay claims by public sector workers. As things stand, there is no pay policy.