Scottish public spending deficit falls to £23.7bn

Getty Images

Getty ImagesScotland's public spending deficit fell to £23.7bn last year as the country's finances continued to be hit by the Covid pandemic.

Scottish government statistics showed that total public spending dropped to £97.5bn.

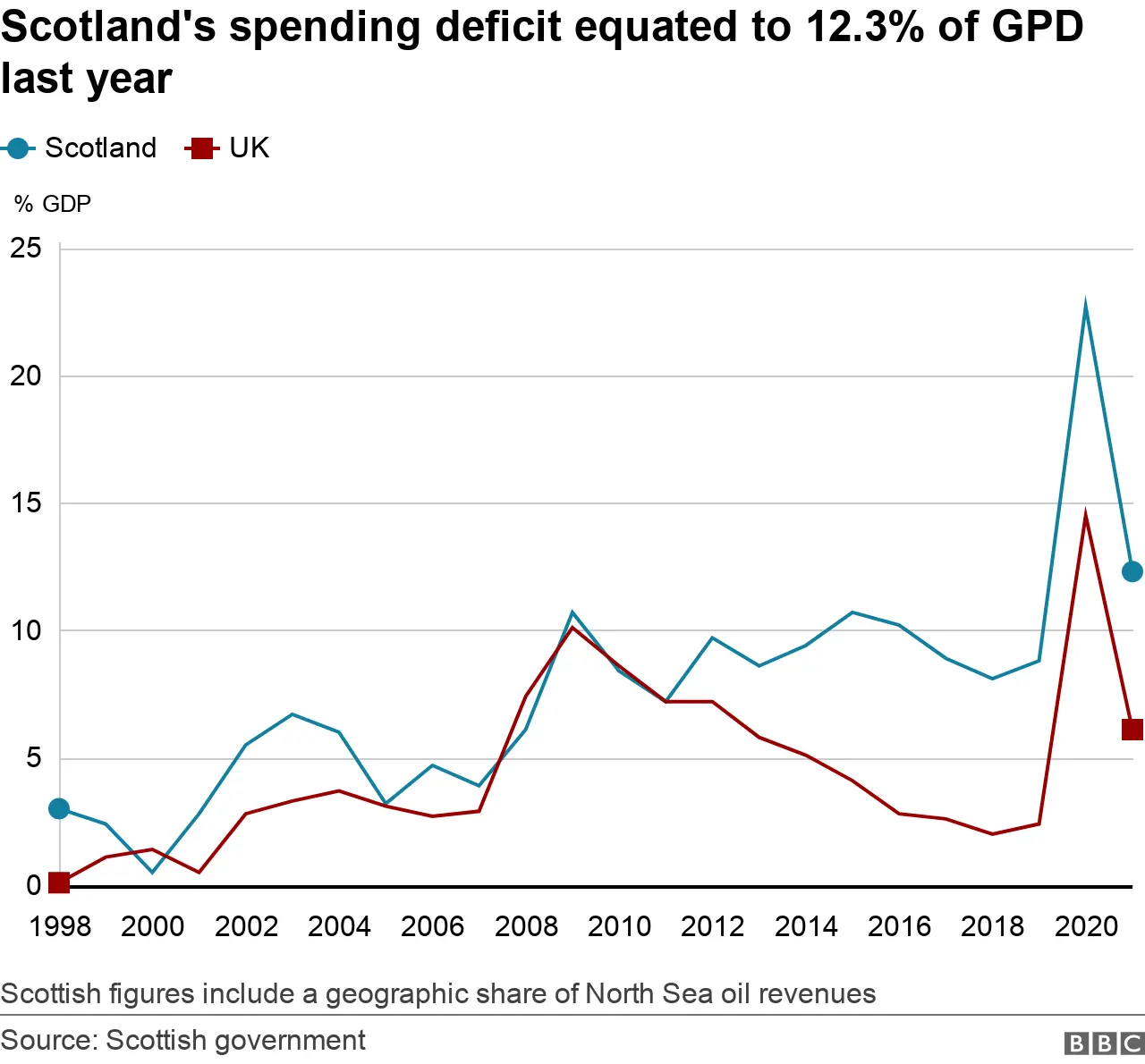

Income from taxes rose by £11bn to £73.8bn, leaving a gap between spending and revenue equating to 12.3% of Scotland's GDP.

The deficit for the UK as a whole over the same period was 6.1% of GDP.

Scotland's public deficit figure stood at £15.1bn - 8.6% of GDP - the year before the pandemic hit but more than doubled to £36.3bn, or 22.4% of GDP, in 2020.

The annual Government Expenditure and Revenue Scotland (Gers) report said that overall spending "for the benefit of Scotland" by the Scottish government, UK government and other public sector bodies fell from £98.5bn to £97.5bn last year - the largest ever drop in public expenditure.

This was equivalent to £17,793 per person, which is £1,963 per person greater than the UK average.

The fall in spending was mainly due to a reduction in money being spent on Covid support schemes - with the authors saying that spending remains at historically high levels.

Overall, the Scottish government spent £5.7bn in response to the coronavirus pandemic last year, down from £8.8bn in 2020.

Scotland received at least a further £3.7bn in reserved spending in response to the pandemic, down from £9.4bn.

However, this reduction in spending on the pandemic was largely offset by the costs of servicing the public sector debt.

Meanwhile, Scotland's illustrative geographical share of North Sea oil and gas revenue was £3.5bn, up from £0.8bn the previous year, as energy prices recovered from the falls during the pandemic.

The report said the oil price increased from $18.38 per barrel in April 2021 to $117.25 in March 2022, while gas prices rose from 55p per therm to 314p.

The increase was driven by Russia's invasion of Ukraine, which increased competition for supplies as countries attempted to switch away from Russian oil and gas.

Overall North Sea production of oil and gas fell by 16.8% in 2021 to 76 million tons of oil equivalent.

Scotland's total public sector revenue was said to be equivalent to £13,463 per person, £221 less than the UK average.

Excluding North Sea revenue, it was £12,831 per person, or £805 less than the UK average

The report said the figures "continue to be affected by the coronavirus pandemic, which had an ongoing and significant impact on global public sector finances."

The data was calculated by Scottish government statisticians, with the annual report having been at the centre of the debate over independence in recent years.

Deputy First Minister John Swinney, who is Scotland's acting finance secretary, said the continued rise in oil and gas prices was likely to see North Sea revenues grow to £13bn next year, which he said would cause Scotland's deficit to fall faster than the UK's.

He added: "Even without North Sea receipts, the record revenue generated was sufficient to cover all day-to-day devolved spending as well as all social security spending in Scotland, including the state pension."

Scottish Secretary Alister Jack said the Gers figures showed how "people and their families benefit massively from being part of a strong, resilient UK".

Mr Jack said: "As we continue to recover from the pandemic and confront global pressures on prices and the cost of living, it is clear we need a shared and a relentless focus on boosting the economy."

Scotland's notional deficit is down year on year for two main reasons: extra Covid spending has reduced and oil and gas revenues have increased.

That said, the gap between what's raised in Scotland in taxes and what's spent in and on behalf of Scotland is still very high at £23.7bn

That is equivalent to 12.3% of Scotland's economic output (as measured by GDP) which is more than double the 6.1% rate for the UK as a whole.

While these numbers are new, they trigger a very old debate about the state of Scotland's economy and its likely prospects in the event of independence.

UK supporters say the figures show how Scottish families "benefit massively" from being part of the union and a much larger economy.

Independence supporters say if the Scottish government had full financial control it could do a better job of running the economy.

Today's report does not tell us what the future holds - with or without independence - but it does highlight the very challenging financial position that needs to be addressed.