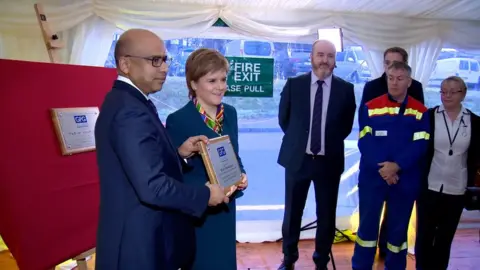

Scottish government defends £586m Lochaber smelter guarantees

PA Media

PA MediaScottish ministers have been accused of risking £586m of public money to help a metals tycoon purchase the UK's last remaining aluminium smelter.

The guarantees were made when Sanjeev Gupta bought the Lochaber smelter in 2016 but the full extent of government support has only just been confirmed.

Scottish Labour branded it a "dodgy deal" while a Conservative MSP said "jaw dropping" sums were put at risk.

The Scottish government said it had acted to support high-skilled jobs.

A spokesperson said: "We are committed to supporting jobs across Scotland and make no apology for doing so - including our backing for Scotland's strategically important aluminium sector and the highly-skilled jobs it provides.

"The Scottish government guarantee, which has not been called upon, was approved by the cross-party finance and constitution committee following appropriate due diligence.

"As part of that guarantee the Scottish government took on a comprehensive security package consisting of the smelter, the hydro power station, extensive land holdings, and a series of other protections."

The smelter, just outside Fort William, was at risk of closure five years ago when its owner Rio Tinto Alcan decided to sell it along with two hydro power plants and a huge portfolio of Highland estates.

Businessman Sanjeev Gupta eventually bought it for £330m and promised major investment in the plant, securing 160 jobs and potentially creating hundreds more.

While it was known that Scottish ministers gave assurances to help him raise the money, the scale of this support has just been confirmed by the Financial Times following two-year freedom of information wrangle with the Scottish government which claimed the figure was commercially sensitive.

Why did the Scottish government get involved?

When Rio Tinto decided to offload its smelting operation in the Highlands, along with two associated hydro electric power plants and 166,000 acres of land, the UK's last aluminium works was under threat.

While there were potential buyers for the power plants, there was limited interest in the smelter which is small by international standards and requires the bauxite-derived raw materials to be imported.

Scottish ministers already had dealings with Sanjeev Gupta, having provided him with loans to help buy two threatened steel plants at Dalzell and Clydebridge in Lanarkshire.

Mr Gupta's conglomerate Gupta Family Group (GFG) Alliance agreed to buy the Lochaber smelter and the other assets for £330m - then set about raising funds to pay for the purchase and future investment.

The initial plan was to expand the works to manufacture alloy wheels for cars, potentially creating hundreds more jobs at the plant and in the supply chain.

In order to raise the money Mr Gupta enlisted the help of Greensill Capital, founded by Australian money man Lex Greensill.

They came up with something called "Project Boots", in which investors would buy bonds in return for guaranteed quarterly payments.

What was unusual about this transaction was that the Scottish government was also involved - guaranteeing to meet the payments even if the power stations broke down or the smelter couldn't afford them.

The Financial Times has fought a two-year freedom of information battle to confirm the size of this "taxpayer guarantee" - and, following intervention from Scotland's information commissioner, the government has revealed the figure to be £586m.

What has happened since the purchase?

Many of Mr Gupta's business ventures were financed with the help of Greensill Capital which collapsed into administration in March.

This has left the tycoon battling to find new sources of finance, with some of his companies being pursued by creditors.

The Serious Fraud Office has confirmed it is investigating allegations of fraud and money laundering in relation to GFG Alliance, including its financing arrangements with Greensill Capital.

Former prime minister David Cameron has also faced questions about his lobbying work on behalf of Greensill since leaving office.

GFG Alliance

GFG AllianceMeanwhile, at Fort William the plans to make alloy wheels have been shelved, with GFG Alliance blaming a "significant decline" in car manufacturing.

Instead, it now plans to recycle aluminium at the site, producing 80,000 tonnes a year of billets - solid lengths of aluminium - for use in the construction industry.

One of the power stations, at Kinlochleven, has been leased to a London-based investor.

Despite these challenges, metal prices are high and GFG Alliance insists the Lochaber smelter remains a profitable operation.

A spokesperson said its expansion plans would "further bolster Lochaber's role as a hub for green aluminium production" which was already producing "some of the lowest carbon aluminium on the market".

Separately, there has been local criticism that an undertaking to transfer some of the huge Highland estates that came with the smelter sale to community ownership has not happened.

Jahama Estates, which manages the land, has said it has not yet been presented with a proposal it could consider.

Another controversy is a plan by a GFG Alliance owned company to build a large wind farm on land it acquired near Laggan.

The Glenshero Wind Farm is opposed by the John Muir Trust, Highland Council and Cairngorms National Park but a final decision will be taken by Scottish ministers.

What are the opposition parties saying?

The Scottish government has previously faced criticism over "secret loans" to the Ferguson shipyard and the cost of saving Prestwick Airport from closure.

The SNP's political opponents say the smelter is another example of a lack of transparency and a high risk approach to helping struggling businesses.

Scottish Conservative MSP for the Highlands and Islands Jamie Halcro Johnston said: "This is an astonishing amount of public money - and the fact that the SNP have tried so hard to hide the true cost of their dealings around the Lochaber Smelter is deeply worrying."

He added: "Local people are entitled to expect better outcomes from this level of public support. This is just the latest in a long line of problematic SNP experiments with Scottish industry, which have put jaw-dropping amounts of public money at risk."

Scottish Labour's finance spokesman Daniel Johnson said: "Questions are piling up for SNP ministers about this dodgy deal which they have desperately tried to bury.

"The SNP urgently need to admit who signed off on this extraordinary arrangement - and why they spent two years trying to hide it from the public."

For the Liberal Democrats, economy spokesman Willie Rennie said only about 50 jobs had been created at Lochaber under Mr Gupta.

"It looks like the Scottish government have been taken for mugs by the GFG Alliance, with financial backing worth £586m in return for a handful of extra jobs," he said.

The Scottish government points out that it has not been called upon to honour these guarantees and no money is owed to it.

The exposure to risk has also fallen over the years since 2016. It told the Financial Times the value of remaining guaranteed payments now stands at about £286m.

And if Mr Gupta's businesses in the Highlands were to run into trouble, the Scottish government could have a claim on those assets.