The man who really invented the cash machine

BBC

BBCThe world's first ATM was unveiled 50 years ago today but the inventor of the bank cash machine has been a source of dispute for years, with two Scottish men claiming the credit.

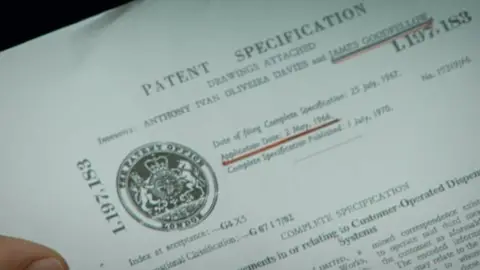

James Goodfellow, who will be 80 this year, is the man who first patented automated cash machines that use pin numbers - but for years the only credit he received was a £10 bonus.

He lodged his patent in May 1966, more than a year before the first cash machine was ceremonially opened in a blaze of publicity.

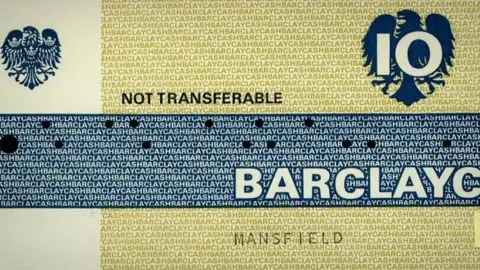

On 27 June 1967, comedy actor Reg Varney took money from a cash machine dispenser at a Barclays branch in Enfield, north London, but this was not the ATM card and Pin system we know today.

Getty Images

Getty ImagesThis machine was developed by John Shepherd-Barron, who was born in India, to Scottish parents, and lived much of his later life in Portmahomack in Ross-shire.

Shepherd-Barron's ATM beat Goodfellow's machines, which were installed at branches of Westminster Bank (later to become NatWest), by just a month.

So Shepherd-Barron became known as the "man who invented the cash machine" and not Goodfellow, the man who patented the system we use today.

The two devices were very different.

Shepherd-Barron's did not use plastic cards, instead it used cheques that were impregnated with carbon 14, a mildly radioactive substance.

The machine detected it, then matched the cheque against a Pin (personal identification number).

Shepherd-Barron worked for banknote manufacturer De La Rue, which never patented its machine.

Before he died in 2010, he told a BBC documentary that he didn't patent the idea because he did not want fraudsters knowing how the system worked.

He also said that the chief executive of Barclays had been quick to say yes to the idea when they had discussed it after a couple of Martinis.

Shepherd-Barron then had to go back to his team and get them to develop his idea.

However, it is Mr Goodfellow's plastic card and PIN which became the forerunner of the system we recognise today.

In recent years, his claim to have been the real inventor of the cash machine has been recognised more widely.

Mr Goodfellow now does not like to talk about the years in which Mr Shepherd-Barron got all the credit but in a 2009 BBC documentary he said it "really does raise my blood pressure".

The engineer, from Paisley, told BBC Scotland: "My patent was licensed by all the manufacturers. They thought that was the way to go.

"The race to get it on to the street was not as important.

"Getting it right was the answer, not getting it first."

Mr Goodfellow was working as development engineer for Glasgow firm Kelvin Hughes in the mid-1960s when he got involved in a project to design a machine that could dispense money to customers when banks were closed.

He told BBC Scotland that the driving force for the move was unions putting pressure on banks to close on Saturday mornings.

He said most people worked during the week and could not get to the bank, which closed at 3pm on weekdays.

Many people went to the bank on Saturday mornings but the unions were pressing for staff to work a five-day week.

The banks wanted a way to give working people access to their money when they were closed.

Mr Goodfellow said: "The problem with cash machines was access.

"How would a genuine customer, and only a genuine customer, get money out of it?"

They considered biometrics - fingerprints, voice prints or retinal scans.

"But in the 60s the technology to do this was not there, it was impossible," Mr Goodfellow said.

Eureka moment

So the next approach was an "exotic token", a piece of paper or plastic with "uncommon characteristics" that a machine would recognise.

His "eureka moment" came when he hit upon the idea of the Personal Identification Number (PIN).

This was the vital security measure that would make the system work, the number would be known to the customer and the bank and could be related to the card but not read by anyone else.

Goodfellow's invention was patented in May 1966, more than a year before his rival unveiled the first ATM in London.

But he still had a battle to make his concept reality.

"We had to meet some of the banks demands which were pretty severe," he said.

"They had a million customers and they wanted 2,000 machines across the UK.

"They wanted any one of the one million customers to be able to access any one of the 2,000 machines.

"You've got to remember there was no IT network in those days. The banks had no IT equipment. The bank's branches had nothing.

"We spent a lot of time developing the code. We had to submit something like 1,000 of these cards to a consultant, who would try to decipher it."

James Goodfellow

James GoodfellowInventor of the ATM

The cards he used were one quarter of a "Hollerith" punch-card, which just happens to be the same size as today's credit card. It contains just 30 bytes of data.

His patent for the card and Pin ATM was licensed for millions but Mr Goodfellow, as a humble technician, did not own the rights and did not get rich from his invention.

He said he signed patents for 15 countries around the world and got a dollar for each - worth about £10.

Mr Goodfellow left the firm in 1967 when it moved its operations to England and he went to work for IBM.

There have been arguments for years over who should officially go down in history as "the inventor of the ATM".

In 2005, Mr Shepherd-Barron received an OBE in the New Year honours list for services to banking as the "inventor of the automatic cash dispenser".

However, since then Mr Goodfellow, the man who patented the invention, has regained his place.

In 2006 Mr Goodfellow received an OBE for services to banking as "patentor of the personal identification number".

He has also been placed in the Scottish engineering hall of fame alongside John Logie Baird, the inventor of the television.

Mr Goodfellow even makes an appearance in a Home Office guide book aimed at those seeking UK citizenship.

The book, called Life in the United Kingdom, has about "great British inventions of the 20th century".

It says: "In the 1960s, James Goodfellow (1937-) invented the cash-dispensing automatic teller machine (ATM) or 'cashpoint'."