Keir Starmer: Recall Parliament and abandon budget

Labour leader Sir Keir Starmer has called for Parliament to be recalled so MPs can abandon last week's mini-budget "before any more damage is done".

The value of the pound dropped to $1.05 on Wednesday, after the Bank of England announced it would buy government debt to stabilise the economy.

Downing Street has rejected calls for Parliament to be recalled.

Sir Keir said the "government has clearly lost control of the economy" and had to do a U-turn immediately.

"Unlike other situations where it may be a world event, an unexpected event that causes this sort of crisis this is self-inflicted. This was made in Downing Street last Friday.

"And for what? For uncosted tax breaks for those earning hundreds of thousands of pounds."

The Treasury has rejected calls to reverse any of last week's budget.

Parliament is currently suspended while the two main parties hold their annual conferences. It is due to come back on 11 October.

Labour are calling for the mini-budget to be completely scrapped, despite supporting some measures, including keeping the basic rate of income tax to 19% from 20%.

According to the Institute for Fiscal Studies (IFS) Labour's plans would reverse less than half of the £45bn in tax cuts announced last week,

In an interview with BBC Political Editor Chris Mason, Sir Keir would not rule out cutting public services to reduce borrowing.

Sir Keir said: "I'm not predicting what we will put in our manifesto."

"We've got very clear rules which are that we will pay for day to day spending and we will borrow to invest.

"We will inherit, a complete mess from this government and obviously we'll get to those rules just as quickly as we can, as any incoming government would do.

"That's the normal situation when a government comes in."

'Inept madness'

All the main opposition parties - including Labour, Liberal Democrats, Green Party and Plaid Cymru - have now called for Parliament to be recalled early.

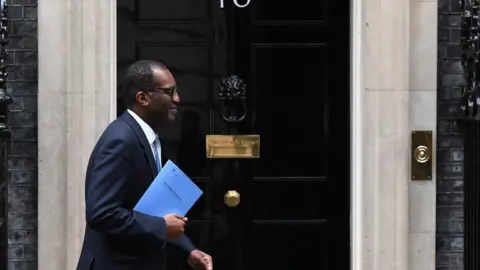

The Conservative Party conference is due to begin on Sunday, with Chancellor Kwasi Kwarteng giving a speech on Monday.

Last week, Mr Kwarteng unveiled the biggest package of tax cuts in 50 years, including scrapping the top rate of income tax and lifting the cap on bankers' bonuses.

The Treasury said the plans would be funded by £72bn of borrowing and there is an expectation this will surge as interest rates rise.

The pound slumped following his statement and later fell to a record low against the dollar after Mr Kwarteng hinted there were more tax cuts to come.

Conservative MP Simon Hoare who supported Liz Truss's defeated Tory leadership rival Rishi Sunak - described Mr Kwarteng's handling of the economy as "inept madness".

Mr Hoare, the chair of the Northern Ireland select committee, tweeted: "These are not circumstances beyond the control of Govt/Treasury. They were authored there.

"This inept madness cannot go on."

Managing the market

On Wednesday the Bank of England announced it would buy government bonds on a temporary basis to help "restore orderly market conditions".

The Bank also signalled it is prepared to ramp up interest rates in response to the falling value of the pound, leading mortgage lenders to pull deals.

But the International Monetary (IMF) fund has criticised the UK's plans for tax cuts, warning the measures were likely to fuel the cost-of-living crisis.

The IMF works to stabilise the global economy and one of its key roles is to act as an early economic warning system.

But the Chancellor of the Duchy of Lancaster Nadim Zahawi defended the government's economic plan, claiming interests rates would come down once inflation is under control.

Getty Images

Getty ImagesHe promised that the "fiscal discipline that the markets are looking for will be delivered in November".

Mr Zahawi said that co-ordination between the Bank of England and the Treasury was "incredibly strong."

The Treasury said Mr Kwarteng was due to publish his medium-term plan for the economy on 23 November, which would include ensuring that UK debt falls as a share of economic output in the medium term.