Tax cuts: Kwasi Kwarteng's measures benefit richest, Labour says

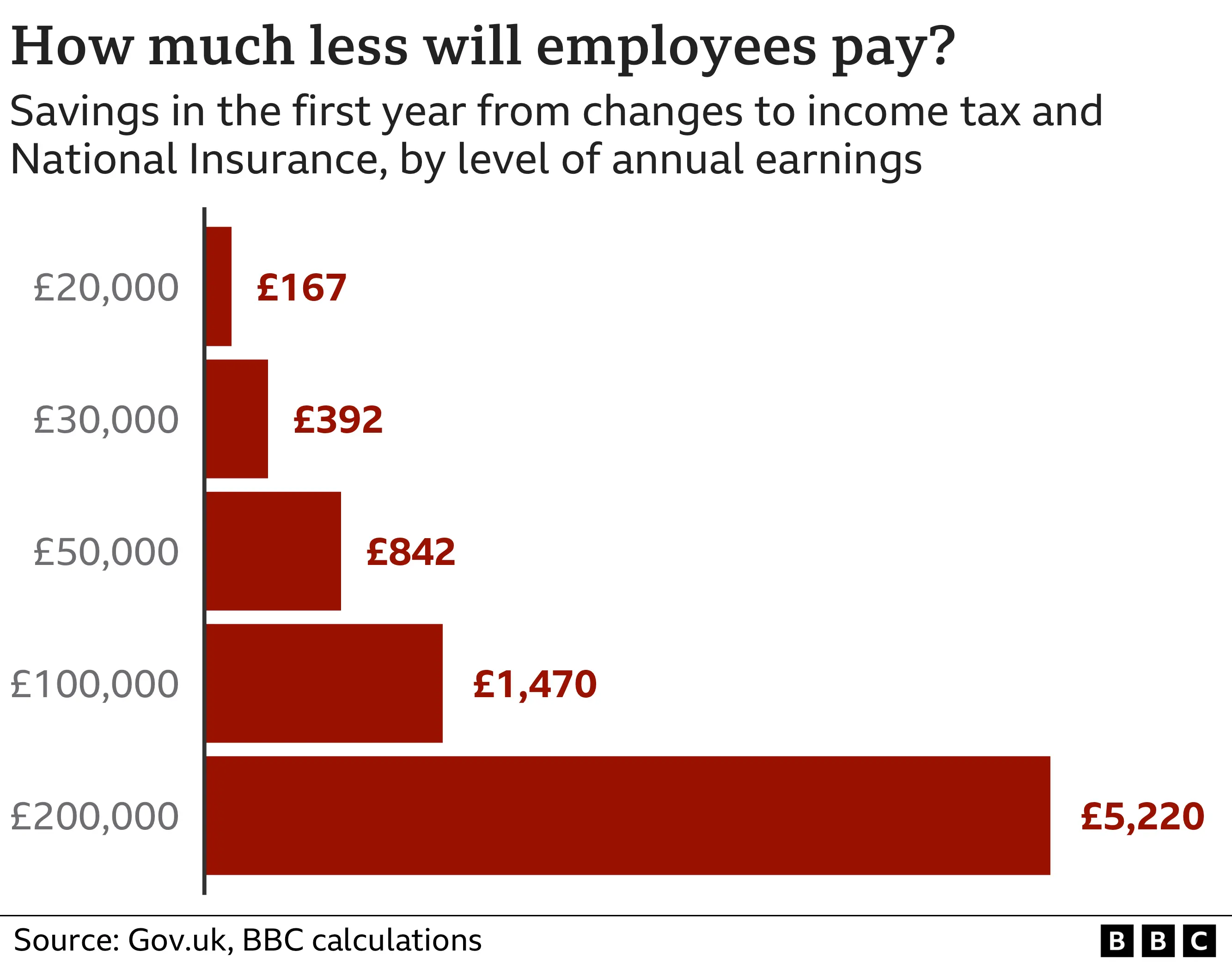

The government's tax cuts will benefit the richest 1% and make the next generation worse off, Labour has said.

Deputy leader Angela Rayner told the BBC the chancellor's approach of "trickle-down economics" was a "dangerous gamble".

Independent think tank the Institute of Fiscal Studies said the richest 10% of households would gain the most.

But Chief Secretary to the Treasury Chris Philp said tax cuts for all would get the economy growing.

Chancellor Kwasi Kwarteng unveiled the biggest package of tax cuts in 50 years on Friday, including the scrapping of the top rate of income tax.

He also reversed the National Insurance rise from November; cut stamp duty for homebuyers; and brought forward to April a cut to the basic rate of income tax to 19p in the pound.

The measures will be paid for by a sharp rise in government borrowing amounting to tens of billions of pounds.

There was an immediate reaction in financial markets, as the pound sank and UK stocks fell.

Speaking ahead of Labour's party conference, Ms Rayner called the plans "a very dangerous gamble on our economy and future generations".

"I don't accept the argument of trickle down economics - which is what this is - give those at the top loads more money and that will filter down to those at the bottom. That's not how it works."

She added the proposals were "grossly unfair" and would "saddle the next generation with more debt".

Arriving at the party conference in Liverpool, Labour leader Keir Starmer said the government had shown its "true colours" and the conference was "our chance to set out the alternative".

But minister Mr Philp told BBC Radio 4's Today programme: "Yesterday's tax package cut taxes for everybody across the income spectrum...

"It's a growth plan, and to get Britain growing we need to get rid of the burden of taxation. You can't tax your way to growth."

The announcements by Mr Kwarteng came after the Bank of England warned the UK may already be in a recession and raised interest rates to 2.25%.

'Betting the house'

Meanwhile, the IFS published analysis suggesting only those earning over £155,000 would see any benefits from the tax policies over the current Parliament, with the "vast majority of income tax payers paying more tax".

The think tank also said the chancellor was "betting the house" by putting government debt on an "unsustainable rising path".

IFS director Paul Johnson told BBC Breakfast: "If looked straightforwardly at people's incomes with these tax changes, the more money you have, the more you gain.

"In fact, because there was one big tax increase the chancellor didn't reverse - and that is the fall over time in the point at which you start paying income tax. If you take that into account, in three or four years' time, the only people gaining from this will be earning more than about £150,000 a year."

Responding, Mr Philp said the IFS analysis "involves speculation about what future budgets may do with the various tax thresholds".

"This wasn't a full budget - it didn't address the question of tax thresholds and I'm not going to get into speculation about what they might do in the future."

Analysis

Marc Ashdown, BBC business correspondent

It's already the biggest package of tax cuts for decades, but the chancellor might not be done yet.

There's been criticism from some economists that the policies announced disproportionately benefit those on higher incomes and those living in London and the south east of England.

The Treasury wants to give people and businesses more money to invest and spend to help boost growth, and the economy.

The previous chancellor, Rishi Sunak, froze the threshold at which we all start to pay basic rate tax.

That will stay at £12,570 for the rest of this Parliament. That means more people will start paying tax as wages rise. All earners will be worse off, but lower earners disproportionately.

Chief Secretary to the Treasury Chris Philp hinted today that the policy could be looked at.

And Treasury insiders explained to me that a wider review of all taxes was very much on the table.

A full budget, mooted for late autumn, could see even more tax cuts.

The Resolution Foundation, a think tank which focuses on those on low to middle incomes, said the package would do nothing to stop more than two million people falling below the poverty line, amid soaring living costs.

The richest 5% will see their incomes grow by 2% next year (2023-24), while the other 95% of the population will get poorer, it said.

The package will also see London and south-east England "disproportionately" better off than those living in Wales, the North East and Yorkshire, according to the think tank.

Chief executive Torsten Bell, a former Labour adviser, said: "The backdrop to yesterday's fiscal statement was an ongoing cost-of-living crisis that will mean virtually all households getting poorer next year as Britain grapples with high inflation and rising interest rates."

Elsewhere, Tony Danker, director-general of the Confederation of British Industry (CBI), told Today the measures would not "suddenly unlock growth".

"Having borrowed £150bn to support an energy package, we have to grow faster, there is no alternative."

He added: "We need a broad-based plan for growth... Action on tax is necessary but not sufficient."

On Friday Mr Kwarteng said the UK needed "a reboot", adding: "I don't think it's a gamble at all. What was a gamble, in my view, was sticking to the course we are on."