Summary of Budget 2020: Key points at-a-glance

PA Media

PA MediaChancellor Rishi Sunak has delivered his first Budget in the House of Commons, announcing the government's tax and spending plans for the year ahead.

Here is a summary of the main points.

Coronavirus and public services

Reuters

Reuters- £5bn emergency response fund to support the NHS and other public services in England

- All those advised to self-isolate will be entitled to statutory sick pay, even if they have not presented with symptoms

- Self-employed workers who are not eligible will be able to claim contributory Employment Support Allowance

- The ESA benefit will be available from day one, not after a week as now

- £500m hardship fund for councils in England to help the most vulnerable in their areas

- Firms with fewer than 250 staff will be refunded for sick pay payments for two weeks

- Small firms will be able to access "business interruption" loans of up to £1.2m

- Business rates in England will be abolished for firms in the retail, leisure and hospitality sectors with a rateable value below £51,000

- £6bn in extra NHS funding over five years to pay for staff recruitment and start of hospital upgrades

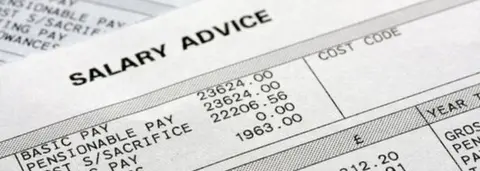

Personal taxation, wages and pensions

- The tax threshold for National Insurance Contributions will rise from £8,632 to £9,500

- The move, first announced in November, will take 500,000 employees out of the tax altogether

- Those earning more than £9,500 will be, on average, £85 a year better off

- 5% VAT on women's sanitary products, known as the tampon tax, to be scrapped

- No other new announcements on income tax, national insurance or VAT

- Tax paid on the pensions of high earners, including NHS consultants, to be recalculated to address staffing issues

Alcohol, tobacco and fuel

PA Media

PA Media- Fuel duty to be frozen for the 10th consecutive year

- Duties on spirits, beer, cider and wine to be frozen

- Tobacco taxes will continue to rise by 2% above the rate of retail price inflation

- This will add 27 pence to a pack of 20 cigarettes and 14 pence to a packet of cigars

- Business rate discounts for pubs to rise from £1,000 to £5,000 this year

Business, digital and science

Getty Images

Getty Images- System of High Street business rates to be reviewed later this year

- Firms eligible for small business rates relief will get £3,000 cash grant

- Entrepreneurs' Relief will be retained, but lifetime allowance will be reduced from £10m to £1m

- £5bn to be spent on getting gigabit-capable broadband into the hardest-to-reach places

- Science Institute in Weybridge, Surrey to get a £1.4bn funding boost

- An extra £900m for research into nuclear fusion, space and electric vehicles

- VAT on digital publications, including newspapers, e-books and academic journals to be scrapped from December

Environment and energy

Getty Images

Getty Images- Plastic packaging tax to come into force from April 2022

- Manufacturers and importers whose products have less than 30% recyclable material will be charged £200 per tonne

- Subsidies for fuel used in off-road vehicles - known as red diesel - will be scrapped "for most sectors" in two years' time

- Red diesel subsidies will remain for farmers and rail operators

- £120m in emergency relief for English communities affected by this winter's flooding and £200m for flood resilience

- Total investment in flood defences in England to be doubled to £5.2bn over next five years

- £640m "nature for climate fund" to protect natural habitats in England, including 30,000 hectares of new trees

Transport, infrastructure and housing

PA Media

PA Media- More than £600bn is set to be spent on roads, rail, broadband and housing by the middle of 2025

- There will be £27bn for motorways and other arterial roads, including new tunnel for the A303 near Stonehenge

- £2.5bn will be available to fix potholes and resurface roads in England over five years

- Further education colleges will get £1.5bn to upgrade their buildings

- £650m package to tackle homelessness, providing an extra 6,000 places for rough sleepers

- Stamp duty surcharge for foreign buyers of properties in England and Northern Ireland to be levied at 2% from April 2021

- New £1bn fund to remove all unsafe combustible cladding from all public and private housing higher than 18 metres

The state of the economy and public finances

PA

PA- Economy predicted to grow by 1.1% this year, revised down from 1.4% a year ago

- The figure, which does not take into account the impact of coronavirus, would be the slowest growth since 2009

- Growth predicted to rebound to 1.8% in 2021-22, 1.5% in 2022-23 and 1.3% in 2023-24

- Inflation forecast of 1.4% this year, increasing to 1.8% in 2021-2022

- Government to borrow £14.6bn more this year than previously forecast, equivalent to 2.1% of GDP

- Total additional borrowing of £96.6bn forecast by 2023-2024 to pay for spending commitments

- Debt as a percentage of GDP forecast to be lower at end of current Parliament than now

Nations and regions

- An extra £640m for Scotland, £360m for Wales, and £210m for Northern Ireland.

- Treasury's Green Book rules to be reviewed to factor regional prosperity into spending decisions

- Treasury to open new offices in Wales and Scotland and civil service hub in the North of England, employing 750 staff

- New £1.8bn devolution deal for West Yorkshire, with elected mayor for region

- Universities outside the south east of England to get lion's share of extra £400m R&D funding

- £800m for two carbon capture and storage clusters, creating 6,000 new jobs in Teesside, Humberside, Merseyside and Scotland