Mini-budget favours wealthy over workers, says Murphy

PA Media

PA MediaStormont's finance minister has criticised the chancellor's tax-cutting budget for favouring the wealthy over "ordinary workers".

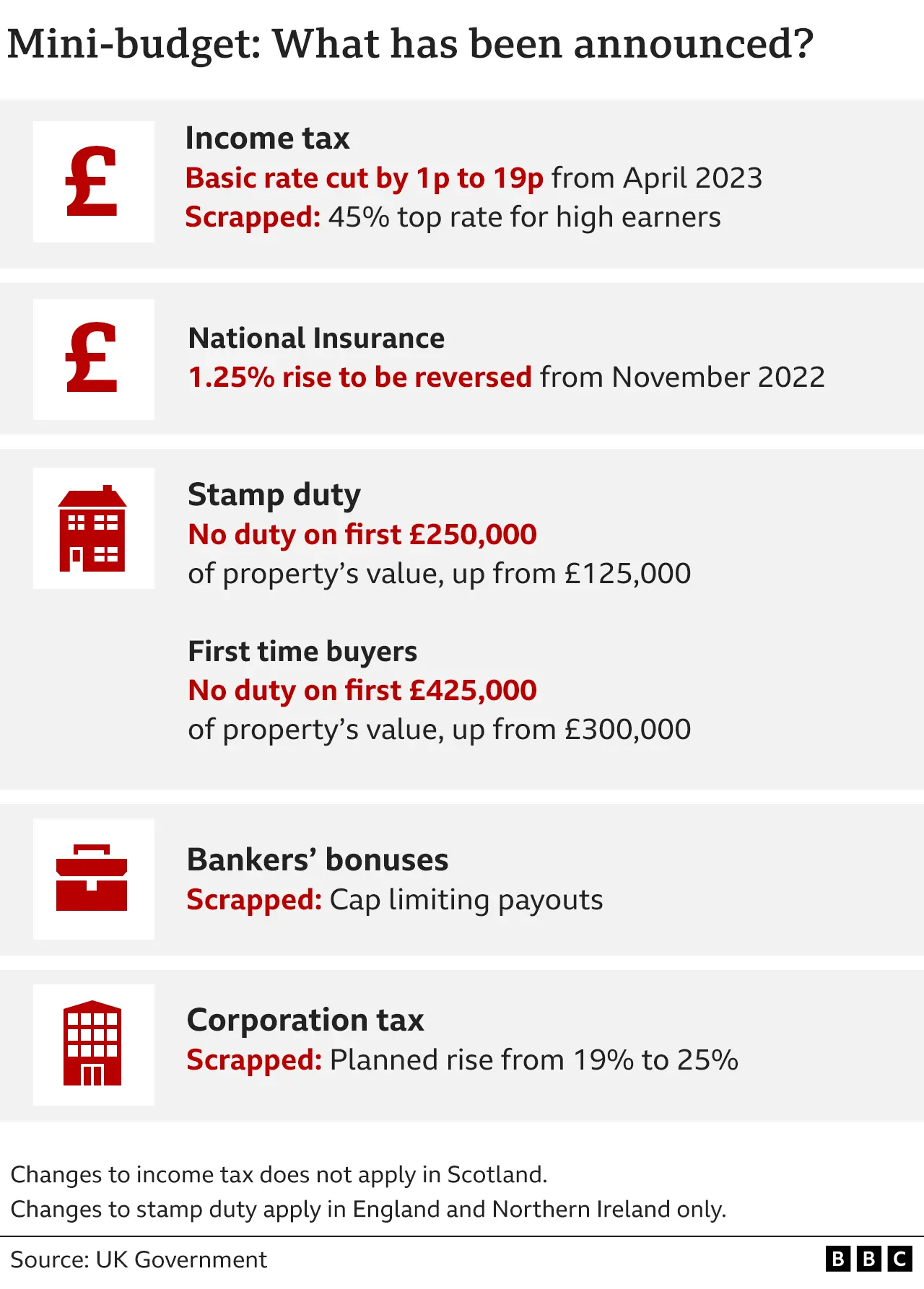

Kwasi Kwarteng unveiled the biggest package of tax cuts in 50 years, as he hailed a "new era" for the UK economy.

Income tax and the stamp duty on home purchases will be cut and planned rises in business taxes have been scrapped.

There has been a mixed response from Northern Ireland business organisations to the so-called "mini-budget".

The Northern Ireland Chamber of Commerce said businesses would welcome the chancellor's pledge to focus on economic growth.

The Federation for Small Businesses said it was "deeply disappointing" that VAT for the hospitality sector was not cut.

Mr Kwarteng said a major change of direction was needed to kickstart economic growth.

But the Labour Party said it would not solve the cost-of-living crisis and was a "plan to reward the already wealthy".

'Tax breaks for super-wealthy'

That was echoed by Finance Minister Conor Murphy who said: "What we needed today was a tax break for small businesses struggling with rising costs, and an increase in funding for public services and support for public sector workers who carried us through the pandemic.

"Instead the British chancellor has announced tax breaks for the super-wealthy and no extra funding for public services."

Mr Kwarteng announced that the basic rate of income tax would be reduced by one percentage point to 19% in April - one year earlier than planned.

He also unveiled a cut to the top rate of income tax from 45% to 40%, meaning the UK will have a single higher rate from April.

Other measures include keeping corporation tax, the tax on company profits, at 19% instead of increasing it to 25% as planned.

The threshold people in England and Northern Ireland start paying stamp duty on home purchases will rise to £250,000.

For first-time buyers the threshold will rise to £425,000 which should mean almost no first time buyers in Northern Ireland will pay stamp duty.

Northern Ireland Chamber of Commerce chief executive Ann McGregor said that reversing the planned increase in corporation tax would be "crucial for local firms competing on the island of Ireland in particular."

How have politicians reacted?

Democratic Unionist Party (DUP) MP Sammy Wilson welcomed the chancellor's plan.

He said it would "increase living standards, boost employment, raise revenue for public services and reduce the national debt".

Stephen Farry, the Alliance Party deputy leader, described it as a "shameful and reckless financial statement".

"Trickle-down economics will only serve to assist the wealthiest in society but at a huge cost to everyone else," said the North Down MP.

Social Democratic and Labour Party (SDLP) leader Colum Eastwood said the tax cuts were "designed by millionaires for millionaires, rather than those in need".

The Foyle MP said: "These plans show just how detached this government is from the desperate situation families are facing."

Ulster Unionist Party MLA Steve Aiken said the chancellor was taking a "huge gamble" with the proposed tax cuts.

"In Northern Ireland the cuts in income tax, the abolition of the higher rate of income tax and the reverse in the increase in national insurance contribution will be welcomed by most," he added.