Cryptocurrency scam: Man swindled out of pension and life savings

Xavier Lorenzo/Getty Images

Xavier Lorenzo/Getty ImagesA County Down man has lost his life savings and his pension in a sophisticated cryptocurrency scam.

He invested a six-figure sum in what turned out to be a fraudulent company.

The man, who wants to remain anonymous, is warning others not to fall for the scam.

"It started just over a year ago. I noticed an ad that was endorsed by two well-known celebrities showing you could earn more money than you could earn in a bank," he said.

"I started with £250. I didn't know anything about how cryptocurrency worked, I knew it existed but I didn't know the ins and outs."

That initial investment gave a good return and the company had its own website and even assigned a personal client manager, with all dealings done over the phone, not online.

"Nothing appeared to be strange, there were no red flags flying in my mind," he said.

"Every question I asked I got answers to, so there was nothing to alert me that I was going down a very rocky road.

"It's ironic that from the very start I kept a very detailed spreadsheet of all the transactions and the tradings. I wasn't frightened at that stage. I was using money but if I lost it I could survive."

'They enticed you in'

After a few months of continued investment, by this stage about £5,000, he was invited to join the company's "retirement section".

"They were quoting unbelievable figures and when I asked about tax they said cryptocurrency is unregulated and I was thinking 'I'm not sure', but they enticed you in," he said.

"Then the gentleman - or maybe gentleman isn't the right word in this case - the man who was my client manager he went off, supposedly with Covid, and another man was assigned to me."

The man said he had access to an account and a trading platform he could log in to and see his investments and trading.

"When I checked the cryptocurrency market websites, that had nothing to do with this company, you could see where the different types of cryptocurrency were trading and that confirmed what was happening on my account," he said.

By now he had invested a six-figure sum.

He is not prepared to say exactly how much, but it was all of his savings and his pension lump sum.

The company had asked him for extra money as an insurance on his investment, but it was not supposed to be traded and he was told he could get it back at any time.

On 15 February he logged on to his account and the extra money had been traded without his permission.

It was only then he realised that the whole set-up was a scam.

'I wanted to crawl into a hole'

"Luckily there was no borrowing or selling anything or dealing with the house. It was all personal savings and pension, " he said.

"You would have gone to bed at night before all of this and had plans, thoughts and dreams about what you want to do, but this has killed all of that."

Throughout the interview with BBC News NI, the man was visibly upset, crying and it was clear the scam had a detrimental affect on him.

"When I found out in February that it was all gone, I just wanted to crawl into a hole," he said.

"Home-wise, it has destroyed home life because I was dealing with all this by myself, my wife didn't know what was happening."

He contacted the company to complain and they referred him to a client support group, which was also part of this sophisticated and detailed scam.

He also started to contact everyone, from the police to the Financial Conduct Authority to Trading Standards.

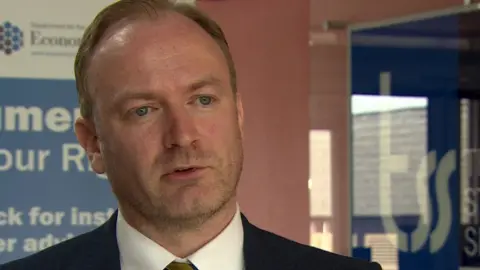

Damien Doherty, chief inspector of the Northern Ireland Trading Standards Service, said scams such as this were not uncommon.

"We're very well aware of how these scams operate. They're very slick," he said.

"As we've heard in this case they have account managers, they have complaint managers, they have escalation procedures.

"Everything about it would make you believe you're dealing with a legitimate company.

"The sums of money involved and the devastation that this has caused to this man's life and his family is heartbreaking .

"It's a real emerging trend and the sums of money huge and they really have the potential to ruin people's lives and in this case we're trying to raise awareness and let people know that this is a scam that is prominent, that anyone could fall for it."

Retirement plans for the victim of this scam have had to be shelved and despite the obvious toll it has taken, he really wants to warn others not to fall prey to this scam.

"You're sleeping, waking and thinking about it. It has taken over my whole life," he said.

"Trying to get a resolution, to get even some of the money back would be the icing on the cake, but it has been completely devastating.

"You can't think about plans because you've nothing to plan with. It has basically put a stop on my life."

For more information on scams and how to avoid them, visit https://www.nidirect.gov.uk/articles/scams