Cash machines: NI counts cost of industry change

PA

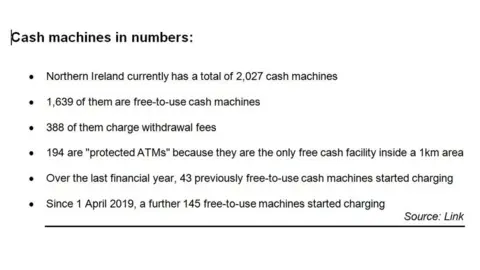

PASince the beginning of April, 145 free-to-use cash machines across Northern Ireland have become pay-to-use machines.

It means that out of a total of 2,027 cash machines in the region, almost one in five (388) now charges customers a fee to withdraw money.

It is part of a wider trend across the UK, as our changing shopping habits make getting hold of cold, hard cash ever more difficult.

People living in rural parts of Northern Ireland are among the most disadvantaged when it comes to getting their hands on their own money.

Many had come to rely on cash machines after a series of bank closures - 152 branches have shut in Northern Ireland since 2010.

But cash machine ram-raids and now withdrawal fees have left some communities as "cashless societies" long before they were ready.

The shop owner: 'We are losing about 1,000 customers a week'

Kenny Bradley

Kenny BradleyIt came as shock to Kenny Bradley when the free-to-use cash machine outside his shop in Garvagh, County Londonderry, suddenly began charging 95p for a transaction.

There was an even nastier shock when customers vented their anger online, wrongly blaming his staff for imposing the fees.

"We had such a backlash on social media - it was quite aggressive," he says.

"And I can fully understand why - in Garvagh, the people in the village now have no access to free cash after 23:00."

Kenny Bradley

Kenny BradleyThe businessman has no control over the fees because the machine is operated by Cardtronics, the UK's largest independent cash machine provider.

Mr Bradley says there has been a "drastic" fall in usage since charging began in February, estimating it has cost the shop 1,000 potential customer visits a week.

During September 2018, when the machine was still fee-free, there were 6,269 transactions.

By contrast, March saw 2,060 transactions - a drop of more than 4,000 over the month.

Kenny Bradley

Kenny BradleyMr Bradley's firm runs nine shops across Northern Ireland, including two in Garvagh, and hosts several cash machines for different operators.

He wants rid of the machines that are costing customers, but he is tied to a contract.

So his firm has introduced alternative payment methods, including cashback, but that too brought problems.

"Our card provider charges us every time we do cashback, but to support our customers and provide that service we're now taking that financial hit."

The customer: 'People can't manage as it is'

Northern Ireland Rural Women's Network

Northern Ireland Rural Women's NetworkMajella Murphy says people already struggling on small incomes will find it difficult to pay cash machine charges.

"My husband and I are on the state pension," she says.

"If I was going to be charged, we'd take it out in one lump sum."

But she is worried about theft and fears that pensioners and benefits recipients could be forced into carrying larger amounts of cash to avoid fees.

"We've already been robbed - the house was broken into four years ago, so we don't keep money at home."

Getty/Charles McQuillan

Getty/Charles McQuillanIt is not only security that is concerning the retired community worker but also how vulnerable people will manage their money.

"If you're on, say, £80 and you take out the whole £80 at once, it could end up spent and then you have nothing left for the rest of the week."

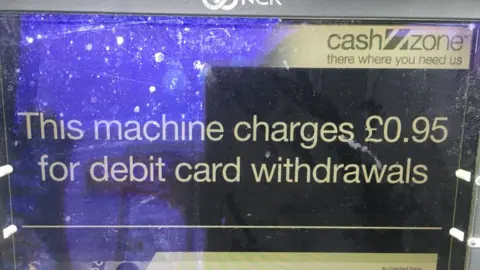

Consumer group Which? recently warned that free-to-use cash machines were disappearing "at an alarming rate" across the UK, but in Northern Ireland it is not just free ones that are vanishing.

Cash machines have been ripped out of walls in a spate of robberies.

So far this year, 15 cash machines have been targeted in thefts or attempted thefts around Northern Ireland and some will not be replaced.

Mrs Murphy recently retired on medical grounds and struggles with mobility.

There is one cash machine within walking distance of her home in Forkhill, County Armagh, and another at a supermarket about half a mile outside the village, but they are only available when the shops are open.

The supermarket's cash machine was moved inside the premises a number of years ago after an attempted ram-raid.

In spite of not having round-the-clock access to money, Mrs Murphy thinks all cash machines should now be inside to protect local services.

"My fear would be that they will be stolen and the shopped wrecked and you end up with no shop and no ATM."

Why are cash machines charging?

Cash machines are not as profitable as they used to be because shoppers are increasingly turning to cashless transactions like debit cards and contactless payments.

Every time a customer uses a cash machine that does not belong to their own bank, their bank pays a fee to the cash machine provider.

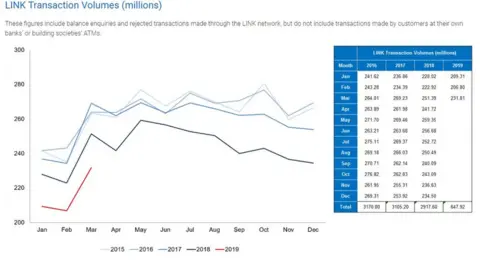

The fee is known as the interchange rate and is set by the UK's largest cash machine network, Link, which oversees the industry.

Link

LinkUntil recently, each transaction cost the banks 25p but Link is gradually reducing the rate to 20p in an attempt to keep cash machines financially viable.

"We need to make sure we have a sustainable and geographically broad ATM network," says Link's spokesperson.

"That means fewer machines in busier areas, where often there are too many, and protecting those in remote areas, often where there are no alternatives."

But the rate cut angered cash machine providers who make their profits from the interchange fee.

How have cash machine providers reacted?

Cardtronics is one of a number of cash machine providers but it is the biggest in the UK.

The firm said it had no choice but to introduce withdrawal charges because of the interchange rate cuts imposed by Link.

"Independent ATM operators such as ourselves often fill the gap left as a result of the banks closing branches and removing their own ATMs," it adds.

"But these cuts have made some of our ATMs unsustainable as a free service."