Brexit export EU costs a 'nasty shock' for small business owners

New Vintage Posters

New Vintage PostersThe UK's new trading relationship with the European Union (EU) might be less than two weeks old but some businesses - and their European customers - are already struggling to adjust to the new trading landscape.

'Horrified'

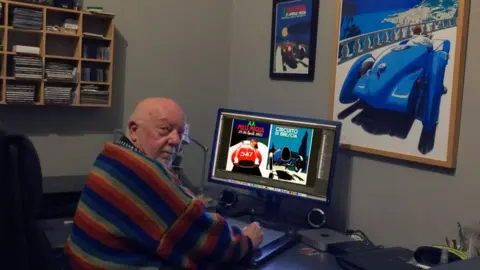

About half of the posters Bill Philpot creates and sells from his Suffolk-based studio are sold to customers in Europe.

His very first sale after the new post-Brexit rules came into effect was from a customer in France.

But that customer was far from amused. On top of the £80 cost of the poster, says Mr Philpot, the customer had to pay a further €34 (£30) made up of French tax, a brokerage charge from delivery firm UPS (to expedite it through customs), and the new EU sales tax.

The 73-year-old, who spent a career in advertising before setting up his Art Deco-style poster business 15 years ago to supplement his retirement income, says he is "horrified" by the extra charges.

New Vintage Posters

New Vintage PostersMr Philpot, who lives in Great Glemham, near Framlingham, says he "genuinely fears" he "might lose [his] business".

"Customers will stop buying - €34 (£30) is a hefty loading," he says.

"It's a modest business, I get about half a dozen orders a week.

"Once potential customers cotton on to these new charges, they'll stop buying from me, and from many other small UK businesses."

The new rules

New rules have come into force for those in the UK either importing from, or exporting to, Europe.

Exactly what licenses are needed or what duties must be paid depends on what is being exported, its value, where the product originates from and to which country it is being sent, according to government guidance.

From 1 January, the UK government introduced a rule that VAT must be collected at the point of sale rather than the point of importation.

This essentially means that overseas retailers sending goods to the UK are expected to register for UK VAT and account for it to HMRC if the sale value is less than €150 (£135).

This has led to a number of Europe-based retailers deciding they will no longer deliver to the UK.

'Massive disadvantage'

Anne Neill

Anne NeillAnne Neill has run Walkers.Style, an online women's wear store, for 30 years.

She says her initial "delight" at the announcement of a tariff-free deal with the EU on 24 December gave way to "startling" concerns.

A "significant proportion" of her customers live in EU countries, she says, and it has now emerged recent orders had been levied with unexpected charges running to more than €100 per order.

"We had been monitoring the Brexit situation since 2016 and I was fearful that import duty could put me at a price disadvantage to my European rivals," Ms Neill says.

"When the trade deal was announced, I was delighted… but on Friday our customers began reporting issues with unexpected charges on their doorstep. Now all the stock has to come back to us, and that has a cost.

"It's a huge deal to me. It couldn't be bigger."

Suppliers to the company, which is based in Lowestoft, Suffolk, are all European designers - but the country of origin for the orders are usually from further afield, often China, and not something that the company has an influence over.

This has meant goods can now have three lots of duty applied, putting UK retails at a "massive disadvantage".

She says her "vibrant" business was not under threat but it faces a "serious problem" and she has written to MPs to press for "immediate" changes.

You might also be interested in:

'Dust is still settling'

Facebook / Steve Grimwood

Facebook / Steve GrimwoodIpswich-based Elmy Cycles was established in 1922 - but its owner Steve Grimwood says Brexit "is affecting the whole industry".

"Shipping costs are through the roof," he says. "A lot of parts are made outside of the UK and often in the Far East and the dust is still settling on the way forward.

"Some of our bicycle suppliers are based in Europe - the likes of Bianchi and Ridley - but they're either suspending shipping until the middle of January, when more is known about how the new tariffs will work, or factoring in 5% to 10% price increases to cover the extra costs."

Mr Grimwood anticipates "massive shortages" of bicycles later in the year.

Facebook / Elmy Cycles

Facebook / Elmy Cycles"People think you can make everything in the UK but it's not quite that simple," he says. "A lot of bicycle parts are made in Asia - but the companies that make them have patents on their designs which are tightly controlled.

"Without getting too political, this isn't proving to be the seamless change promised. The lead time on manufacturing is usually six months - at the moment, they are more like summer 2022."

The Federation of Small Businesses says many small firms had not had the time, money or clarity needed to properly prepare for the new trading arrangements with the EU.

A Cabinet Office spokeswoman says: "The UK has left the EU customs union and single market, there are new rules and processes businesses need to follow.

"Any business unsure about what they need to do should visit GOV.UK, attend one of our free webinars or watch one of our short films about importing and exporting.

"The government will continue to work closely with businesses to ensure they are able to trade effectively under the new rules."

Find BBC News: East of England on Facebook, Instagram and Twitter. If you have a story suggestion email [email protected]