Cost of living: The Norwich mother working five jobs to make ends meet

BBC

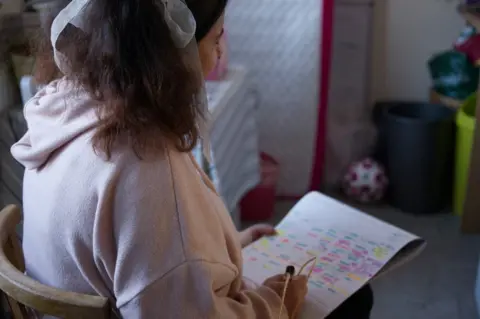

BBCEach page of the calendar on Rebecca Kellaway's living room wall is full of highlighted entries - some for her, some for her 10-year-old daughter. The bulk of the entries are in blue, each one denoting one of Ms Kellaway's shifts. Sometimes there are three shift entries per day.

Rebecca Kellaway is a waitress. And a carer. And a cleaner. And, when she is not going to work, she is a lone parent to her 10-year-old daughter.

"It is a real struggle," the 37-year-old, who lives and works in Norwich, says. "I call the days when I only have one paid job my days off."

She currently has the main waitressing job, a caring job and three cleaning roles.

She says she ended up with a handful of part-time jobs because, as a single mother, she needed the working flexibility to fit around her daughter's schooling, holidays and the availability of [paid for] childcare.

But her multiple jobs have come at a cost because, she says, of the Universal Credit taper rate, which reduces the amount paid when a claimant earns above their "work allowance".

"I should be getting £1,000 [a month] from Universal Credit but because of the jobs I do, I lose £350 on the taper, bam, outright," she says.

"For one of the jobs I do, I get £360 a month - so it is basically a straight swap [for the money lost through the taper mechanism], gone."

While Ms Kellaway's monthly earnings can vary, they collectively pay her about £1,030.

But her earnings are increasingly being eaten up by the rising cost of living.

Her monthly outgoings include:

- Rent: £360

- Council tax: £80

- Travel: £73

- Energy: £60 (an agreed reduced rate with her supplier)

- Food: £100-£120

- Childminder: £5 an hour during the day or £9 during the evening

The greatest price rises, she says, have been in the cost of food.

"It is small things - like food shopping, which has gone up about £1 per item, which soon adds up.

"I use the scan-as-you go things so you can keep track of it and, before you know it, you are up to £50, and then you have to think about what you are going to put back.

"What I need to be able to survive is long-term planning, to be able to know what I am doing in a month's time, because everything is budgeted down to the penny."

Ms Kellaway says she is doing everything possible to keep her costs down.

She washes the dishes once every three days to limit the amount of hot water she uses, she thinks hard each time she fancies a cup of tea because of the electricity cost of boiling her kettle and clothes are dried in the middle of the living room rather than in a tumble dryer.

"The stress of worrying about all of this, and being a mum, a single mum, and the jobs and the house stuff - it is a lot."

For the past year, Ms Kellaway has been putting aside whatever she can to pay for her daughter's recent 10th birthday party.

The party, held at the Gravity trampoline park in Norwich, was exactly what her daughter had wanted.

But the £300 cost meant Ms Kellaway could not afford a big present as well.

"I had to say, 'this is your present', and she was really understanding about it and actually I did find some money to get something small," she says.

"But that is a really [bad] thing to have to say to a kid - that you can't, as a mum, afford to buy them a present because you've spent all the money on a party.

"It shouldn't be like that."

You might also be interested in:

Ms Kellaway would love to go away on holiday but adds: "It is not really a thing, it is more of a dream.

"I find I can't give myself permission for things, like clothes or a new pair of shoes without holes in them because I know that is food money gone or money that my daughter could be using for things she needs.

"I can't remember the last time I went to a supermarket and just bought whatever I felt like without adding it up as I went along.

"That's the tell of it all - after working all these hours, if you don't have enough money in your account to go shopping and buy whatever you want to buy, then surely something is wrong?

"It is so hard when your child asks whether they can get a magazine and you have to say 'no'.

"Day-to-day life is just so expensive and it is frustrating.

"Life is even more expensive when you are in poverty because you can't afford to bulk buy things.

"It is a real trap."

And yet Ms Kellaway loves working.

"I'm stuck doing fairly low paid jobs," she says.

"They are really rewarding but they don't pay a lot."

Sitting on a chair in Ms Kellaway's living room is a painting of her. It was painted for her by one of the people she cares for, an artist with multiple sclerosis.

"Care work is such a massively important job, to be able to support somebody who needs it is such a privilege and really, really matters - and yet it is minimum wage."

If Ms Kellaway was given a magic wand, what would she do?

"I would take away the taper rate so that people get paid for working, subsidise childcare properly and put lots of funding into schools for breakfast and after-school clubs.

"There seems to be this idea that people are just sitting on their bums but we want to be out and earning a decent wage."

Ms Kellaway hopes to retrain as a counsellor or psychotherapist in the future.

She began studying last year but the demands of work and parenting made it impossible.

She will, she says, try once again when her daughter is a little older.

"I keep myself as happy and busy as I can," she says.

"But then when my daughter asleep yes, it really gets me down.

"I am really, deeply tired."

The Department for Work and Pensions said it was "committed to supporting hard-working families and making work pay".

A spokesperson said: "That's why we have reduced the Universal Credit taper rate from 63% to 55%, and increased work allowances by £500 per annum.

"This is effectively a tax cut for the lowest paid in society worth around £1.9 billion this year and it also means we're enabling 1.7 million households on Universal Credit to keep £1,000 more of what they earn."

Find BBC News: East of England on Facebook, Instagram and Twitter. If you have a story suggestion email [email protected]