Tunbridge Wells: Investors face losses of £30m after firms fold

More than 140 people claim to have lost £30m after a property business collapsed, the BBC has found.

JVIP Group told its clients, which include elderly and vulnerable people, that they could receive more than 10% interest on their investments.

But many of the companies linked to the group folded last year.

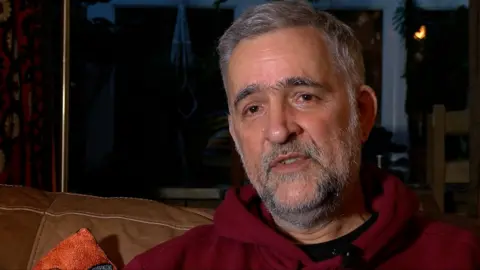

Police are investigating complaints from dozens of people, including Ruth Fretwell, from Brighton, who fears she has lost £190,000 in an investment.

"I was told they were buoyant," she said. "I stupidly believed what I was being told."

The investments were made into a number of companies styled as JVIP Group, or Joint Ventures in Property.

The companies were run by businessman Peter Dabner and based in Tunbridge Wells in Kent. He denies any wrongdoing.

JVIP told investors it would use their money to purchase or develop properties, and investors were offered annual returns often in excess of 10%.

But many of the associated companies collapsed at the beginning of 2022 and are now in the hands of administrators.

Ms Fretwell told the BBC: "I was told they were buoyant, and managing Covid well, and still competing against competitors who'd gone under.

"[I was} assured in no uncertain terms that everything was just fine for JVIP."

Mark Palmos, from East Grinstead, in West Sussex, invested more than £400,000.

He said: "From what I understand, we're not going to see any of that back. It's all gone, which is quite astonishing considering we believed it was all based on solid value proposition against property."

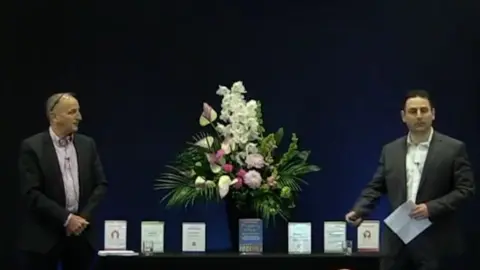

Mr Dabner appeared in a corporate video produced for JVIP, saying: "We established Joint Ventures in Property in 2002 and since then we've been involved in delivering 150 different sites."

YouTube

YouTubeHis father, Dick Dabner, who was also involved in the running of the business before stepping back in 2020, added in the video that JVIP was "delivering inspirational homes at every level".

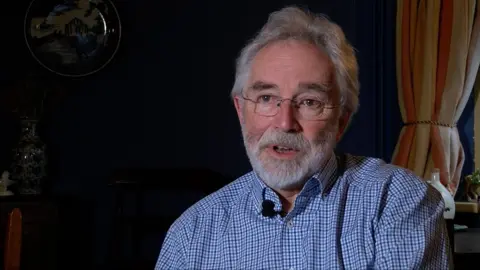

Dr Peter Coxon, who handed over £255,000, said JVIP had told him he would get him security on his property investment in the form of a fixed charge over property, but said it was never registered, leaving him with no legal recourse when the company he had invested in collapsed.

He said: "They believed by taking in more and more money from investors, even though they knew they were in trouble, they'd somehow muscle their way through this."

In a report by administrators on a company linked to the group - JVIP Group Limited, the administrator said economic uncertainty caused by the pandemic had impaired the group's finances and that the management team had tried to put it on a more stable long term financial footing.

Worryingly for investors, he also said: "Quite often, rather than funding specific projects it appears that monies borrowed (from investors) have been used to fund overheads, interest payments and redemptions across the associated companies."

The report, which was filed with Companies House in April 2022, continued: "Investor money may have been funding substantial losses over a considerable period of time."

Much of the cash that was invested has been difficult to trace as many JVIP companies did not file accounts for the final two years they were trading for.

JVIP

JVIPPeter Dabner refused requests from the BBC to explain in detail how and why things went wrong with the group.

In an email he said he "refutes entirely and without reservation any suggestion of wrongdoing or fraud in the management of JVIP", adding that what happened to the companies would be fully scrutinised during the insolvency process.

Follow BBC South East on Facebook, on Twitter, and on Instagram. Send your story ideas to [email protected].