Hospitals relying on 'emergency' loans to cover costs

Getty Images

Getty ImagesHospitals in England are "lurching" from month to month on "emergency" government loans to cover costs, a think tank has said.

The Nuffield Trust said some NHS hospitals had to cut spending on patients to pay the interest.

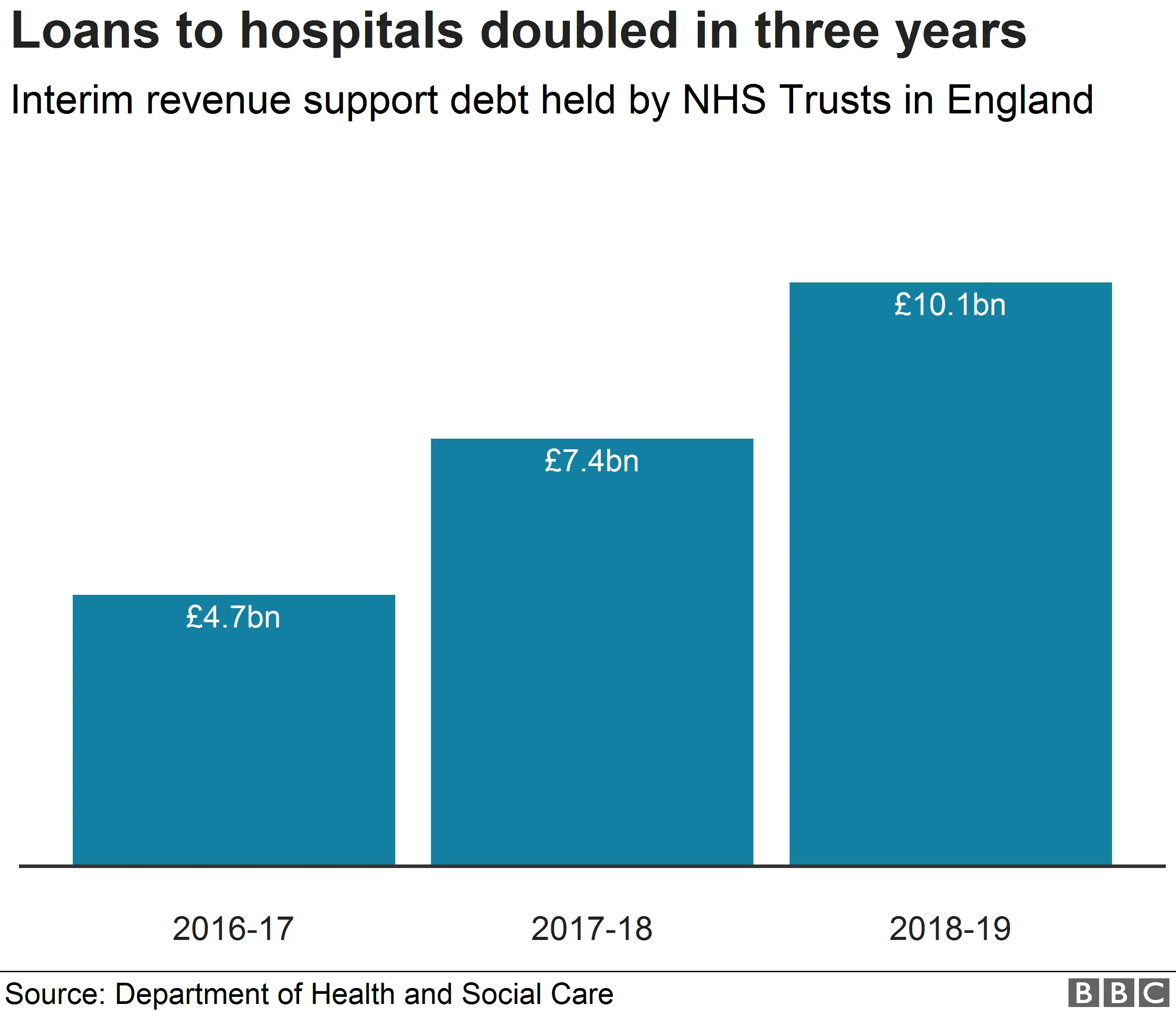

Trusts owed £10bn to the government in 2018-19 for "interim revenue support" and paid £185m in interest last year.

The Department of Health and Social Care (DHSC) said the money went back to the NHS.

The amount of money loaned by the government to NHS trusts in England doubled between 2016-17 to 2018-19, BBC analysis of official figures shows.

Interim revenue support was given to 122 NHS trusts, according to DHSC's annual reports. It allows hospitals and other healthcare providers to meet running costs while running at a deficit.

However the trusts have to pay them back with interest.

Sally Gainsbury, senior policy analyst for The Nuffield Trust, said hospitals were already unable to cover costs and were being forced to make further cuts in spending on patients to pay interest charges.

"Many hospitals can only survive by lurching from month to month with emergency bailouts from central government," she said.

"While it is true that interest paid to the department can in theory be recycled back out to the NHS, there is by no means a guarantee that it will go back to the individual NHS organisations that paid it.

"That leaves NHS trusts in the greatest financial difficulty unable to plan their future and make spending decisions that best suit their patients."

Siva Anandaciva, chief analyst for health charity The King's Fund said some hospitals and providers would be "unable to pay their staff and suppliers on time" without the extra cash brought in by government loans.

"In other words, they would be bankrupt," he said.

However, he added it was "inconceivable" that an NHS ambulance service, hospital or mental health provider would be allowed to go bust.

"DHSC may eventually have to bite the bullet and write off these debts or at least accept that they will not be paid back on time," he added.

Rachel Power, chief executive of The Patients Association charity, said: "The sustained period of underfunding in recent years has caused problems that will be harming patient care for years to come, as money is diverted around the system to balance books and recover deficits, not for the benefit of patients."

'Significant financial difficulty'

Google

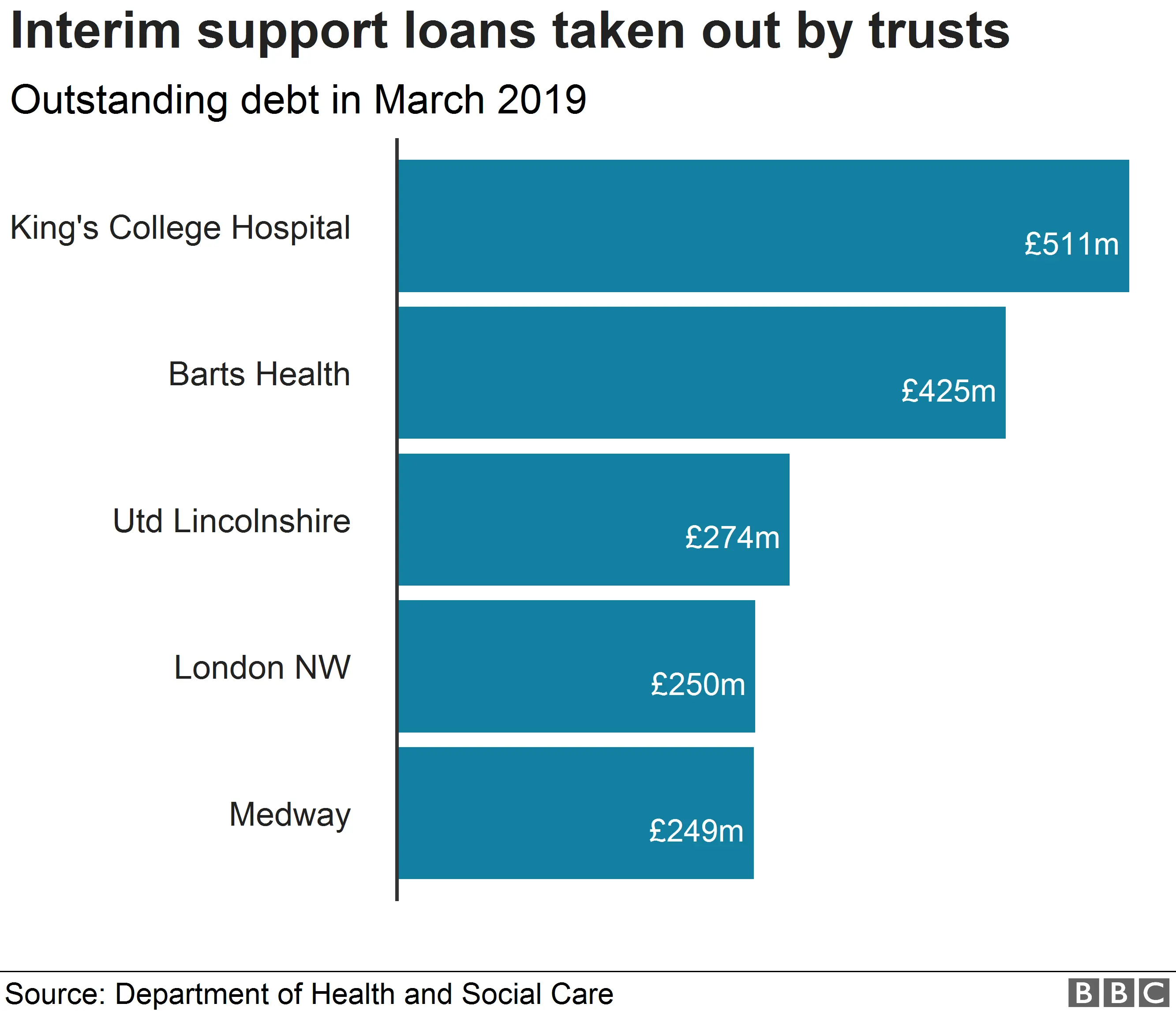

GoogleBorrowing by King's College Hospital NHS Foundation Trust in London more than doubled from £244m to more than £510m between 2016 and 2019, the equivalent to nearly half of its income over the last year.

The trust, which has been in financial special measures since 2017, spent £136m more on patient care than it was given last year and in its annual accounts admitted to being "reliant" on government loans.

It has the largest debt to the government of any hospital trust in England.

A trust spokesman said it had been "in significant financial difficulty for a number of years" and the loans provided "working capital".

"Without these loans the trust would find it difficult to maintain its current services for any length of time," he added.

A spokeswoman for London's Barts Health NHS Trust also said it had "historical" debt, but added it had "consistently reduced its underlying deficit".

The trust, also in special measures, said it was "usual NHS practice" to take out loans with the government to cover losses and it was working closely with regulators to address its financial issues.

A spokesman for the DHSC said: "NHS trusts rightly have the responsibility to manage their finances but where trusts do struggle financially, we will provide short-term loans to ensure they continue to run vital services and provide outstanding care to patients, with the interest paid going back to the NHS."

"We are also backing the NHS with an extra £33.9 billion a year by 2023-24 in cash to support our long term plan, which aims to ensure no provider is in deficit by 2024."