Most English local authorities 'plan to raise council tax'

BBC

BBCAlmost all councils in England plan to increase council tax and many will be cutting services, research suggests.

Three-quarters of local authorities are set to increase tax by more than 2.5% from April, the Local Government Information Unit (LGiU) said.

It comes as almost a third of councils surveyed said they were planning to cut spending on adult social care, and a quarter may reduce children's care.

The Local Government Association (LGA) said councils had "little choice".

The survey, by the LGiU think tank and the Municipal Journal, found eight in 10 councils believe the current funding system is "unsustainable".

The figures are based on the responses from 158 senior council figures, including leaders, chief executives and finance directors, representing 123 of the 353 English local authorities.

Some 97% of local authorities surveyed were planning to raise council tax in 2019-20, but more than half (53%) still expect to have to dip into their reserves to cover costs.

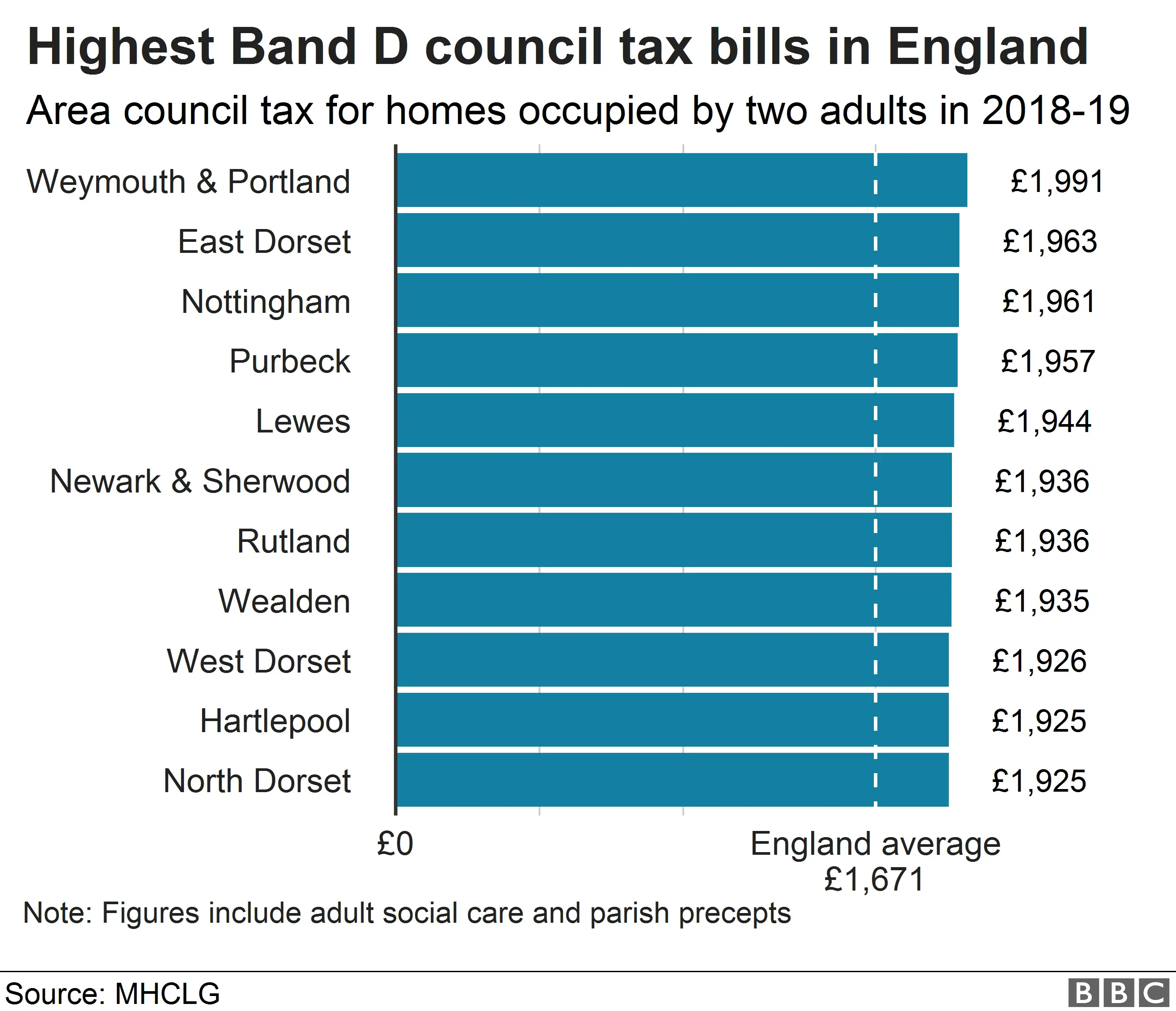

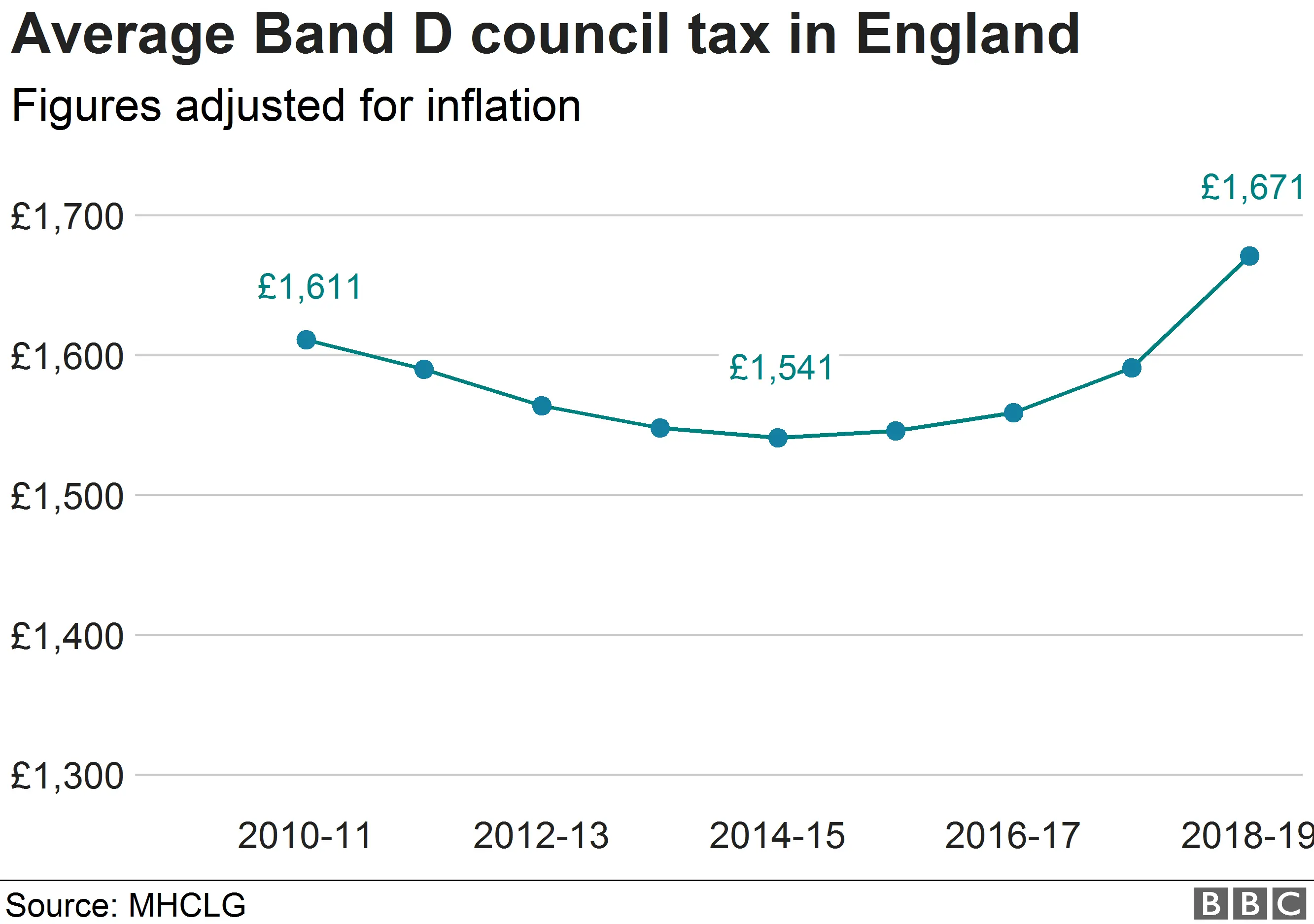

The average council tax for a Band D home in England was £1,671 in 2018-19.

A local referendum is needed to increase council tax by 3% or more in most areas.

Authorities responsible for social care are allowed to increase council tax by a further 2%.

Despite this, 29% of those who answered the survey said intended to "reduce activity" in adult social care in 2019-20.

Discounts scrapped

Local authorities have a legal obligation to set a balanced budget, where they do not plan to spend more than they have coming in, for the forthcoming year, beginning 1 April.

The LGIU and Municipal Journal do not name the councils that are planning to raise taxes, however some councils have already held votes or confirmed their intentions publicly.

They include:

- Northamptonshire County Council, which is in financial difficulty, has been given permission by the government to put its tax up by 5%

- Gloucestershire County Council will raise council tax by 4.99%, equivalent to £5.13 a month more for a Band D household

- Oldham Council is increasing bills 3.99%, adding £62 to the yearly Band D bill

- Cornwall Council's cabinet has recommended an increase of 3.99% in April, according to the Local Democracy Reporting Service

- Oxford City Council is increasing council tax by 2.99%, about £8.94 on a Band D bill, which on top of Oxfordshire County Council's bill makes a total of £1,776.63

Some councils are also looking to increase the amount of council tax they can raise by charging more for empty homes.

Owners of long-term empty homes in Manchester will be charged a higher premium on their council tax under a series of measures that could raise £1m.

Long-term empty homeowners already pay an extra 50% on their council tax but under proposals approved by the city council's executive, any homes empty for two years or more will be charged double council tax from April.

Stockport Council has also proposed scrapping discounts on empty homes and properties under renovation.

LGiU chief executive Jonathan Carr-West said councils had no option but to adopt "drastic measures" if they were to make ends meet.

"We know that council funding is broken. Councils are making do by increasing council tax as much as they can, increasing charging and dipping in to their reserves," he said.

Richard Watts, the chairman of the LGA's resources board, said: "Many councils feel they have little choice but to ask residents to pay more council tax again this year to help them try and protect their local services."

The local referendum rule only applies in England. The National Assembly for Wales and the Scottish Parliament have the power to cap local authorities' council tax rises.

Northern Ireland has a rates system instead of council tax.

In Conwy in Wales, council leaders have set an increase of 9.6%, while taxpayers in Scotland, will see bills rise up to 4.79%.