Council tax hikes planned 'across England'

Nearly all local authorities in England are set to raise council tax and service charges amid concerns for their financial stability, a survey suggests.

Council tax is set to rise in 95% of authorities while 93% will hike service fees, according to the 2018 State of Local Government Finance research.

The planned increases come as 80% of councils fear for their balance sheets.

Last week, Northamptonshire County Council banned all new spending and said its financial future was "grave".

Council tax can rise by 3% this year, in line with inflation, before a referendum is triggered, although the largest authorities are to be allowed to increase it by up to 5.99%.

Local authorities also oversee charges for services such as parking, burials and planning and 93% of respondents to the survey indicated new or increased fees in order to make ends meet.

Central government funding has come under fire as a result, with councils said to be calling for a "fundamental redesign of the financial system".

The research - carried out by the Local Government Information Unit (LGiU) think tank and The Municipal Journal - claims the biggest pressure on authorities' budgets is children's services (nearly 32% of councils), then adult social care (close to 28%) and housing and homelessness (19%).

In the 113 councils that responded to the survey, a third of all those in England, social care was found to be the greatest long-term pressure.

Additionally, councils are uncertain about what monies they will receive after 2020 as decisions over business rates and the Fair Funding Review are yet to be decided, the report found.

Of those 113 respondents, just six said they would not raise council tax. Of those six, only East Hampshire District Council agreed to be identified.

You might also be interested in:

On Friday, it emerged Northamptonshire County Council had imposed emergency controls on its spending in order to address "severe financial challenges". The move, known as a section 114 notice, is issued when a council does not have enough money to meet its expenditure. It is the first local authority in 20 years to resort to the measure.

The Conservative-run council has projected overspend of £21.1m for 2017-18 and its chief financial officer warned predictions for the following year were "grave".

On Tuesday, Surrey County Council (SCC) agreed a 6% rise in its council tax in the face of a £105m funding gap, according to analysis by the Bureau of Investigative Journalism, as reported in The Times.

In February 2017, the Tory-led authority threatened to impose a 15% increase in council tax in order to deal with its deficit - which would have triggered a referendum - but then found itself at the centre of a political row over a so-called "sweetheart deal" from the government.

Analysis by Daniel Wainwright, BBC England data journalist

How much you pay in council tax depends on where you live and how expensive your house would have been when the system was first drawn up, in 1991.

Police and crime commissioners and fire authorities all add to the bill and in areas with county, district and parish councils, each tier of local government will have its own precept.

Band A homes, those that would have been of the lowest value, will pay the least and Band H will pay the most.

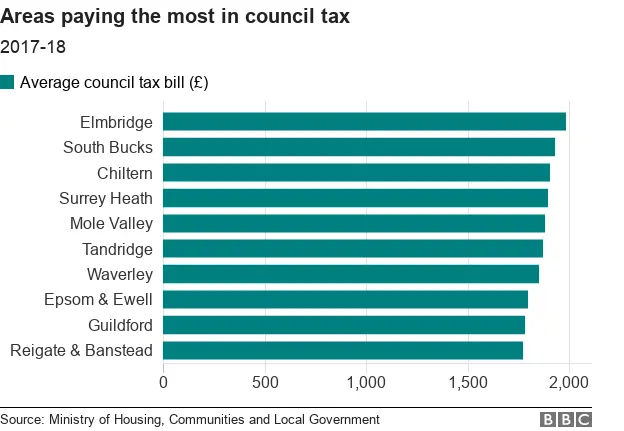

When all these bills and different bands of housing are taken into account, eight of the 10 areas with the highest average council tax bills are in Surrey.

People in the Elmbridge district will pay almost £2,000 per home.

Despite this, the county council is still facing a £105 million funding gap.

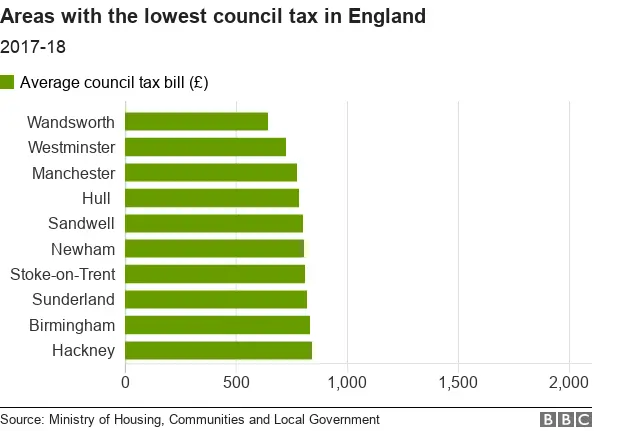

While London is known for being expensive, particularly when it comes to housing, it has some of the lowest council tax bills in the country.

People in Wandsworth pay an average of £645 a year per household. In Westminster, where the average property price is more than £1 million, people pay an average of £724 a year.

A spokesman for SCC, which serves the UK's richest county in terms of high net-worth individuals, said: "We've been successfully managing the growing need for adult social care, children's and other key services partly through making savings of £540m since 2010 and have made sure we keep within our overall budget."

Council finances

Councils in England get their money from:

- Council tax

- Taxes paid by local businesses

- Central government grants - some (like education) is ring-fenced

- Rent from social housing

- Fees and charges, such as for parking

The money is then spent on:

- Adult social care

- Children's services

- Transport and highways

- Housing

- Waste collection and recycling

- Community safety and crime reduction

- Cultural services like libraries

- Cremations and burials

Source: BBC Reality Check

Jonathan Carr-West, chief executive of LGiU, claimed the survey showed that councils "are on the edge" and most are "holding it together" by "raising council tax, increasing charging and draining their reserves".

"Councils are calling for assurances around funding for the next three years and for a fundamental redesign of the finance system. At present government is offering neither. That has to change," he said.

Council tax in Scotland and Wales

In Scotland, council tax policy is the responsibility of the Holyrood government but the 32 local councils set the rates and collect the duties.

Authorities were discouraged from increasing rates for a period of nine years via the threat of financial penalties, but this central freeze was ended in 2017.

Most councils have now opted to raise taxes by up to the 3% permitted.

In Wales, the Welsh Government settlement assumes a rise of 2.5% in council tax on average. There is no official cap, but there is an informal limit of 5% which was set ministers.

So far, this has not been exceeded, although last month Pembrokeshire County Council said it was considering a rise of 12.5%.

Lord Porter, chairman of the Local Government Association, the body which speaks for local councils, added that some authorities are "perilously close" to financial collapse.

"Many will have to make tough decisions about which services have to be scaled back or stopped altogether to plug funding gaps," he said.

"Extra council tax raising powers will helpfully give some councils the option to raise some extra income but will not bring in enough to completely ease the financial pressure they face.

DANIEL SORABJI/AFP/GETTY

DANIEL SORABJI/AFP/GETTY"This means many councils face having to ask residents to pay more council tax while offering fewer services as a result."

A Ministry of Housing, Communities and Local Government spokesman said its finance settlement "strikes a balance" between relieving pressure on councils and ensuring taxpayers "do not face excessive bills".

"Overall, councils will see a real-term increase in resources over the next two years, more freedom and fairness and with a greater certainty to plan and secure value for money," he said.

He added that more control had also been given to councils over the business rates they raise locally so "millions of pounds" could stay in communities.