Personal lending increases four times faster than wages

BBC News

BBC NewsThe value of outstanding personal loans in Great Britain has grown four times faster than wages, research by BBC News has found.

Data published by UK Finance shows households had outstanding loans worth £37bn in 2016-17.

Christians Against Poverty (CAP) said January 2018 was its busiest ever month for people seeking debt advice.

The Financial Conduct Authority (FCA) said the "vast majority" of loans went to people who could afford repayments.

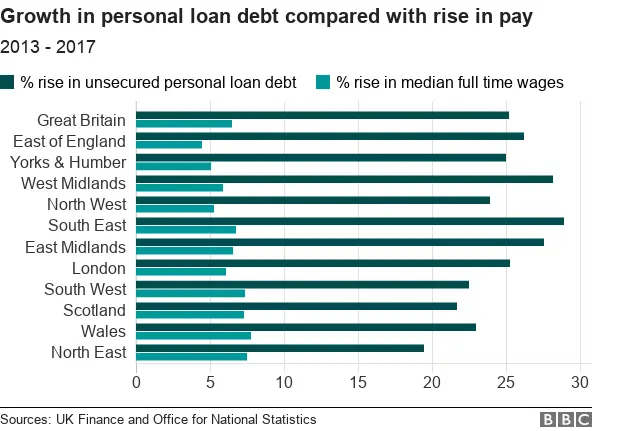

Statistics published by UK Finance, which cover 10 of the UK's biggest banks and building societies, shows the value of outstanding loans has increased by 25% since 2013-14.

In comparison, wage data from the Office for National Statistics (ONS) shows the typical full-time worker has seen pay increase by 6.5%, over the same period.

British households amassed £37bn in unpaid personals loans in 2017, an increase of £7bn from three years earlier.

In Northern Ireland personal loan debt is just over £1bn and has risen 4% since 2014.

Rising living costs and small increases in pay mean some people say they have had to borrow money to survive.

'Borrowing to pay for food'

BBC News

BBC News Mel Reynolds, a mother of two from Batley, West Yorkshire, said: "My salary simply covered my mortgage and utilities, meaning I was borrowing money to pay for food.

"There was a moment just before payday where I had five pounds left in my purse.

"I didn't have petrol in my car so I was left thinking, do I spend the five pounds on getting to work, or making packed lunches for my boys? I chose to feed my kids."

Ms Reynolds, who works full time for a car auction house, accumulated debts worth nearly £28,000 through bank lending and credit cards, between 2007 and 2015.

"I get upset thinking about that period in my life because I know there are a lot of other people out there going through exactly the same situation now," she said.

CAP, which has helped Ms Reynolds, said January had been its busiest ever month for people seeking help with their debt problems. It was founded in 1996.

Daniel Kelly, a manager at the charity, said: "We estimate about eight million people will be in their homes worrying about how they're going to be paying the bills."

BBC News

BBC NewsThe data published by UK Finance covers 60% of personal loans made by banks and building societies in the UK - it excludes student loans, credit cards and payday lending.

The analysis by the BBC England Data Unit also revealed that:

- The £3.7bn owed on personal loans in Great Britain was equivalent to £1,384 per household in 2016-17

- Regions that have seen the lowest increases in median pay for full-time workers have also seen the largest increases in unsecured personal loans

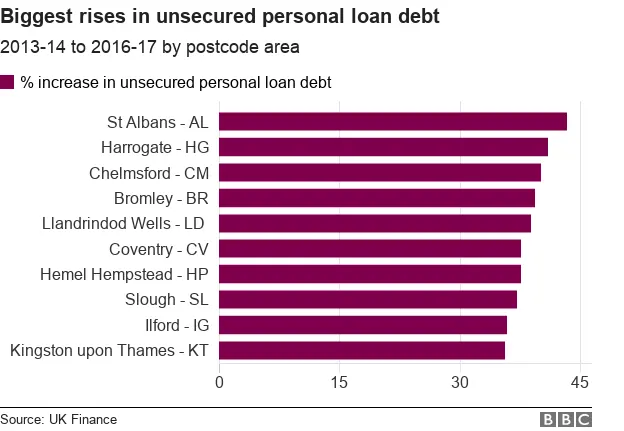

- More than half of postcode areas in Great Britain have seen unsecured lending amounts increase by more than 25%

- Households in the St Albans postcode area (AL) have seen unsecured lending increase by an average of 43%, the biggest rise in Great Britain

The Bank of England says households in the UK in total currently owe more than £1.5tn (including mortgage debt) and has warned that a sharp rise in personal loans could pose a danger to the UK economy.

Some charities are concerned people are receiving loans they will "never be able to repay".

Sylvia Simpson, from Leeds-based charity Money Buddies said: "We had one client who came to see us who was signed up to a £20,000 loan from her bank, completely unsecured, and she was six months pregnant.

"There was no way she was going to be able to start paying that money back while she was on maternity leave.

"We have clients that have said to us they were struggling with their debts and the banks are willing to offer them more money."

The FCA, which is responsible for regulating the lending market in the UK, said it would take action against those who lend "irresponsibly".

Director of strategy and competition Chris Woolard said: "Overall current levels of personal debt are around the long-term average but we are concerned about vulnerable consumers who could be exposed to high-cost lending.

"The vast majority of lenders are sticking to the rules which mean that when a bank lends money to someone it needs to make sure the repayments are affordable, and we will take action where we see our rules being broken".

A UK Finance spokesperson said its members "are committed to lending responsibly to help their customers, and always undertake a thorough risk assessment of a customer's finances whenever they apply for credit."

They added: "The vast majority of borrowers repay their loans without getting into financial difficulty, but if a customer is struggling with repayments we would always advise they speak to their lender straightaway.

"It's also important to remember these figures don't reflect total borrowing or indebtedness by area, as they exclude other sources of credit such as car loans, payday lenders and student loans."