Thousands lose benefits after tax credits overpaid

BBC

BBCCampaigners fear thousands more people face benefit deductions because of tax credit debts they didn't know about.

In excess of 800,000 households on universal credit received less money last year because they were previously awarded too much in tax credits, the BBC has found. More people will go on to the scheme from September.

To repay the debt, monthly benefits can be reduced by up to 25% by the Department for Work and Pensions (DWP).

The DWP says safeguards are in place.

In a statement it added: "We're committed to supporting those who are struggling with repayments."

Debt advice charities say universal credit deductions are leaving households in a spiral of debt, with families' reduced incomes meaning some are unable to afford rent or going without meals.

Data obtained by the BBC through a Freedom of Information request shows that the DWP has to claw back more than £1.5bn in overpaid tax credits - a form of benefits which will be replaced by universal credit by the end of 2024.

Tax credits are initially calculated according to claimants' circumstances at the start of each financial year. For those with fluctuating incomes and family circumstances, this can lead to over- or underpayments.

HMRC data shows each year about a third of all households in Britain claiming tax credits will be overpaid, and 13% underpaid.

At least 80,000 households across Great Britain owe £5,000 or more, which will take years to pay off.

In some cases, these debts have been forgotten about for years, coming to light only when households are placed on universal credit.

With all remaining tax credits recipients set to be transferred on to the system from September, campaigners fear many more households will be alerted to years-old debts.

It comes as families are also having benefits taken away to pay utility bills.

The charity Citizens Advice told the BBC an "illogical situation" had occurred in which households facing deductions were being referred to local authority hardship schemes - funded by the DWP - for support.

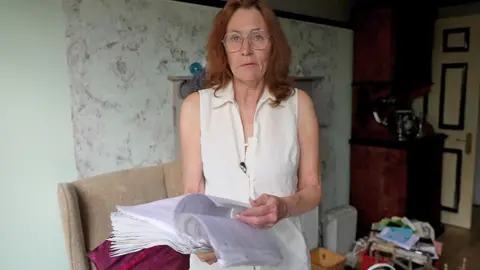

Nancy Crow from Somerset currently owes more than £5,000 to the DWP, having been told she was overpaid in working and child tax credits for several years between 2005 and 2016.

She is entitled to about £400 a month in benefits under universal credit, but has seen this deducted by about £50 a month.

The 61-year-old former nurse has now fallen behind on rent and says she has been left with little to survive on.

She has used food banks, gone without heating and electricity, and has even resorted to taking out payday loans.

PA Media

PA MediaAs someone living with a kidney disorder, Ms Crow says it has also left her unable to afford the foods doctors say she needs to maintain her health.

"I think part of my health problems is to do with my hardship," she says.

She was hospitalised last year, but hopes to work again once she is feeling well enough.

HM Revenue and Customs (HMRC), which managed Ms Crow's tax credits, has previously admitted an error in calculating how much she owes.

Ms Crow also points to documents from different tax years appearing to contain inconsistencies in the amount of debt remaining.

She says that when she moved abroad, she informed HMRC of changes in her circumstances and accepts she has been overpaid in tax credits.

"I'm frustrated, upset, angry. It makes me very depressed," she says.

HMRC says Ms Crow did not tell them about her move overseas within their allotted timeframe.

It added all customers "must report changes of circumstances to us as soon as possible, as this may impact their entitlement".

Debt advisers say this can be hard for people on zero-hours contracts, those with disabilities or mental health issues, and others who do not speak English as a first language.

In other instances, awards may be wrongly calculated by the system.

For those who are overpaid, this leaves them in debt to the government. Up to 25% of a claimant's monthly benefits can be taken from them to repay the money if they are in work, and 15% for those not in work.

Campaigners are calling for this figure to be capped at 5%, so deductions are more manageable for claimants.

The government said it had already reduced the maximum percentage it could deduct from a household's universal credit each month, down from 40%.

Grace Brownfield from the Money Advice Trust charity told the BBC losing benefits income made a "massive difference" to those affected.

"Because deductions from benefits are taken without any assessment of what's affordable for the individual, we're seeing parents who are skipping meals to feed their children, people that have health conditions who haven't been able to afford to put on the heating," she says.

When claimants are informed of a deduction, they can dispute it or ask for it to be paused because of their financial situation.

But that is not always easy.

"You basically are fobbed off and told to talk to a different office," Ms Crow says.

The BBC has spoken to several debt advisers and support services that reported concerns over the process of challenging debts.

Many claimants, they said, were given little information on how their debt had been incurred, which made it harder to challenge. And unlike in the private sector, the government doesn't face a six-year limit on reclaiming forgotten debts.

Sylvia Simpson, from the debt advice service Money Buddies in Leeds, told the BBC they had come across cases where deductions had been wrongly taken because of system error.

"The problem is that when there's been an administrative error, and it's not being challenged [within the set timeframe], you end up being liable for it," she says.

"So it's really important that you get advice and find out whether that overpayment is actually correct, because it might not be."

A government spokesperson told the BBC that "universal credit deductions… help recover taxpayers' money when overpayments are made".

Update 7 September: This article has been updated to include some additional details about Nancy Crow's case and HMRC's response.

Have you experienced issues relating to Universal Credit? You can share your experiences by emailing [email protected].

Please include a contact number if you are willing to speak to a BBC journalist. You can also get in touch in the following ways:

- WhatsApp: +44 7756 165803

- Tweet: @BBC_HaveYourSay

- Upload pictures or video

- Please read our terms & conditions and privacy policy

If you are reading this page and can't see the form you will need to visit the mobile version of the BBC website to submit your question or comment or you can email us at [email protected]. Please include your name, age and location with any submission.

How to check if you can claim a benefit

- Guide to benefits. when you qualify and what to do if something goes wrong, from the independent MoneyHelper website backed by government

- Check benefits calculators run by Policy in Practice and charities Entitledto and Turn2us

What to do if I cannot pay my debts

- Talk to someone. You are not alone and there is help available. A trained debt adviser can talk you through the options. Here are some organisations you can contact.

- Take control. Citizens Advice suggest you work out how much you owe, to whom, which debts are the most urgent and how much you need to pay each month.

- Check you are getting the right money. Use the independent MoneyHelper website or benefits calculators run by Policy in Practice and charities Entitledto and Turn2us.

- Ask for breathing space. If you are receiving debt advice in England and Wales you can apply for a break to shield you from further interest and charges for up to 60 days.

Tackling It Together: More tips to help you.