Thousands recruited to front UK firms in 'tax dodge'

Getty Images

Getty ImagesMore than 40,000 people from the Philippines have been recruited to front British companies as part of schemes costing the UK "hundreds of millions of pounds" in lost taxes.

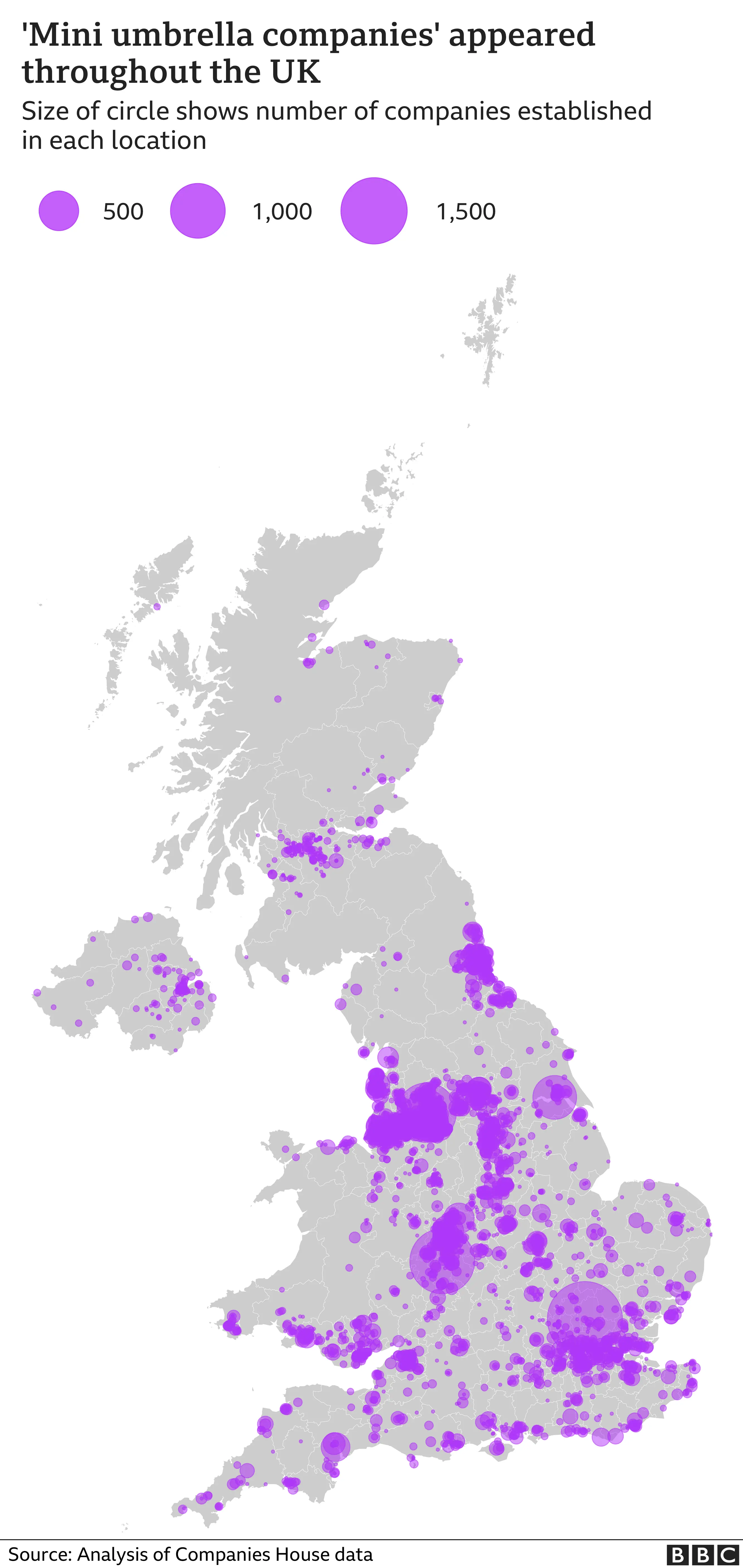

BBC Radio 4's File on 4 discovered more than 48,000 of these companies have been created in the past five years.

Some staff at Covid test centres run by G4S have been employed by subcontractors in this kind of scheme.

G4S said that, when this came to its attention, HMRC was notified.

The company said it was taking steps to ensure that all agency workers were employed directly and not via a subcontractor.

At the start of the pandemic, "John" - not his real name - was looking for employment.

As the pandemic grew, he saw an advert for staff at his local Covid testing site run by G4S.

He rang an employment agency called HR GO, got the job, and - as the second wave of infections hit - started to work. The job was stressful, he says, but the money wasn't bad - £10 an hour.

It wasn't until his payslip arrived that he noticed something odd was happening.

He had not been paid by G4S or HR GO, the agency that recruited him. Instead, he had been paid by a company he had never heard of.

He looked it up on Companies House and found it had been only set up a month before he had started his job - and its director was from the Philippines.

He started to think something "sketchy was happening". So why was John employed in such a convoluted way?

Employers pay 13.8% in National Insurance contributions on most of their employees' earnings, if the employee earns more than £170 a week.

But File on 4 discovered the way in which John is employed is used by recruitment agencies to cut their National Insurance bill.

It works by exploiting the government's Employment Allowance - an annual discount of £4,000 per company on National Insurance contributions. The allowance was meant to encourage companies to take on more workers.

However, recruitment agencies exploit the allowance by employing temporary workers through a series of mini umbrella companies - or "MUCs".

Each individual MUC has only a small number of workers and qualifies for the tax relief. These kind of arrangements can cost the taxpayer hundreds of millions in lost tax revenue a year.

HMRC warned against them as early as 2015, saying schemes designed to exploit the Employment Allowance were "too good to be true" and "simply did not work".

A G4S spokesperson said: "To deliver these services, G4S works with employment agencies which are Recruitment and Employment Confederation accredited and members of the government's Crown Commercial Service (CCS) Framework."

It said their payments to agencies include all of the appropriate national insurance contributions - and all staff working on the G4S contracts pay their national insurance contributions correctly.

HR GO said they were satisfied that the way they have managed their supply chain is "legal and in harmony with the guidance on supply chain management issued by HMRC Threat Response Unit".

File on 4 found that more than 48,000 "mini umbrellas" have been created in the UK in the past five years, each following a particular pattern.

The companies are originally incorporated with a British director recruited via private groups on Facebook. They resign as directors after a short period of time and a Filipino director is appointed in their place.

"Emma", who did not want to use her real name, lives in south-east England and says she was at her lowest ebb when she took part.

"At the time, I had broken up with my son's dad. And he left me in the flat with all the bills to pay. And I only had a part-time job because I had a six-month-old baby," she said.

"I started doing it just purely to sort of pay the bills."

Emma signed up to the scheme four times, each time being paid £150 for "fronting" six companies.

Her only job was to upload letters she received by post from HMRC and Companies House to an online portal run by a company called WRS Formations.

Shortly after that, she would resign as the director of the six businesses and start all over again.

On the same day she resigned, a Filipino director would be appointed to "front" these companies. It can be harder for HMRC to pursue companies with directors in other jurisdictions.

File on 4 discovered that tens of thousands of Filipinos from some of the poorest regions in the country are being recruited through Facebook and word of mouth.

The only qualifications to get the job are an internet connection, a mobile phone number, an email address and an ID document.

They have to review and sign the British company's documents through an online portal run by a company called Compass Star Limited.

One Filipino director - who didn't want to be named for fear of losing his income - said he signed up last year to support his wife and a baby.

He said it was "really very easy" and the extra cash was "a big help". It paid his bills and daily expenses.

But he couldn't remember the name of the company he is the director of and doesn't know what the company does.

When its name was disclosed to him by File on 4, he said: "Ah yes… I've seen it [in the portal]."

Thousands of companies fronted by Filipinos are then used to employ workers in the UK, including supply teachers and Covid testers.

Compass Star Limited and WRS Formations did not respond to the BBC's letters.

Jo Maugham, a tax QC and the founder of the campaigning group the Good Law Project, said the number of companies File on 4 discovered were set up in this way was "staggering".

"It's not as though this is some tiny piece of tax avoidance - you know, where your local minicab firm isn't declaring all of the fares that it receives. This is industrial scale tax abuse," he said.

"I mean it's really absolutely extraordinary, hundreds of millions of pounds if not billions of pounds is likely to have been lost due to HMRC's apparent disinclination to tackle this abuse."

Anneliese Dodds, former shadow chancellor, called upon HMRC and the government to do more to tackle these schemes.

"We do need to see greater action being taken by HMRC… and the Conservative government really should have been facing up to this, because certainly, the alarm bell has been rung by many over many years," she said.

HMRC said it was using both its criminal and civil powers to challenge what it called "MUC fraud" - and recently deregistered more than 22,000 mini umbrella companies thought to be involved in such schemes.

It says it has made a number of arrests and taken steps to recover unpaid tax from businesses which knew or should have known about fraud in their supply chain.

- Listen to more on this story on File on 4, on 11 May at 20:00 GMT on BBC Radio 4 and after on BBC Sounds.

Additional reporting by Gillian Schonrock and Richard Smith.

Clarification: This story has been updated to make clear G4S works with employment agencies which are Recruitment and Employment Confederation accredited and members of the government's Crown Commercial Service (CCS) Framework.