Universal Credit: 'I've nearly lost my house twice'

BBC

BBCA mother of three says she has nearly been made homeless twice in two years due to the new Universal Credit benefits system.

Lisa Dunnington says the new system, which rolls six benefits into one, has pushed her into debt.

Citizens Advice says Lisa's story is not unusual, with half of the people it helps with the system struggling to pay rent or mortgages.

The government says there is no single reason why rent arrears build up.

Lisa, from York, says despite being in debt most of her life, she had been debt-free before moving on to Universal Credit.

But she says she now owes York City Council over £1,000 in unpaid rent.

"Since I've got on Universal Credit last year, I've nearly lost my house twice and then I just end up in debt again."

She added: "I've tried building a home for me and my kids for years and years.

"And for it to be nearly ripped away from you when you've tried to better yourself by getting a job and things like that - you just wake up and think 'what's the point?'"

Ms Dunnington is being helped by debt charity Christians Against Poverty (CAP).

CAP spokeswoman Rachel Gregory said: "We are seeing some of our clients being issued with eviction notices due to the wait for their universal credit, which causes lots of stress and worry for that person."

A spokeswoman for York City Council, which is Ms Dunnington's landlord, said it was working with the government to support people on universal credit.

The government says Universal Credit was designed to make claiming benefits simpler and help people to get back into work.

More than 1.5 million people in the UK now receive the payment.

But new Citizens Advice analysis, using 190,000 people the organisation helped between July and September 2018, suggested many people were struggling due to the means-tested benefit.

Its report, Managing Money on Universal Credit, found:

- 49% people the charity helped were in rent arrears or fell behind on their mortgage payments while waiting for their first payment

- 60% of people it helped are taking out advances while they wait for payment

- 24% of the people it helped with Universal Credit were also seeking debt advice.

Among the people the charity helps with debt and Universal Credit:

- 47% said they have no money left after essential living costs such as food, housing and transport to pay creditors, or are spending more than comes in

- 82% hold what Citizens Advice classes as "priority debt" such as council tax, rent arrears or mortgage payments, and energy debts

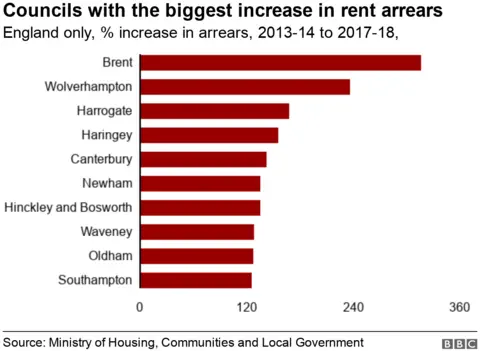

Four years ago, councils in England, Scotland and Northern Ireland were owed around £250m by tenants.

Last year that figure had grown by 27% to £315m, a review of government figures by the BBC has found.

The Welsh government does not collect comparable figures.

Richard Watts from the Local Government Association says the situation will only get worse.

"I fear that there's a great risk the trajectory of increasing rent arrears continues as Universal Credit gets rolled out across the country", he said.

Homeless charity Shelter said the "shambolic" changes to the welfare system had led to a "dire housing emergency" in the UK.

Chief executive Polly Neate, said: "The Government urgently needs to get Universal Credit fit for purpose before rolling it out any further, as well as bringing up housing benefit and local housing allowance rates so people can actually afford their rents.

"Alongside this, it needs to ramp up social housing building so families will have a chance of a stable, affordable home."

The system has proved controversial almost from its inception, with reports of IT issues, massive overspends, administrative problems and delays to the scheme's rollout.

In January, two high court judges ruled the Department for Work and Pensions (DWP) was wrongly interpreting universal credit regulations.

Four working single mothers argued a "fundamental problem" with the system meant their monthly payments varied "enormously", leaving them out of pocket and struggling financially.

A DWP spokesman said: "Most people on Universal Credit are happy managing their money, but budgeting support is available for anyone who needs extra help.

"Many people join Universal Credit with existing rent arrears, but this falls by a third after four months.

"We will continue to work closely with Citizens Advice and other stakeholders to develop our approach in order to provide the best possible support for all of our claimants."