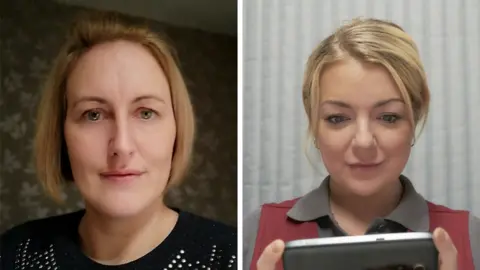

Gambling addict who lost £70,000 calls for more support for women

ITV

ITVA woman who built up debts of £70,000 by betting online is calling for more support for female gambling addicts.

Kelly Field shared her story with the makers of ITV's Cleaning Up. where Sheridan Smith plays an office cleaner who turns to crime to cover her gambling debts.

Ms Field said she hopes the show will highlight how gambling addiction is not just a problem for men.

"There aren't as many women speaking out," she said.

"Gambling is seen as bookies and men and dogs and horses. But there's probably just as many women who are gambling addicts as men."

Why women gamble

Ms Field said she was contacted by the programme makers and told them her story of how she used online gambling as "escapism" after a stressful period when she was off work due to a grievance.

According to Mark Marlow, the writer of Cleaning Up, Sheridan Smith's character Sam "came alive" when he spoke to women about their gambling and how it affected family and friends.

"I looked into the differences between why women gamble as opposed to why men gamble and I discovered women do it more as an escape," he said.

Ms Field said she was pleased to see Smith, a Bafta Award-winning star, highlighting an issue such as gambling addiction.

"She's so popular and she creates such good characters that it will get the message across a lot further," she said.

'Like computer games'

Within six months of being introduced to online bingo and online slot machines, Ms Field said she had run up debts of £10,000.

She said: "You're in this online virtual reality so you're not dealing with what you're dealing with in reality.

"It feels like playing computer games when you're a kid. You've got your high scores, your lives left. It just seems like digits, it's not really money. That's why people lose so much."

ITV

ITVMs Field said she hid her addiction at first, choosing to "smile and hide the credit card bill". But the pressure of the financial losses and lies took its toll.

"You isolate yourself so much for everybody. You get trapped in a cycle of playing to win, losing, then playing to win back whatever you've lost, and then losing more. You miss appointments, social events," she said.

"It takes a part of you that you never get back. You are physically and mentally not the person that you were before."

A nervous wreck

Eventually she confessed to her partner and went to the doctor, seeking counselling for addiction.

But she said the counsellor never turned up to her appointment. After that, she spent several more years as an addict, increasing her debts by tens of thousands of pounds.

"People don't understand the struggle it takes to go to a medical professional and say you need help. I didn't go back to counselling with the NHS," she said.

"My partner was a nervous wreck. He didn't know how to help me and I didn't know how to get help."

Eventually, at a point when Ms Field said she was suicidal, they got help from Beacon Counselling, a Stockport-based charity.

She said that while it was hard to find information about support for addiction, online gambling adverts featuring celebrities were common on daytime TV.

"It's glamorising it and making it socially acceptable. If advertisers are going to do this, they should tell the whole story, including the dangers and where to get help."

Taking the consequences

To support her recovery, Ms Field stopped using a smartphone, stopped using debit and credit cards and put a block on gambling sites on the computer.

As a BBC investigation highlighted flaws with industry schemes for problem gamblers, Ms Field said that credit card companies should do more to prevent people gambling their way into debt.

She said: "If there's suspect activity on your card they will stop transactions. So they know if you're spending £500 a day over six months. Why can't they block your card?"

The Gambling Commission is currently considering banning online betting with credit cards.

But in the meantime, Ms Field said she will still be paying her debts until 2021.

She said: "It's a hard process. As much as it's negative, it's about taking the consequences of your actions. I spent the money, I should have to pay it back."