Paradise Papers: F1 champion Lewis Hamilton 'dodged' VAT on £16.5m private jet

Formula 1 champion Lewis Hamilton avoided tax on his £16.5m luxury jet, according to Paradise Papers documents.

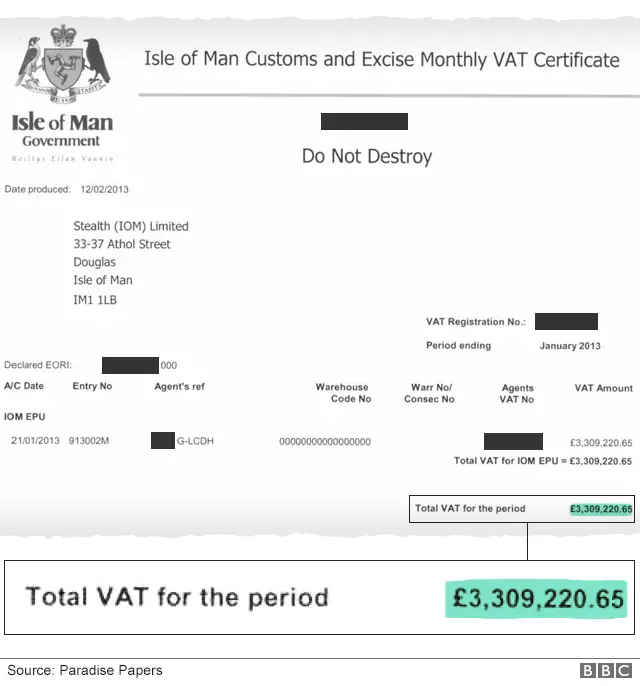

They show a £3.3m VAT refund was given after the Bombardier Challenger 605 was imported into the Isle of Man in 2013.

It appears a leasing deal set up by advisers was artificial and did not comply with an EU and UK ban on refunds for private use - although he may have been entitled to one for business.

Hamilton's lawyers say a tax barrister review found the structure was lawful.

They added it was not correct to say no VAT had been paid on any of the arrangements.

A statement later issued by the racing driver's representative said: "As a global sportsman who pays tax in a large number of countries, Lewis relies upon a team of professional advisers who manage his affairs.

"Those advisers have assured Lewis that everything is above board and the matter is now in the hands of his lawyers."

Instagram posts

At 06:15 on 21 January 2013, Hamilton touched down at Ronaldsway airport on the Isle of Man in his new jet with his then-pop star girlfriend Nicole Scherzinger to finalise the paperwork with customs.

While Hamilton's planned use of the jet was predominantly for business purposes, the BBC's Panorama programme has seen documents which suggest the 32-year-old F1 Mercedes driver intended to make private flights about a third of the time.

AIRTEAM IMAGES

AIRTEAM IMAGESHamilton's social media accounts provide evidence he has used the candy apple red Challenger for holidays and on other personal trips around the world.

He has posted a number of photographs of himself on the plane on Instagram - including one showing his bulldogs Roscoe and Coco on board.

Allow Instagram content?

"If private usage of the jet is being disguised as business usage of the jet, then what you essentially have is a tax avoidance scheme," says Rita De La Feria, professor of tax law at Leeds University.

"You're using it for your own private interests, you're going on holidays, meeting friends. You're supposed to pay the tax on private consumption."

Ultimate client

Private jets purchased outside the EU are subject to 20% VAT on importation in order to qualify for free circulation within the bloc.

While the Isle of Man is not part of the EU, it is a British Crown Dependency and forms a common area with the UK for VAT purposes. Because of this link, an aircraft imported via the island is granted full access to the EU.

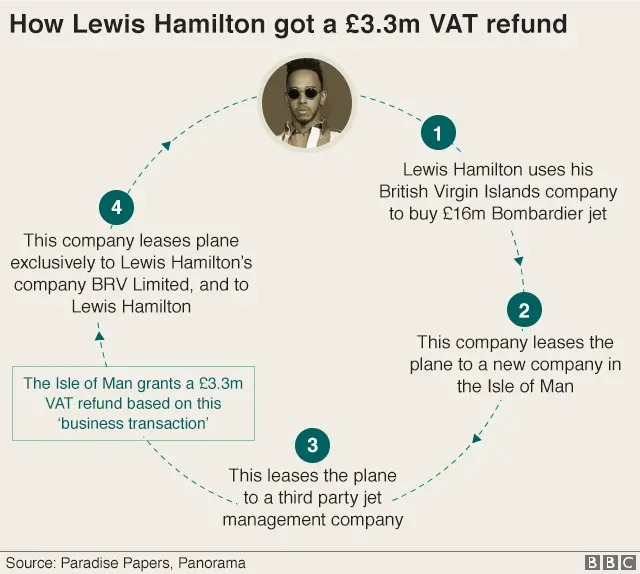

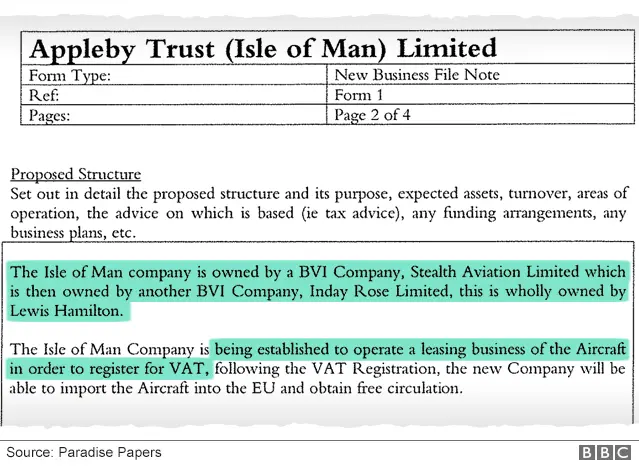

To try and get round EU and UK rules banning VAT refunds on aircraft used by private individuals, Hamilton's advisers formed a VAT-registered leasing business on the Isle of Man, the leaked documents held by offshore law firm Appleby suggest.

The new company, Stealth (IOM) Limited, leased the jet from Hamilton's British Virgin Islands company, Stealth Aviation Limited, and imported it into the Isle of Man.

It was then leased on to a UK jet management company that provided Hamilton with a crew and other services - and which leased it back to Hamilton and his Guernsey company, BRV Limited.

Source document

Hamilton is described in the documents as the jet's "ultimate client".

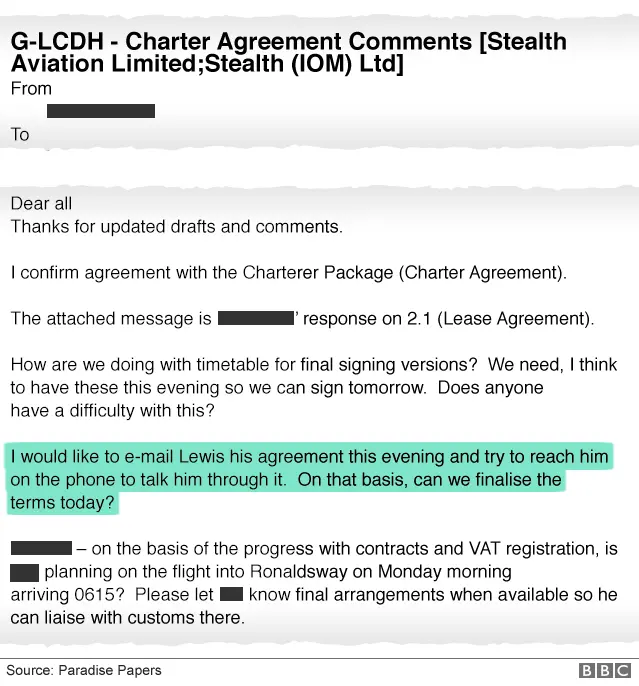

They also suggest he was being kept up to date.

In one email sent ahead of the final signing of the charter agreements and the jet's importation into the Isle of Man, an adviser states: "I would like to email Lewis his agreement this evening and try to reach him on the phone to talk him through it."

Source document

Other documents show the hourly rate of the plane's lease was increased from £2,000 to £5,500 overnight at one stage, so the Isle of Man company turned a profit as a "commercial" aircraft leasing business.

On the basis of the transactions, Hamilton's advisers were able to claim a 100% VAT refund on the £3.3m he was obliged to pay at the point of importation.

But the leasing agreements suggest Hamilton was going to be using the plane 80 hours per month, with his company using it for 160 hours.

If this estimate had been used for the basis of the VAT refund, under UK and EU VAT rules, only two thirds could have been considered for a refund in relation to business use. The artificiality of the structure raises questions about whether Hamilton should have received a refund at all.

'No subterfuge'

PA

PALawyers acting for Hamilton said the driver has a "set of professionals in place who run most aspects of his business operations and that no subterfuge or improper levels of secrecy had been put in place".

In a statement, they said Stealth (IOM) Limited was formed to run a leasing business and hire the aircraft on a long-term basis at a commercial rate.

They added that the company made all necessary disclosures to Isle of Man officials, who approved the approach.

The lawyers said that reducing taxes was not the motive, but even if it had been, it is lawful to lease rather than buy in order to reduce VAT.

There are 50 schemes like Hamilton's in the Paradise Papers.

The documents show that Appleby on the Isle of Man has imported luxury jets worth £1.25bn.

In total, the island has handed out more than £790m in VAT refunds to jet leasing companies, involving more than 230 planes.

In light of the Paradise Papers revelations, the Isle of Man government has invited the UK Treasury to conduct an assessment of the practice of importing aircraft into the EU through the island.

It has denied "mistakenly" refunding VAT.

The Isle of Man says since 2011 more than 30 assessments for under-declared or over-claimed VAT against businesses in the aircraft leasing sector, with a value of about £4.7m, have been raised.

Labour Leader Jeremy Corbyn last week called on the Prime Minister Theresa May to launch an investigation into VAT avoidance allegations linked with business jets in the Isle of Man.

In a statement on the Paradise Papers leak, Appleby said it was a law firm which "advises clients on legitimate and lawful ways to conduct their business. We operate in jurisdictions which are regulated to the highest international standards".

Timeline of a VAT refund

Source document

December 2012: Lewis Hamilton's company in the British Virgin Islands Stealth Aviation Limited pays $26.8m (£16.5m) to buy the Bombardier Challenger 605 and luxury additions

24 December 2012: Hamilton flies his family and Nicole Sherzinger to Hawaii for Christmas in the jet

9 January 2013: Appleby Isle of Man incorporates a company for Hamilton - Stealth (IOM) Limited

15 January 2013: The new company is VAT registered by Isle of Man customs as a company engaged in "renting and leasing of passenger air transport equipment"

17 January 2013: Hamilton's BVI company leases the plane to Stealth (IOM) Limited. Stealth (IOM) Limited leases it to a UK jet management company, which agrees to charter it to the driver and his Guernsey company BRV Limited

21 January 2013: Hamilton and Nicole Scherzinger arrive at the Isle of Man's Ronaldsway airport. The £3.3m VAT bill is paid on his behalf by his an Isle of Man accountancy firm. A customs officer attends out of hours and stamps a VAT paid form to be kept on board the jet. The couple fly-off again at 08:10

12 February 2013: The accountancy firm receives a full VAT refund of £3.3m

'Pimp it out'

Lewis Hamilton has amassed an estimated £131m fortune, according to the Sunday Times Rich List. Forbes reports his earnings and endorsements in 2016 were more than £30m.

One of Hamilton's first trips on the jet was for a Christmas 2012 holiday in Oahu, Hawaii, accompanied by members of his and then girlfriend Nicole Scherzinger's family.

In May 2015, just after competing in Monaco, he flew to Los Angeles. The Daily Mirror newspaper reported that he was "having a break" following the Grand Prix.

On 11 July 2017, he posted a photo of himself sitting with friends on its steps.

"To my loving fans, I can't wait to see you in Silverstone. Until then, I'm away on a two day break."

Speaking to US talk show Jimmy Kimmel in December 2015, Hamilton talked about the plane and how he decided to "pimp it out" in the red colour scheme.

"We travel a lot - I love cars and I love planes," he said. "Every time I'm at the airport you see these really sad white planes old planes with the saddest stripe down the side."

Bombardier Challenger 605

AIRTEAM IMAGES

AIRTEAM IMAGESMaximum range: 4,045 nautical miles (7,500km)

Maximum speed: 541mph (870km/h)

Flying hours: 8.00

Maximum operating altitude: 41,000 ft (12,500m)

Length: 68ft (21m)

Wingspan: 64ft (20m)

Engines: 2 x General Electric CF34-3B turbofans

Passengers: 12

Crew: 2

Source: Bombardier

Find out more about the words and phrases found in the Paradise Papers.

The papers are a huge batch of leaked documents mostly from offshore law firm Appleby, along with corporate registries in 19 tax jurisdictions, which reveal the financial dealings of politicians, celebrities, corporate giants and business leaders.

The 13.4 million records were passed to German newspaper Süddeutsche Zeitung and then shared with the International Consortium of Investigative Journalists (ICIJ). Panorama has led research for the BBC as part of a global investigation involving nearly 100 other media organisations, including the Guardian, in 67 countries. The BBC does not know the identity of the source.

Paradise Papers: Full coverage; follow reaction on Twitter using #ParadisePapers; in the BBC News app, follow the tag "Paradise Papers"

Watch Panorama on the BBC iPlayer (UK viewers only)