BT's Openreach to build full-fibre internet 'like fury' after Ofcom move

Openreach

OpenreachBT has said it will "build like fury" to roll out full-fibre internet connections after new rules announced by the UK's telecoms regulator.

Ofcom has decided not to impose price caps on full-fibre connections provided by the firm's Openreach subsidiary.

This gives the company the certainty it had been looking for ahead of a planned £12bn investment.

However, the decision lays Ofcom open to criticism that is has given a near-monopoly operator a generous deal.

That could mean more expensive internet connections for the public than might have been the case.

Ofcom also froze the price curbs it levels on what Openreach charges internet service providers for its slower copper-based connections.

'Ramp up'

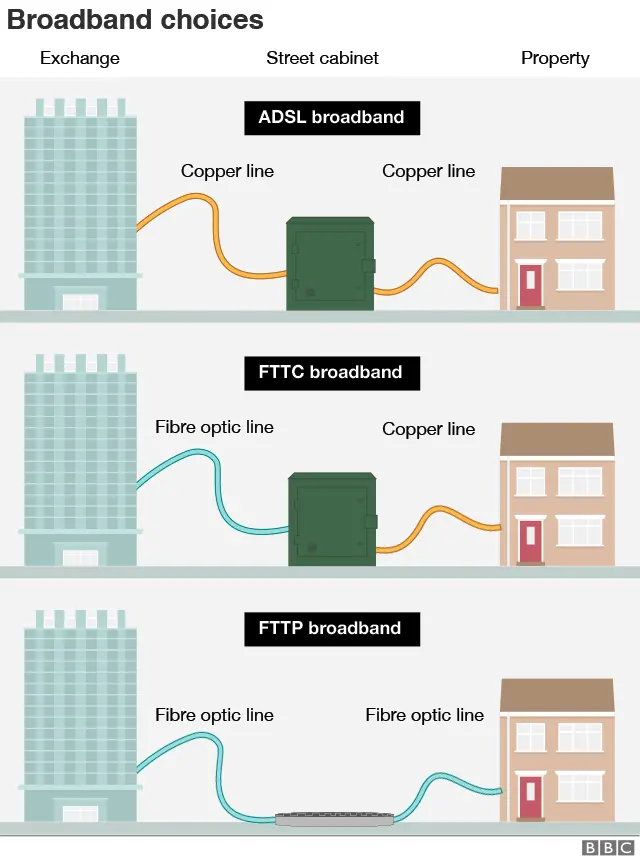

Openreach lays down and maintains the fibre-optic cables involved as well as operating the associated telephone exchanges, and then sells use of these services to individual internet service providers. They in turn sell access to the public.

The business has said it can now confirm a plan to build fibre-to-the-premises (FTTP) connections to 20 million homes and offices by the mid- to late-2020s.

"Today's regulation will allow us to ramp up to three million premises per year providing vital next generation connectivity for homes and business right across the UK," said Openreach's chief executive Clive Selley.

Ofcom's chief executive denied its move would harm consumers.

"It's true we certainly want to make sure that BT can have a fair bet on this investment, but at the core of our approach is that we are trying to get competition into the wholesale network layer, of broadband for the future, really for the first time in quite a new way," Dame Melanie Dawes told BBC Radio Four's Today programme.

"And the reason we believe in competition is we actually think that's best for the consumer. It gives us all more options to choose from, not just on pricing but also on service quality and reliability."

Unregulated fees

As part of the measures, Ofcom will effectively freeze the wholesale fees Openreach charges for providing "superfast" data speeds of up to 40 megabits per second, which rely on copper links via fibre to the cabinet (FTTC) or older technologies.

The watchdog had previously forced these to fall by about 20% over recent years.

The price Openreach charges for faster and more reliable FTTP connections will remain unregulated.

There is, however, one new restriction.

Openreach will not be allowed to offer geographic discounts on its full-fibre wholesale services. A similar limitation already existed on its provision of "superfast" links.

And Ofcom has said it will review all long-term discount arrangements offered by Openreach to its clients, and will intervene if necessary to prevent the firm from stifling investment by rivals.

It said it believed its approach should mean about 70% of the UK would still end up with a choice of networks.

Virgin Media, CityFibre and Hyperoptic are among alternative providers.

Their ability to profit from building rival networks would have come under pressure if they had been required to match new full-fibre price caps imposed on Openreach.

"Rolling out infrastructure is a costly and time-consuming venture, that comes with a long pay-back on investment," commented Kester Mann, an analyst at the tech consultancy CCS Insight.

"This is particularly true in less-densely populated areas where the economics may be considerably less appealing.

"As such, Openreach needed certainty that it would be able to make a sufficient return on investment before embarking on the next stages of roll-out."

Copper switch-off

Openreach will also be allowed to turn off copper-based networks in areas where faster full-fibre internet connections to properties have already been deployed.

This should help reduce its costs by removing the need to maintain two different systems in parallel.

Ofcom said this would also help promote take-up of faster fibre services.

However, it indicated that any such switch off must be done "progressively... over a number of years".

And it added that customers would be "protected" during the transition to ensure they would continue to have access to the net.

Ofcom had to walk a difficult line with this review.

If it set regulation too tight by capping wholesale prices at a low level, the risk was that BT and its fibre network rivals would be reluctant to invest the billions needed to roll out ultrafast broadband.

If it loosened the reins it would be accused of going soft on BT, sparking anger from the likes of Sky, which use the Openreach network and would have to pass on the higher prices to their retail customers.

By opting to impose no price controls on BT's fibre product for a decade, Ofcom has chosen the second option, insisting that it is the only way to spark the frenzy of competitive network building needed to move the UK up into the broadband fast lane.

What this review does not do is ensure ultrafast connections reach the 20% of the country where BT and its rivals still don't believe they can make a commercial return.

The broadband industry is waiting impatiently to hear how the government plans to spend the £1.5bn of public money it has promised by 2025 to spur investment in rural fibre coverage. An announcement on that is expected imminently.