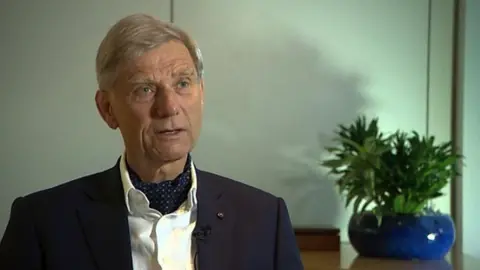

Hermann Hauser: ARM sale to Nvidia would be a disaster

Getty Images

Getty ImagesThe co-founder of the company described as the jewel in the crown of British tech has said it would be disastrous for it to be sold to a US computing firm that is reportedly negotiating a takeover.

It's the second time in four years that the future of Cambridge-based chip-designer ARM Holdings has been uncertain.

In 2016, Softbank ended up buying it. But the Japanese firm is now reportedly in advanced talks to sell it to Nvidia.

Hermann Hauser told the BBC he thought the UK government should intervene.

The tech entrepreneur - who spun off ARM from Acorn Computers in 1990 - says ministers should help make it an independent UK business again.

'Unsuitable owner'

ARM creates computer chip designs that others then customise to their own ends. It also develops instruction sets, which define how software controls processors.

Just about every modern mobile phone and smart home gadget is powered by a chip that relies on one or both of these innovations.

When Softbank bought the firm for £24bn soon after the referendum to leave the EU in 2016, it was hailed by the government as a vote of confidence in a post-Brexit Britain.

But Dr Hauser said at the time it was a sad day for him and for UK technology.

Four years on, after a number of big bets went wrong for the Japanese firm - notably its investment in the shared office space business WeWork - SoftBank wants to dispose of ARM, either returning it to the stock market through a share sale or letting another organisation buy it outright.

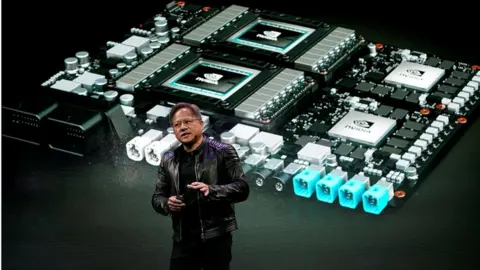

In recent days, there have been a number of reports that Nvidia - which recently overtook Intel to become the world's most valuable chip-maker - is keen to buy it.

The last weekend in July, I contacted Dr Hauser who spends the UK's winters in New Zealand and remained there because of the coronavirus pandemic.

He told me that a sale of ARM to Nvidia would be a disaster, but thought it very unlikely to happen.

This past weekend he got back in touch to say the reports now looked very credible and his concern had deepened.

He explained that ARM's business model - in which all the big chip-makers license its technologies - made Nvidia an unsuitable owner.

"It's one of the fundamental assumptions of the ARM business model that it can sell to everybody," he explained.

"The one saving grace about Softbank was that it wasn't a chip company, and retained ARM's neutrality.

"If it becomes part of Nvidia, most of the licensees are competitors of Nvidia, and will of course then look for an alternative to ARM."

While Dr Hauser voted against the Softbank deal in 2016, he says the Japanese firm kept its promises to retain Cambridge as the main focus of ARM's research and to boost employment there.

He has little faith in that remaining the case if Nvidia takes over.

Reuters

Reuters"It will become one of the Nvidia divisions, and all the decisions will be made in America, no longer in Cambridge."

But the Austrian-born venture capitalist hopes that can still be avoided.

"The great opportunity that the cash needs of Softbank presents is to bring ARM back home and take it public, with the support of the British government," he said.

'Not about the money'

Dr Hauser added that he would like to see it listed on both the London and New York Stock Exchanges.

He acknowledged that an already financially stretched government could not be expected to provide cash for the deal, but could still encourage it to happen.

"It's not about the money, it's the industrial strategy statements that the government can make," he said.

Dr Hauser thinks the government's recent move to invest $500m (£378m) in the satellite firm OneWeb may be a sign that it is prepared to intervene when the UK's technology future is at stake.

And he thinks the UK's wider microprocessor sector should be championed, pointing to the success of Bristol-based Graphcore in designing AI chips.

"[OneWeb was] a strong statement that the government is actually serious about industrial strategy," he said.

"And if ever there was a big strategic prize to be had, it would be to take the crown away from Intel as the number one microprocessor company in the world and make it part of the UK".

Both Softbank and Nvidia declined to comment.