Bitcoin dips below $10,000 for first time since December

Getty Images

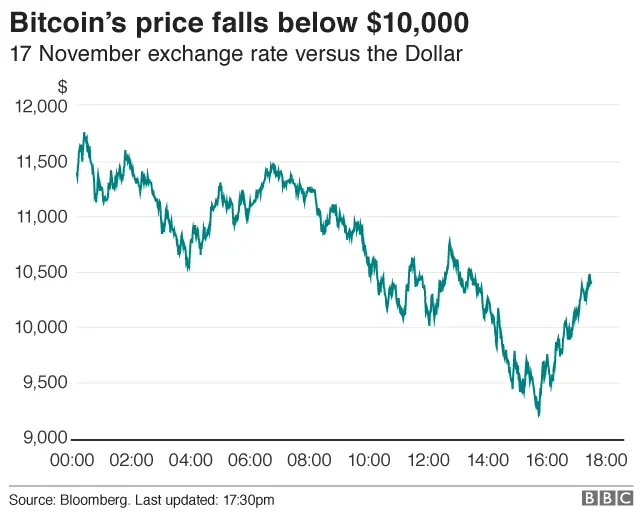

Getty ImagesBitcoin has traded below $10,000 for the first time since early December.

The value of one bitcoin fell to $9,958 (£7,222) before making a slight recovery, according to a price index run by the news site Coindesk.

However, it later fell again dipping just below $9,200. That represents a drop of more than 53% since it peaked close to $19,800 five weeks ago.

Other crypto-currencies have also experienced steep falls, including Ethereum, Ripple and Bitcoin Cash.

There has been concern among some experts that a bubble had been forming in the market as casual investors piled into an asset they did not fully understand.

Trading restrictions

It is notoriously difficult to be certain of what causes moves in Bitcoin's value - the asset has been much more volatile than most traditional currencies and commodities to date - but speculation that regulators may be about to restrict trade has been causing concern.

In particular, South Korea has suggested that it might soon take action.

"The government stance is that it needs to regulate crypto-currency investment as it is a largely speculative investment," its finance minister Kim Dong-yeon said in a radio interview on Tuesday.

"The shutdown of virtual currency exchanges is still one of the options [that the government has]."

Earlier this week, the Bloomberg news agency reported that the Chinese authorities were planning to restrict local access to crypto-currency trading platforms, having already taken steps to curb Bitcoin mining - the process that validates transactions.

Investors may also have been spooked by Bitconnect's announcement that it was closing down its lending and exchange platform on Tuesday.

The business had centred on its own digital token - the Bitconnect Coin - which crashed in value following the announcement, despite the firm saying it would still be supported.

Bitconnect said it had faced "continuous bad press" - including claims it had been running a Ponzi scheme - and had received cease-and-desist letters from two US watchdogs.

Last Wednesday, the influential investor Warren Buffett predicted further trouble ahead, although he was vague about the timing.

Getty Images

Getty Images"In terms of crypto-currencies, generally, I can say with almost certainty that they will come to a bad ending," he told CNBC .

"When it happens or how or anything else, I don't know."

However, photography firm Kodak has seen its stock price soar since last Tuesday when it announced its involvement with two crypto-currency-related ventures.